Grasping the Situation

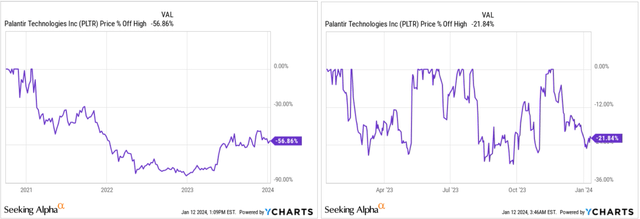

As I write these lines, Palantir Technologies

(NYSE:PLTR) stock is trading almost 57% below its all-time high and about 22% below its local peak following the recovery rally of the last few months:

Is this dip worth buying?

I regularly see Palantir pop up among the most popular names on Seeking Alpha and other platforms, but opinions about this company vary wildly among different investors. Some believe in PLTR’s breathtaking growth thanks to the AI effect and new business developments that will help the company be profitable and increase profit margins faster-than-expected. On the other side of the barricade, however, there are skeptics who consider PLTR’s business model unprofitable at a prime rate of over 2% and who predict a deflation of the company’s excessively high valuation in the medium term

when the AI hype subsides.

After performing my analysis, I decided in favor of the bulls based on several key factors.

The Strategic Approach

Palantir Technologies Inc. develops and implements software platforms functioning as a central data operating system capable of analyzing vast amounts of data from diverse unstructured sources. The company employs machine learning and user/analytics interactions to enhance data, presenting it in a user-friendly interactive view, including AI interaction. This approach aims to make data more accessible, actionable, and operational, facilitating faster and more informed decision-making across various sectors, including defense, intelligence, and enterprise logistics.

In Q3 FY2023, Palantir reported its 4th consecutive quarter of GAAP profitability, achieving a GAAP net income of $72 million with a 13% margin. The company closed 80 deals of $1 million or more across 30 industries and experienced growth in its U.S. commercial business, which accelerated by 33% YoY. The U.S. commercial customer count rose by 12% QoQ, reaching 181 customers and representing a ten-fold increase from three years ago.

In May 2023, Palantir launched its latest offering, the Artificial Intelligence Platform [AIP], initially rolled out to select customers with ongoing onboarding to additional clients. AIP is designed for both commercial and government sectors, leveraging breakthroughs in artificial intelligence by integrating existing software platforms with large language models (LLMs). This unique platform allows users to connect LLMs with their data and operations, facilitating decision-making within legal, ethical, and security constraints.

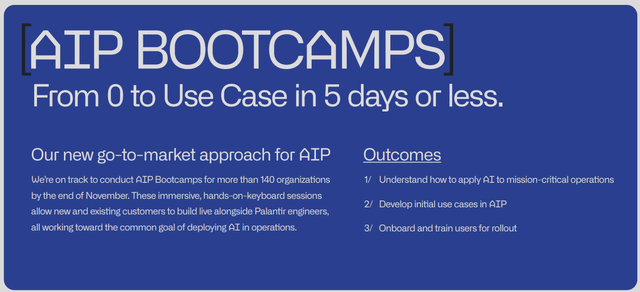

In Q3, PLTR’s go-to-market strategy focused on particularly on the AIP bootcamps, allowing real workflows on customer data in 5 days or less, significantly impacting unit economics and accelerating new customer negotiations.

The AIP witnessed rapid expansion, according to the management, with nearly 300 distinct organizations using it since its launch just five months ago. The company tripled the number of AIP users in the last quarter and expects to conduct boot camps for over 140 organizations by the end of November. The positive impact of AIP on customer operations is evident, with attendees reporting achievements that surpass other AI technologies in terms of speed and resource efficiency.

Concerning the Government segment, Palantir anticipates a reacceleration of business expansion here, expecting a growth rate beyond the current 10% YoY. Palantir highlighted a new contract worth up to $250 million with the U.S. Army, demonstrating its continued involvement in providing intelligence and defense capabilities.

Looking at events in the world and the rapidly changing geopolitical landscape, I like to think that demand for Palantir products should be significantly higher over the next few years. Perhaps I am looking at the situation too emotionally or prematurely, but it seems to me that today’s actions by the Houthis in the Red Sea basin should remind the world how fragile global supply chains remain. We should expect an increase in defense budgets – especially in the United States, where none of the future presidents want to see a new round of inflation in the first year of their reign right after the election. But fighting the Houthis on their own territory without the help of modern technologies like AI – basically the main advantage of Western military power abroad – will likely be ineffective. Therefore, I see this as a new catalyst for Palantir’s growth in the government business. And when I think of the recent correction in the company’s stock, I don’t think this catalyst is priced in yet.

But even without the implementation of this catalyst and without the positive effect from AIP, we can see the frequency with which Palantir signs new contracts and extends old ones. Isn’t it an indirect indication of success?

- December 15, 2023: Palantir receives $115M contract from US Army

- December 13, 2023: Palantir Technologies renews partnership with UniCredit

- November 21, 2023: Palantir slips even as it wins contract to overhaul UK’s National Health Service

- October 10, 2023: Palantir gets up to $250M contract from Army for AI capabilities

- October 04, 2023: Palantir, PwC team up to bring AI solutions to clients

In addition to the indirect signs, I’d also like to cite direct evidence of the likely strong demand for Palantir’s products in the coming years – reviews from real users. Since PLTR’s offering is not available to the general public, it is quite difficult for analysts to assess the quality of the product being sold. This is still a business model that is not comparable to that of Apple (AAPL) or, say, Grammarly. But in a study by Kerrisdale Capital from March – their short report on C3.ai (AI) – I found a lot of useful information about Palantir. The short seller conducted a survey of former high-level employees from C3.ai, as well as users of the company’s products, who shared their opinions on interacting with different platforms. From their feedback, I conclude that professional users prefer Palantir’s offering.

![Kerrisdale Capital's short report on the AI stock [Oakoff's notes]](https://static.seekingalpha.com/uploads/2024/1/13/53838465-17051352108765984.png)

![Kerrisdale Capital's short report on the AI stock [Oakoff's notes]](https://static.seekingalpha.com/uploads/2024/1/13/53838465-1705135270114709.png)

Palantir’s Future Growth and Valuation: A Comprehensive Analysis

Based on a combination of indirect and direct evidence of the strength of Palantir’s products, and taking into account the company’s rapidly improving financial position, I expect PLTR’s customer base and general operations to continue to actively grow in both the commercial and government business segments.

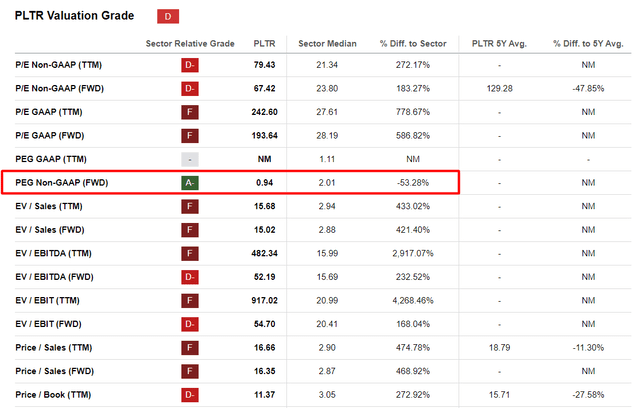

However, the biggest argument of skeptics is the PLTR stock’s valuation level, which seems to be overheated. Here, however, I would like to ask the skeptics a question: What exactly are you looking at when you value PLTR and consider its growth potential? Do you look at the P/E ratio, the EV/EBITDA, the price/sales ratio?

Here the company most likely has no chance of being liked by investors. But the 100-200 times P/E ratio alone tells us nothing unless we correlate it with the projected earnings growth. To do this, we will be helped by PEG which for PLTR is at the level of 0.94. According to Seeking Alpha, it is half the median of the entire IT sector:

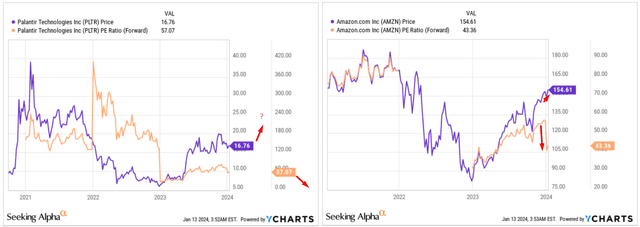

I’m also not afraid of high P/E ratios because there are many examples from history where share growth can continue despite strong multiple contraction. Theoretically, this should happen through a) a sharp turnaround in business or b) a renewed acceleration in the business’ growth rate. This is how I see the future development of PLTR and what happened recently with Amazon (AMZN) – juxtaposing the companies for demonstration purposes only, not to compare their operational similarities.

Therefore, I expect PLTR to continue to beat earnings expectations and that its valuation won’t slide as much as the market expects. This should give PLTR more room for growth.

Risk Factors: A Cautionary Tale

Investing in Palantir Technologies stock involves various risks that potential investors should consider. Firstly, the company’s heavy reliance on government contracts exposes it to uncertainties associated with changes in government spending priorities, budget constraints, and political factors. While I consider the potential defence budget expansion as a bright tailwind for PLTR, you should keep in mind that in reality anything may happen. Any adverse developments in government relations or contract renewals could negatively impact the company’s financial performance due to its heavy exposure to this segment.

Secondly, Palantir faces a concentration risk in its customer base, with a substantial portion of its revenue coming from a limited number of large clients. The loss of a major customer or a reduction in spending by key clients could have a detrimental effect on the company’s financials.

Thirdly, the competitive landscape in the data analytics and government services sectors is intense, with Palantir contending against both established players and emerging competitors. Failure to effectively compete, innovate, or adapt to technological advancements could lead to a loss of market share. Additionally, technological risks, such as system disruptions or cybersecurity threats, pose challenges for a company deeply entrenched in data analytics. Any compromise of data integrity or security breaches could harm Palantir’s reputation and result in financial losses.

Furthermore, there are valuation risks associated with investing in PLTR. The stock’s market price may be influenced by factors such as market sentiment, macroeconomic conditions, and perceptions of the company’s growth potential. So far everything looks in favour for buying PLTR (at least to me), but any of the aforementioned factors may change overnight, making my thesis irrelevant.

The Future of Palantir: A Promising Outlook

Despite all the risks, Palantir seems to rise like a phoenix from the ashes. The unexpected outbreak of war in Eastern Europe, the current trade confrontation with China and the new threat of supply chain undermining in the Red Sea make PLTR’s product offering a must-have to protect US interests. This should provide a new tailwind for the company’s growth in the medium term.

Moreover, the company’s valuation, which many fear, does not look so scary given the very low PEG ratio – especially if we recall the many examples in the past of multiple contraction occurred in parallel with the rise in stock prices.

Overall, I like the Palantir stock. I believe that the company has a future, and the bulls are still closer to the truth than the bears. So I rate PLTR as a ‘Buy’ this time.

Good luck with your investments!