Palantir Technologies: Analyzing Its Rapid Growth Amid AI Trends

In the past two years, artificial intelligence (AI) has emerged as a notable megatrend in the market. Within this context, large technology firms have dominated the spotlight, particularly regarding AI advancements.

However, smaller companies are demonstrating their ability to compete effectively with industry giants. Notably, Palantir Technologies (NASDAQ: PLTR) has seen its stock surge by 361% over the past year as of May 6.

While Palantir has garnered significant attention, many investors are questioning whether its remarkable rise in share price can continue. This article will explore Palantir’s valuation trends and compare them with historical behaviors of other technology stocks, providing insights into the potential future direction of its stock.

Understanding Palantir’s Valuation

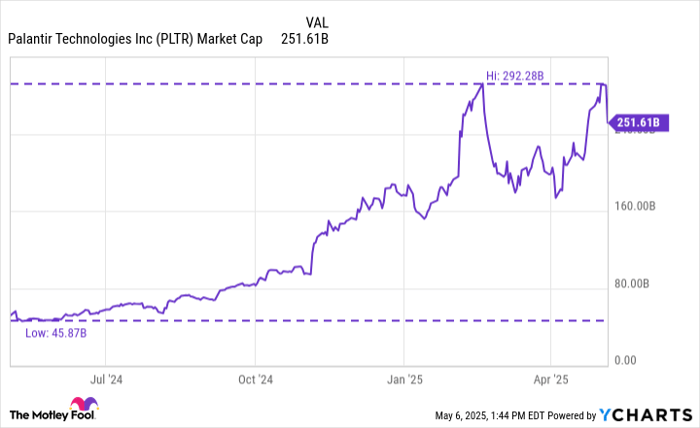

In just one year, Palantir’s market capitalization has increased dramatically from approximately $46 billion to over $250 billion.

PLTR Market Cap data by YCharts.

Currently, the company’s price-to-sales (P/S) ratio stands at around 91. Analyzing this figure alone may not provide a complete picture; therefore, it’s essential to compare it with notable examples from the technology sector’s past.

Stock chart.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F817375%2Fgettyimages-1358049777-6.jpg&w=700″>

Image Source: Getty Images.

Comparing Palantir’s Valuation to Other Tech Giants

Recently, my colleague Sean Williams discussed valuation trends during the dot-com bubble and how they relate to the ongoing AI revolution, drawing insightful comparisons with Palantir.

Before the dot-com crash, leading companies like Cisco and Amazon had P/S ratios peaks around 40. This is similar to Nvidia, which experienced a peak P/S ratio of 46 during the AI boom.

Palantir’s current P/S ratio exceeds those of established tech players during significant market surges, indicating that its valuation may be stretched. By understanding the historical context of the dot-com bubble and the AI sector, investors can better gauge where Palantir’s stock might be headed.

Historical Insights on Palantir’s Potential

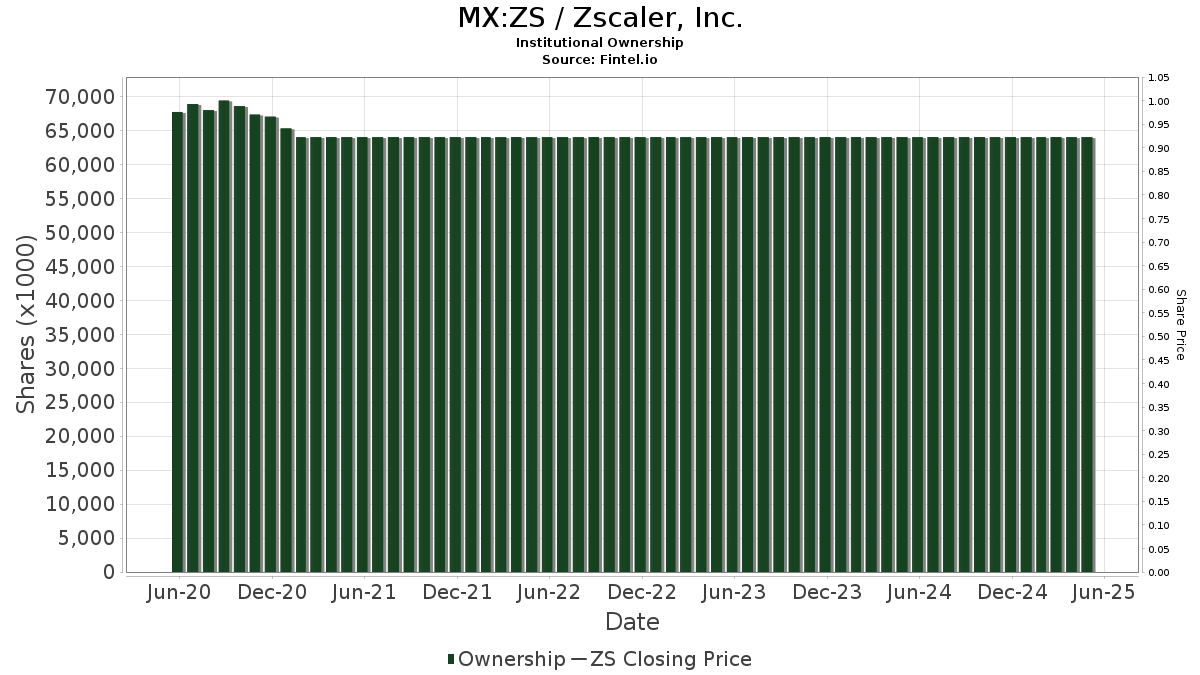

Currently, Cisco, Amazon, and Nvidia have P/S ratios of 4.4, 3.1, and 21.6, respectively. This historical context implies Palantir’s valuation multiples could potentially decrease significantly.

While this might cause some investors to panic, it’s reasonable to expect valuation multiples to normalize over time. As businesses grow, so do their valuations, leading to a natural smoothing of multiples.

CSCO Market Cap data by YCharts.

Importantly, a compression in valuation multiples does not inherently mean a decline in a company’s market value. For instance, Amazon is significantly more valuable today than it was at the height of the dot-com era when its multiples peaked.

Although Cisco’s valuation did not completely recover, its current market cap of $236 billion remains higher than what it was during the mid-2000s. This illustrates the potential long-term gains from holding onto stocks over several years or even decades.

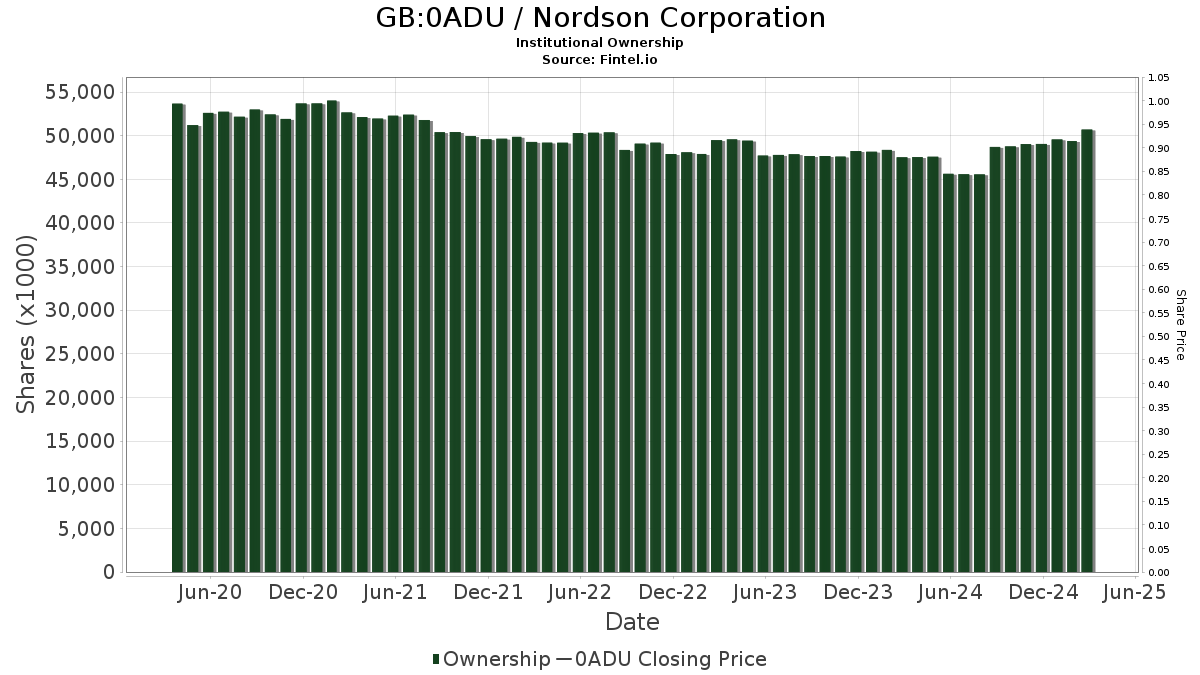

Additionally, Nvidia’s market cap has more than doubled from two years ago when its P/S ratio peaked at 46.

NVDA Market Cap data by YCharts.

Considerations for Investing in Palantir

One of the main differences between Palantir and other tech giants is that the AI sector does not appear to be in a bubble. Palantir’s growth potential seems clearer now than Cisco’s or Amazon’s during the dot-com phase, largely due to increased demand for AI software.

Despite this promising outlook, potential investors should weigh the historical high valuation against the opportunity cost of investing now.

While Palantir could eventually exceed its current market value of $250 billion, evidence suggests that it may trade at more reasonable valuations for new investors in the future. A prudent strategy for building a position in Palantir might be to employ dollar-cost averaging and maintain a long-term investment horizon.

Should You Invest in Palantir Technologies Right Now?

Before considering an investment in Palantir Technologies, it is essential to reflect on this:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks for current investment, and Palantir Technologies is not among them. The selected stocks have strong potential for significant returns in the coming years.

For instance, if you had invested $1,000 in Netflix when it made this list on December 17, 2004, you’d now have $614,911!

Likewise, if you invested $1,000 in Nvidia when it was recommended on April 15, 2005, that investment would now amount to $714,958!

Importantly, Stock Advisor’s average total return is 907%—significantly outperforming the S&P 500’s return of 163%.

*Stock Advisor returns as of May 5, 2025

John Mackey, former CEO of Whole Foods Market, is on The Motley Fool’s board. Adam Spatacco is invested in Amazon, Nvidia, and Palantir Technologies. The Motley Fool recommends Amazon, Cisco Systems, Nvidia, and Palantir Technologies and has related positions.

The opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.