The Unpredictable Journey

I’ve been an investor in Palantir (NYSE:PLTR) since its IPO three years ago, purchasing shares at $18 and $7. The ride has been tumultuous – a wild roller coaster that left my stomach churning. While the recent 40% surge in stock has generated excitement, it’s essential to maintain a rational approach when gauging the company’s future potential.

I first became captivated by Palantir several years ago after stumbling upon a Fortune article that painted the company as one with a distinctive culture and a disruptive product for data analytics within the Army. Beyond mere stock price fluctuations, my admiration for the company runs deep, tracing its roots to those formative years.

In recommending a stance on the company, my focus narrows to three primary aspects. I admire their products and their astute utilization of AI opportunities in the commercial sector. While the government business stands robust, the disappointing Q4 results are hard to ignore. My primary concern, however, lies in the company’s sluggish progress in expanding their commercial business internationally.

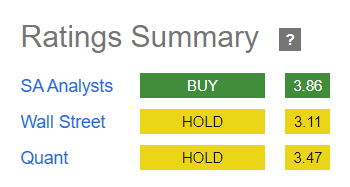

Analysts at Seeking Alpha appear bullish about the stock – a stark contrast to the outlook from Wall Street analysts and Seeking Alpha Quant. So, which camp will I align with as a long-term investor in the stock?

The Power of Their Products

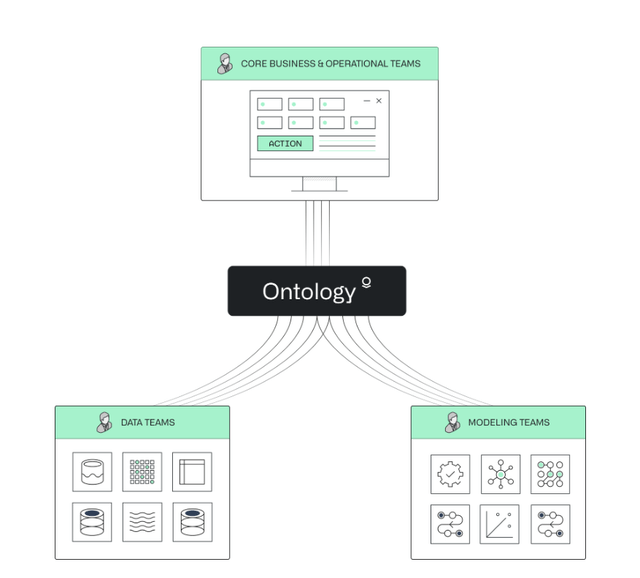

In the last two decades, Palantir has been devoted to crafting the operating system for businesses (Foundry) and governments (Gotham). Unlike developing standalone software applications like CRM or ERP systems, Palantir aspires to create comprehensive platforms that serve as operating systems. These platforms can be tailored to mirror the unique operations of a business, constructing the requisite data structures and integrations that underpin informed decision-making. This approach carries profound business implications, as an operating system yields substantial network effects and has the potential to dominate the market.

In the realm of operating systems, dominance has historically been tethered to a specific hardware platform, such as Windows with Intel processors or Android with smartphones. However, Palantir is striving to breakthrough from this mold by disassociating its platforms/operating systems from any particular hardware infrastructure. This visionary strategy positions them to potentially dominate the B2B market without being captive to the evolution of hardware. Yet, their ambition doesn’t guarantee success – concrete evidence of progress is imperative to validate their path.

Mastering the AI Game

Their software boasts exceptional craftsmanship, evident in how swiftly they integrated Large Language Models (LLMs) and incubated a new platform, AIP, from scratch. This product prowess has poised Palantir to capitalize nimbly on the GenAI opportunity. Not only have they developed a robust product, but they have also architected an effective go-to-market strategy centered around Bootcamps. These Bootcamps serve as workshops where the Palantir team collaborates with developers, analysts, and managers from prospective clients. During these sessions, they work on implementing use cases using the Foundry Platform alongside the client’s systems or cloud solutions. This hands-on approach has reaped tangible rewards, with a recent use case yielding immediate savings of $10 million for a client.

Their shrewd strategy is bearing fruit. The number of commercial clients spiraled by 44% year-over-year to 375 clients in the last quarter. Moreover, in the fourth quarter, the company achieved a landmark by securing a commercial Total Contract Value (TCV) of $699 million, marking its highest quarterly figure to date. This resounding outcome underscores an impressive year-over-year growth of 156%.

Existing clients have also contributed substantially to the growth story. Revenue in the US commercial business has catapulted by 70% year-over-year, in tandem with a 55% rise in client count. Furthermore, the average revenue of the top 20 customers has ascended by 11%, leaping from $49 million to $55 million.

The third pillar – operating leverage – is fundamental to this model. As the business scales, it becomes more lucrative, achieving a free cash flow margin of 50% compared to 15% in the fourth quarter of 2022. Adjusted EBITDA, akin to the operating margin, has surged from 24% to 36% owing to increased business capture from existing and new clients, primarily propelled by the same software infrastructure. This is testament to their effective management of software improvements and new functionality, which has not demanded commensurate effort in revenue capture. Additionally, they have adeptly handled net working capital and CAPEX amidst such rapid growth rates.

Palantir Continues to Chart a Profitable Course Amidst Corporate and International Challenges

Palantir, the data analytics and AI company, has garnered significant attention in financial circles with a string of profitable quarters and a robust outlook for the future. In the context of such significant achievements, the company remains under scrutiny amidst growing concerns and skepticism about its performance, particularly in government and international markets.

Tailwinds in Corporate Events Could Further Boost the Stock Price: Inclusion in the S&P 500 Index

Palantir’s remarkable performance over the past five quarters, with $100 million in net income, has positioned the company for potential inclusion in the S&P 500 index. CEO Alex Karp has been vocal about this milestone, recognizing its potential to elevate the company’s standing and attract fresh attention from investors. The potential uptick in stock value due to this development remains undervalued in the current stock price, which continues to be largely driven by its AI commercial business.

But There Are Some Concerns: Government and International Businesses

Addressing the concerns in Palantir’s business, the company’s government revenue increased by 11% year-over-year to $324 million. While some skepticism exists about the prospects for new business in this sector, Palantir remains upbeat about future opportunities, especially citing the expected Pentagon contract and involvement in major global conflicts. However, the commercial international business, growing by 11% year-over-year to $154 million, presents a clearer challenge. Despite partnerships and growth in Asia, Palantir’s struggles with European companies reflect uncertainty about its international trajectory.

Palantir’s Valuation

Evaluating Palantir’s potential, it is evident that the company is entrenched in its mission to revolutionize business operating systems. With robust software performance and a compelling vision, Palantir’s prospects remain strong, and the method of valuing its future potential underscores its long-term attractiveness to investors.

Conclusion

The latest financial period for Palantir showcased its dominance within the AI sector, particularly within the US commercial market. While the company has encountered obstacles in both government and international commerce, its innovative strides and ambitious outlook are indicative of significant potential for growth and value appreciation.

Ultimately, Palantir perseveres as a company poised to chart an impactful course, leading the charge in AI and positioning itself as a dominant force in the business operating systems sector, despite the challenges it faces. As its valuation remains high, the company holds promise for further stock price escalation, underscoring its potential for investors.