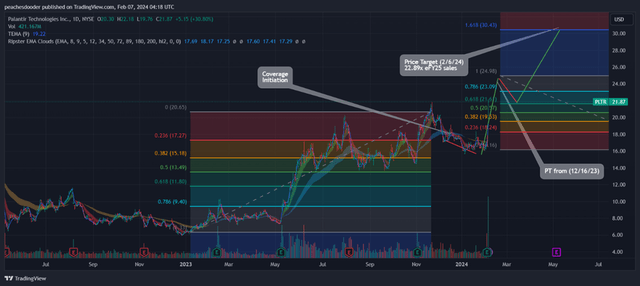

Palantir (NYSE:PLTR) had an extraordinary end to FY23. Since the bullish investment thesis was first written in December 2023, investor sentiment has shifted significantly. Following the recent earnings announcement, the stock surged more than 40% in the next two trading days. The initial bullish investment thesis was momentarily challenged as shares traded down -12% from publication to Q4’23 earnings. However, with this new growth trajectory and accelerated interest in AI at the corporate level, the BUY recommendation is being maintained, and the forecast and price target have been increased to $30.70/share based on 22.89x the eFY25 sales forecast.

Operations

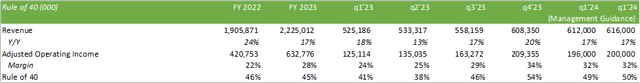

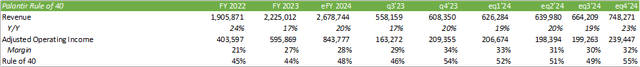

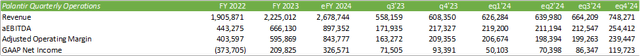

Palantir closed FY23 on a high note, with commercial customers growing by 55% y/y in Q4’23 and 12% sequentially. This translated to a 70% increase in commercial revenue for the quarter from the previous year. TCV booked $1.15b, $699mm of which derived from commercial customers, growing on a y/y basis by 192% and 156%, respectively. Palantir also experienced strong growth in both top line and margins, surpassing the Rule of 40 at 54% when using Q4’23 revenue growth and adjusted operating income.

It is believed that management’s guidance may be conservative as AI takes shape.

One of the strengths that Palantir found in the last few quarters lays within their AIP bootcamps. Rather than a sales call cycle, the firm actively showcases their AIP features in these masterclasses, demonstrating the effectiveness of their products in the business environment. This approach has been highly successful in not only cross-selling across their current customer base, but also expanding and attracting new customers. It is believed that interest in Palantir’s AI-oriented offerings will accelerate and drive the sales conversion cycle. Additionally, the firm closed 103 deals valued at over $1mm in Q4’23, with 37 of those deals over $5mm, and 21 over $10mm.

Management has taken a bold approach, citing:

I go around the country now telling CEOs, CTOs, and really, whoever has $1 million to buy our product and transform their enterprise, take everything you’ve done in AI since you started, put your best people on it, and we’re going to show up at any time you want, and we’re going to run your data at a bootcamp for 10 hours. And then, you compare your self-pleasuring to our operationally-relevant, commercially-valuable, critical-to-your-enterprise results. Our 10 hours, your 10 months. Any products you want, any vendor you want, any hyperscaler you want, you pick them, we’ll show up.

Alex Karp, CEO, Palantir

There also remains a huge opportunity in the public sector as management mentioned that the Army’s budget for their command and control software is only 0.015% of hardware and software spend.

The principal reason is that the DoD is at the very beginning of a long-term allocation shift from hardware to software. For example, the Army is spending a mere 0.015% of its budget on command and control software in fiscal year ’24. But as we confront crisis and conflict in three theaters, this is changing. Growth is being driven by the incredible dynamism of the US commercial market, and US government will follow.

Shyam Sankar, CTO Palantir

One growth headwind that the firm faces is that their salesforce is lagging behind their growth. Management spent a significant portion of the q4’23 earnings call discussing their recruitment process and that the firm is actively seeking to strengthen their headcount as the company’s profitability scales. Additionally, in building a case for Palantir’s growth, it’s worth examining the AI-enabling chip companies like Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel (INTC) as a guide from a hardware perspective.

As the firm grows and scales operations, revenue growth is anticipated to outpace any contractionary effects to margins. Palantir has a huge opportunity and has only scratched the surface in scaling their AIP tool. The future holds great promise for the company.

Predicting Palantir’s Future: A Bullish Perspective

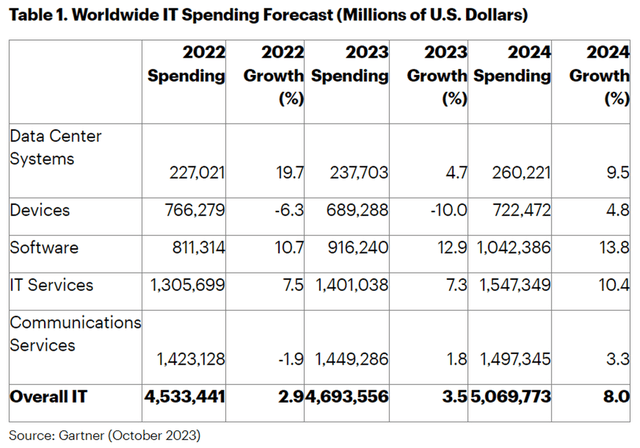

I envision companies harnessing the full extent of Palantir’s capabilities, with Gartner forecasting an 8% growth in total IT spending and a remarkable 13.8% surge in software expenditure for CY24. This signals a clear directive towards cost-reducing technologies, precisely where Palantir’s offering shines, as the management referenced in their Q4’23 earnings call.

Anticipating a concentration of IT spending directed at AI-enabling technologies, I draw a comparison to Snowflake (SNOW), a company I covered on January 30, 2024. While Snowflake provides the database and a suite of data analytics tools for hosting in a hyperscaler environment, Palantir’s software offers actionable capabilities for driving operational efficiencies, playing more of an enabling role rather than just equipping companies with a toolbox.

Valuation & Shareholder Value

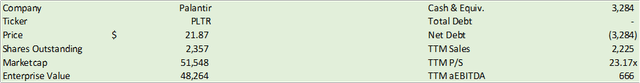

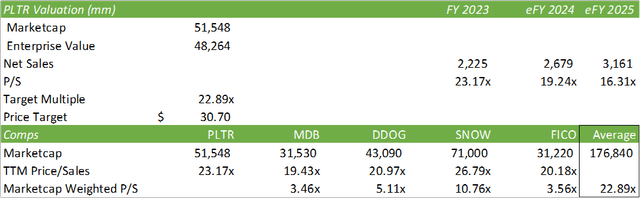

Currently trading at 23.17x FY23 sales, Palantir’s stock commands a slight premium compared to its competitors. With my optimistic outlook for the company’s growth trajectory into eFY24 and eFY25, I foresee significant upside for PLTR shares. Looking ahead to eFY25, I advocate a BUY recommendation for PLTR with a price target of $30.70/share at 22.89x eFY25 sales.

Reflecting on my previous technical chart, PLTR shares have moved precisely as anticipated. With my $30.70/share price target in sight, I foresee a continued near-term upsurge before a slight pullback to $21.59/share, followed by a resurgence towards the ultimate target. In my estimation, any pullback in shares represents a substantial buying opportunity, given my anticipation of a 40% appreciation in the stock.