Palantir Technologies (NYSE:PLTR) is a pioneering company that provides software solutions aimed at empowering government and commercial organizations to organize and harness their data to make informed decisions. Despite its leading role in the field of artificial intelligence, the company often finds itself under intense scrutiny due to its strong political views, diverse global impact, and the perceived mismatch between its market capitalization and influence on the world stage. This has led to extreme investor sentiment – ranging from fervent adoration to deep-seated disdain. However, it is crucial for investors to remain objective and not be swayed by emotions, irrespective of whether they embrace or despise the company.

When considering an investment in any company, my first port of call is to scrutinize any negative aspects. In the case of Palantir, many of the bear arguments circulating in the market are either misinformed, outdated, or simply misunderstood. This presents a significant opportunity, of which I intend to take advantage by assigning the stock a buy rating. Upon closer examination, it becomes evident that the major bear arguments lack substance when thoroughly dissected. Furthermore, the stock is trading below its intrinsic value.

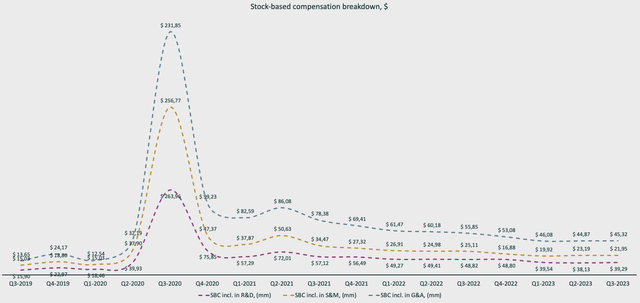

Reassessing Stock-based Compensation

Stock-based compensation (SBC) has long cast a shadow over Palantir, and rightly so. However, the current outlook regarding SBC is not the imminent disaster that it may have once seemed. SBC has now aligned with industry standards and notably contributes to the growth of Palantir.

The data illustrates that Palantir has gained control over its SBC after a substantial surge associated with the company’s direct public offering (DPO). Despite the continued high dollar amount allocated to SBC, its impact has significantly decreased as Palantir scales its revenues. However, these numbers, in isolation, lack context. It is imperative to compare Palantir’s SBC levels with those of industry peers in order to gain a meaningful benchmark. What may seem like an exorbitant 20% of revenues allocated to SBC within one industry could be perfectly normal in another.

Although Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOG) may operate in a similar sphere by providing AI solutions and platforms, their sheer scale sets them apart from Palantir. My yardstick for comparison comprises Salesforce (NYSE:CRM), ServiceNow (NYSE:NOW), Datadog (NASDAQ:DDOG), Snowflake (NYSE:SNOW), IBM (NYSE:IBM), and C3.ai (NYSE:AI). To mitigate variances, I will utilize trailing twelve-month revenue divided by stock-based compensation.

A substantial variance is observable between more established companies and those in the nascent stages. Notably, C3.ai’s SBC equates to a staggering 73% of their revenues – a concerning measure. Following closely is Snowflake at 42%. Conversely, IBM and Salesforce, being more mature entities, lead the pack. Palantir, positioned around the middle, stands at a modest 22%. Nevertheless, my target for Palantir is to approach the 18% equivalent of ServiceNow.

Palantir’s executives frequently extol the quality of talent within their ranks. References to their top-tier employee force are a recurring theme during quarterly earnings calls and media interviews, as evident in a quote from CEO Alex Karp during the Axios Davos 2024 event which underlines Palantir’s ability to attract and retain exceptional talent.

Palantir, over a 20-year period, has garnered the best people. I don’t think there’s any dispute about that. Silicon Valley hated me. Do you know why they hated me? The circus cult leader Karp is marching people away from cockroach.com to help the US government be superior. […] We still get the best people. We retain the best people, by and large. Many of the best companies in the world that have been built are ex-Palantirian.

Measuring this beyond industry temperature remains challenging. However, in terms of numbers, efficiency can be gauged by dividing the employee count by trailing twelve-month revenues. In this respect, among its closest peers, Palantir emerges as the leader.

Comparing the breakdown of SBC costs, it is indeed surprising to note that the majority doesn’t funnel towards research and development (R&D). This consistent distribution predates the DPO. Although there have been epochs where Palantir focused on recruiting and expanding their sales team, this does not manifest clearly in the SBC breakdown. Despite the revelation that the AIP ramp is Palantir’s primary focus, with consistent bootcamps throughout 2023, this does not resonate in the breakdown. The absence of variance in the distribution remains a mystery and is regrettable since it fails to provide any insight into the company’s current focus.

In a nutshell, SBC no longer poses a significant concern. Palantir is ahead of companies within the same maturity curve in the industry and is steadily gravitating towards the benchmark set by ServiceNow, where SBC constitutes 18% of the revenue.

Palantir’s Genius SPAC Investment

The Misunderstood SPAC Investments

Palantir’s investment in Special Purpose Acquisition Companies (SPACs) has been maligned by many in the financial world, yet the true genius of this move is often overlooked. Critics argue that the investment in SPAC equity that subsequently declined was a massive capital misallocation, or that Palantir was essentially purchasing revenue. These criticisms, while not entirely baseless, fail to consider the bigger picture.

The investments in SPACs come with conditions. Palantir takes an equity position in a SPAC, and in return, the SPAC signs a contract to pay for and use Palantir software. However, the most intriguing aspect lies in the details. Palantir has the option to sell its equity positions without affecting the contracted revenue from the SPACs, and the average SPAC contract is five times the size of a regular commercial contract, excluding the top 20 customers.

The revenue impact from SPACs has propelled Palantir’s growth, although it has also cast a shadow on its organic growth when compared across different periods. At its peak, the potential value of the contracts reached $768 million, following an investment of $215 million in Q1 2022. Over the past 24 months, SPACs have accounted for 11% of quarterly commercial revenue, with Q1 2022 reaching nearly 1/5th of total commercial revenue.

Despite Palantir’s sale of equity positions in multiple SPACs that experienced significant declines, including bankruptcies, the company has managed to offset its losses. To date, Palantir has sold equity worth $105 million and collected SPAC revenue amounting to $234.5 million. With a total investment of $450.5 million, the depletion stands at 22%; however, there is still $392.1 million of contract value remaining, ultimately leading to a positive return. Notably, Palantir’s investments do not incur 100% gross margins due to software implementation, slightly altering the actual return.

The underlying genius of these SPAC investments becomes evident in their alignment with Palantir’s business philosophy. The company aims to develop and deploy central operating systems for entire industries, a strategy lauded in their quarterly and annual SEC filings. To achieve this, Palantir adopts a hands-on approach, actively engaging in factories and real-world environments. This commitment to being at the forefront of industry challenges is echoed in the words of Shyam Sankar, the CTO, during the Morgan Stanley TMT Conference in 2022.

Furthermore, the diverse industries in which Palantir has invested through SPACs offer significant strategic advantages. Despite the risk of potential bankruptcies among the SPACs, these investments provide Palantir with invaluable front-line research and development opportunities across a wide array of industries, enabling the company to gain insights into core industrial challenges and drive synergies with its offerings.

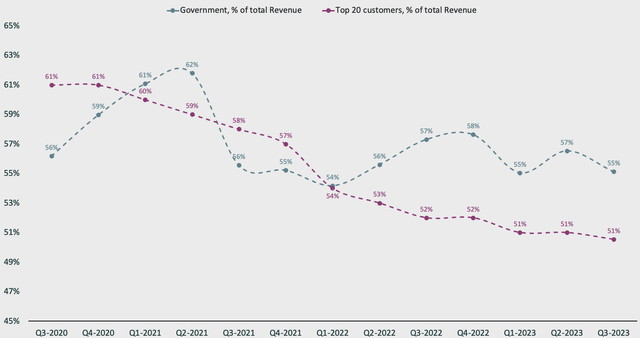

Risk and Reward of Concentration

Another concern raised by investors is Palantir’s vulnerability to concentration risk, as more than half of the company’s revenue is derived from its top 20 customers and the government segment. However, these aspects also serve as a crucial safety net for the company’s operations. Rather than posing a risk, they provide a stable foundation for the commercial segment to scale and grow, without the need for excessive risk-taking or arbitrary time constraints.

The Future Looks Bright for Palantir

Palantir, the data analytics company, has much to boast about given its impressive revenue figures, but what do these numbers tell us about the company’s future prospects? Let’s delve into the details to glean some insights.

The Power of Top 20 Clients

The top 20 clients of Palantir are showcasing remarkable strength, collectively constituting 51% of the total revenue. What’s more, these clients exhibit strong retention and are increasingly embedding Palantir’s solutions into their businesses. The revenue per top 20 customer stands at an average of $53.7mm, dwarfing the $2.43mm for customers outside this elite group. This formidable performance underscores the growing significance of these clients and the solid foundation they provide to Palantir.

Government vs. Commercial Growth

The government arm of Palantir’s business lags behind the commercial sector in terms of consistent growth, primarily due to the procurement process. However, awarded government contracts tend to be significantly stronger, with an average revenue that surpasses three to four times that of commercial customers. Curiously, despite the grant cycles, the stability of the government side makes it an intriguing aspect of Palantir’s overall business strategy.

Evaluating Palantir’s Valuation

Valuing Palantir is no simple matter, especially given its unique revenue model and the absence of comparable, more mature competitors. Palantir, being at the vanguard of a new AI revolution, is shrouded in uncertainty regarding its impact, opportunities, and growth potential. In a recent interview, CEO Alex Karp asserted that there is no reason the company should not be twenty times larger than its current size, hinting at a colossal market cap of $1 trillion. A daunting proposition, indeed!

How can Palantir achieve this extraordinary feat?

Karp has been vocal about the need for the Department of Defense (DoD) to ramp up its spending on AI. Despite its crucial role in various active conflicts, such as those in Ukraine and Israel, the AI battelfield context has sparked discussions about the efficacy of AI solutions in such scenarios, prompting Karp to advocate for a significant increase in the DoD’s AI budget. Furthermore, Karp stresses the value of proven, established companies in the military AI space, emphasizing the consolidation of the market into the hands of these entities.

Market Share and Growth Projections

The AI software market is projected to expand at a remarkable 23% compound annual growth rate from 2023 to 2032. Currently, Palantir holds a 0.6% market share in the commercial segment, as per data from Precedence Research. In a discounted cash flow (DCF) model, observers estimate that Palantir’s commercial market share will rise to about 0.9% by 2033, while the DoD’s AI expenditure is anticipated to gradually increase to 5% of its budget by the same year.

Emulating the Palantir’s growth trajectory, these projections suggest that Palantir is poised for sustained expansion. Based on these optimistic assumptions, pivotal to captured in the DCF model, analysts foresee a fair value of $19 per share, indicating that Palantir’s potential is currently undervalued.

The Rise of Palantir: A Maverick in the Booming AI Market

Palantir, with its colossal strides in the AI market, is set to become a mega-cap. The company has etched itself as a key player with a multitude of deployed solutions at the vanguard. Holding firm with a 25% market share of the Department of Defense’s AI spend, Palantir’s IL-6 certification positions it among the privileged few authorized for deployment in sensitive operations. Projecting an upward trajectory, it is foreseeable that the company will scale up to capture a 0.9% market share of AI software spend by 2033, bolstered by diverse implementations across various industries and the development of robust operating systems for each.

A Compelling Case for Investment

A high-volume stock like Palantir is bound to captivate the attention of both bulls and bears, fueling extensive discourse and conjecture. A closer appraisal, however, reveals that many of the currently echoed bear arguments lack substantial merit, and some narratives can even be reframed as positive indicators.

Adapting and Overcoming Challenges

The seemingly exorbitant stock-based compensation (SBC) has undergone a remarkable transition, now aligning itself with industry standards. SBC, though deemed a necessary evil, is indispensable for Palantir to attract and retain top-tier talent—a critical component for sustaining its position as a provider of some of the most advanced software solutions globally.

The Strategic Leap with SPACs

The strategic move of venturing into Special Purpose Acquisition Companies (SPACs) has proven to be a judicious business decision for Palantir. Notably, SPACs have propelled the company’s growth, facilitated penetration into complementing industries, and furnished invaluable front-line Research and Development (R&D) opportunities. Furthermore, the revenue contracts derived from SPACs exceed standard commercial contract sizes, while also bestowing Palantir with the freedom to divest the equity linked to these agreements.

Concentration Risk as a Strategic Advantage

What may be perceived as a concentration risk is, in fact, a strategic safety net that enables Palantir to adeptly manage growth incentives. Over an extended period, the top 20 customers and the government sector of the company’s business have consistently exhibited scalable expansion, a trend that is poised to endure. The impressive net dollar retention rate of the top 20 customers underscores the deep integration of Palantir solutions within the operations of businesses and the substantial value it delivers.

A Clear Path for Growth

Based on the evident potential for substantial growth and amidst the burgeoning AI software market, I confidently endorse Palantir with a buy rating. The company has established itself at the forefront by consistently deploying its cutting-edge solutions, both in conflict zones and across various industries.