2024 Tech Giants: Palantir vs. Nvidia – Who Will Reign in 2025?

Two tech stocks that have witnessed remarkable growth this year are Palantir (NASDAQ: PLTR) and Nvidia (NASDAQ: NVDA). Palantir’s stock has surged by about 325%, eclipsing Nvidia’s 180% gain. Both returns are noteworthy.

The pressing question is: which stock is more likely to take the lead in 2025? Let’s analyze a few key factors.

Nvidia’s Competitive Advantage

Companies with significant competitive advantages, or “moats,” tend to thrive. Simply put, a moat protects a company from rivals, helping maintain its market share.

Nvidia stands out in the artificial intelligence (AI) infrastructure market, largely due to its strong moat thanks to the CUDA software platform. Initially developed to enhance the performance of graphics processing units (GPUs) for gaming, CUDA evolved to support various computing tasks. As more developers learned to use this platform, it became the standard for GPU programming.

This competitive edge has helped Nvidia secure nearly 90% of the GPU market.

In contrast, Palantir’s moat isn’t as established, as the AI software market is still evolving. However, its AI platform (AIP) has gained significant traction in commercial sectors and is seeing renewed growth in government applications. Palantir’s technology plays a crucial role in various government functions, such as combating terrorism and managing COVID-19 data.

While competitors are racing to build superior AI models, Palantir believes the real differentiator will be the application and workflow layers it focuses on. With its expertise in analytics and pattern recognition, Palantir aims to rapidly advance AI applications from theoretical concepts to real-world solutions.

Image source: Getty Images.

Strong Growth for Both Companies

Nvidia has experienced tremendous revenue growth this year, which is remarkable given its large starting revenue base. In the first nine months of the year, its revenue increased by an astonishing 135%, totaling $91.2 billion. For the fiscal third quarter of 2025, revenue grew 94% to $35.1 billion. Nvidia also enjoys impressive margins of around 75%.

The demand for Nvidia’s chips continues to be incredibly high, surpassing supply for its latest GPU architecture. This trend is expected to persist, with major tech companies needing more computing power to develop advanced AI models. Newer models sometimes require ten times the GPUs previously used for their development.

Looking ahead, analysts project that Nvidia’s revenue will exceed $195.4 billion in 2025, marking over 50% growth.

While Palantir’s growth has not matched Nvidia’s speed, it has shown accelerating revenue increases. The company reported 21% growth in the first quarter, followed by 27% in Q2 and 30% in Q3, bringing its total revenue to $726 million.

Parts of Palantir’s business are seeing even faster expansion, particularly U.S. commercial revenue, which grew 54% last quarter, and U.S. government revenue that rose by 40%. However, international markets have not kept pace.

Palantir boasts a growing customer base—up 39% last quarter—and stands to benefit from transitioning clients from prototype projects to full production. This potential for further growth is not fully reflected in analyst predictions, which estimate a revenue increase of about 24% in 2025 to $3.47 billion.

Valuation Insights

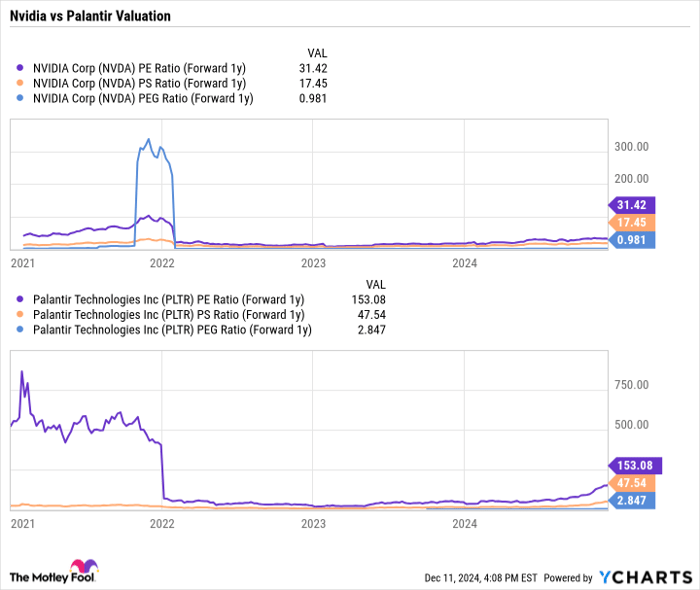

Nvidia clearly leads in valuation, with a forward price-to-earnings (P/E) ratio just over 31 based on 2025 estimates, along with a price/earnings-to-growth (PEG) ratio at approximately 1. A PEG ratio under 1 often indicates undervaluation, while growth stocks typically have PEG ratios well above that mark.

On the other hand, Palantir trades at a much higher forward price-to-sales (P/S) ratio of around 47.5 times the next year’s projections. This valuation is steep for a company experiencing 30% revenue growth and is significantly above historical peak multiples for software-as-a-service (SaaS) firms.

NVDA PE Ratio (Forward 1y) data by YCharts

The Conclusion

On paper, Nvidia presents a stronger case with superior revenue growth, an established moat, and a more favorable valuation, making it a preferable choice going into 2025. If analyst projections hold true, Nvidia is likely to outperform.

Nonetheless, unexpected developments could alter this prediction. If Palantir successfully establishes its AI platform as the leading solution and experiences significant revenue growth, it could surpass Nvidia. Conversely, if spending on AI infrastructure declines, Nvidia may underperform. While my preference leans toward Nvidia, these scenarios are worth monitoring as 2025 approaches.

Should You Invest $1,000 in Palantir Technologies Now?

Before purchasing stock in Palantir Technologies, here’s a point to consider:

The Motley Fool Stock Advisor analyst team has unveiled their picks for the 10 best stocks for today’s investors…and Palantir Technologies is not among them. The stocks on their list have the potential for high returns in the coming years.

For context, consider that when Nvidia was listed on April 15, 2005… an investment of $1,000 then would be worth $853,765!*

Stock Advisor offers investors a straightforward strategy for success, encompassing guidance on portfolio building, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Geoffrey Seiler has no positions in any of the mentioned stocks. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. An investment disclosure policy is in place.

The opinions expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.