Palantir’s Strategic Evolution

In the face of constrained government spending and cautious commercial IT investment, Palantir Technologies Inc. (NYSE:PLTR) has exhibited remarkable resilience and strategic adaptability. The introduction of its Artificial Intelligence Platform (AIP) in 2023 heralds a transition from a service-oriented to a platform-centric business, particularly gaining ground in the commercial sector.

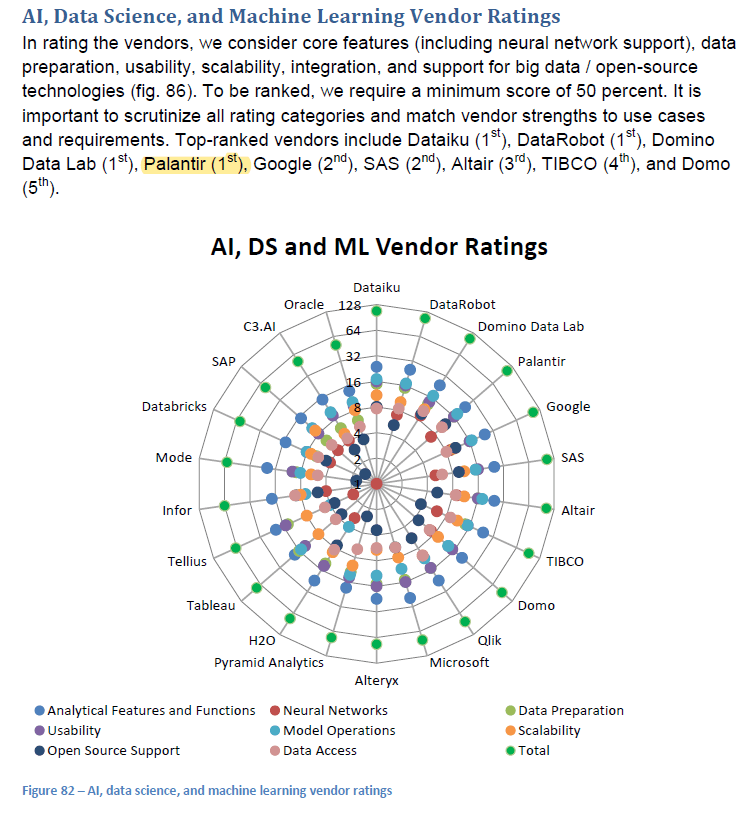

Recognized for its prowess in AI and data science by Dresner Advisory Services, the company is well-positioned to capitalize on the burgeoning AI market, projected to reach $739 billion by 2030. Palantir’s enterprising approach and expanding commercial focus augur an auspicious future in tech-driven business solutions.

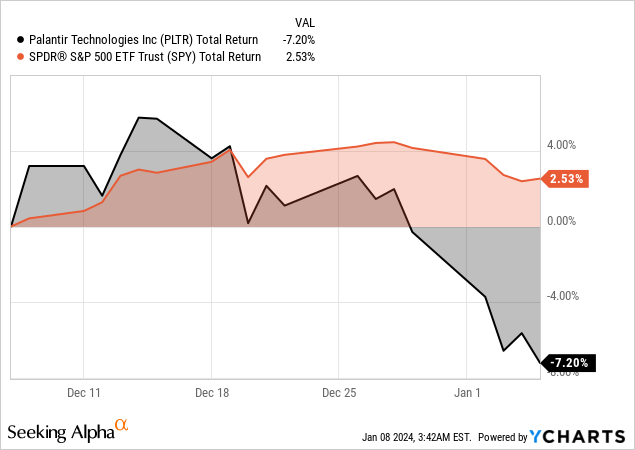

With a recent stock pullback of 12.53%, closing in on our identified entry range of $12.55-$14.95, long-term investors have an enticing opportunity to leverage Palantir’s sturdy fundamentals and growth potential in the buoyant AI market.

Anchoring amidst Economic Shifts

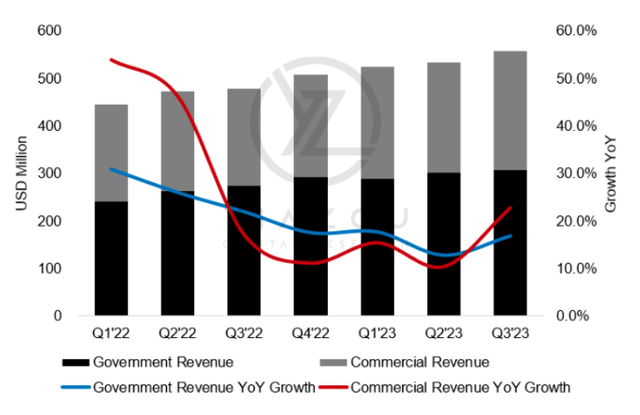

Palantir’s revenue growth has hovered below 20.0% YoY over the past four quarters, partly due to macroeconomic headwinds. Both the government and commercial segments felt the pinch, as US federal budget cuts and global business reticence in non-essential IT spending, prompted by inflationary pressures, took their toll.

The government segment, driving 56.0% of Palantir’s total revenue, bore the brunt amidst a noticeable geographic concentration, with the USA contributing 76.2% of its government segment revenue. An 8.6% year-over-year negative growth in Q3’22 was swiftly replaced by a robust 12.8% YoY growth in Q3’23, signifying a revival in government spending.

The recent quarterly performance of PLTR paints a picture of resurgence in growth and, concurrently, hints at the gradual subsiding of longstanding macroeconomic headwinds.

Foray into Increasingly Diverse Markets

The company’s strategic collaboration with Google Cloud for public cloud services and channel partnerships with IBM and Fujitsu is poised to streamline deployment processes, fostering broader market penetration.

Moreover, the launch of AIP by PLTR is set to significantly bolster the commercial segments, enabling customers to interact with product ontology more intuitively and expediting software deployment for specific use cases. Notably, major contract wins, including those with the UK’s National Health Service and the US Army, are expected to fuel growth in the government segment.

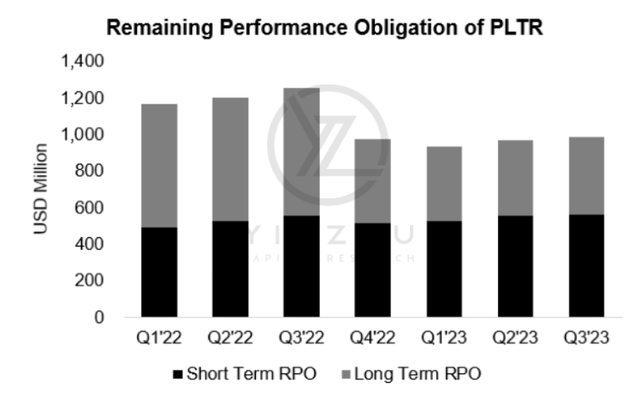

PLTR’s recovery in remaining performance obligation (RPO) also suggests improving revenue growth in the coming quarters. Likewise, the company’s net dollar retention remains above 100.0%, indicating that the PLTR platform’s stickiness has remained intact.

Leading with Unyielding Client Portfolio and Cloud Expansion

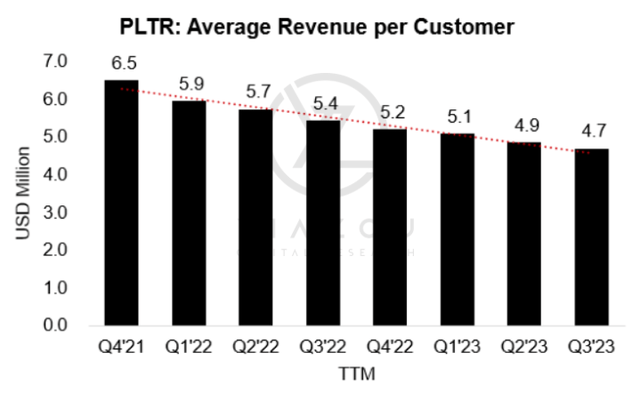

Palantir’s average revenue per customer (ARPC) remains notably higher than its peers. The top 20 high-value customers drive a substantial portion of PLTR’s revenue, yet their contribution has been gradually waning, underlining the company’s endeavor to cater to a broad and diverse market.

Specifically, the top 20 customers’ revenue contribution fell to 50.8% based on TTM as of September 2023, down from 57.1% in FY21. Consequently, the average revenue per customer of PLTR dropped below USD $5 million based on the latest TTM revenue, compared to USD $6.5 million in FY21.

Palantir Technologies’ Expansion Strategies Unleash Growth Potential

Palantir Technologies (PLTR) is on an ascending trajectory, with its commercial customer count exceeding the government segment and a sharp rise in the total remaining deal value. The company’s strategic shift to diversify its client base and revolutionize its commercial approach is propelling its growth and market position. Let’s delve deep into Palantir’s expansion strategies and the unleashed potential of its AI platform (AIP).

Commercial Segment Outpaces Government Contracts

In an era of constant technological evolution, Palantir stands out with its commercial customer count witnessing a remarkable 45.0% year-over-year growth as of September 2023 on a trailing twelve months (TTM) basis. Concurrently, the total customer count displayed a strong 34.0% year-over-year growth during the same period. As a testament to its diversification efforts, Palantir’s total remaining deal value soared to USD $3.7 billion, showcasing a substantial increase from the previous quarter’s USD $3.4 billion. The US commercial segment’s remaining deal value also surged by an impressive 23.0% year-over-year.

Strategic Shift: Diversifying Beyond Top Clients for Sustained Growth

Palantir’s strategic move to diversify its client base has yielded tangible results, highlighted by the successful onboarding of 300 distinct organizations onto its AI platform (AIP) within five months of its introduction. The company’s focus on public cloud offerings is fueling expansion in the commercial segment, enhancing the scalability of its Foundry and Apollo products. This emphasis is altering its client base, extending beyond specialized software applications for defense and counterterrorism purposes.

The implementation of AIP is redefining the company as a platform rather than a service provider, marking a significant milestone in its evolution. This transformative push is elevating Palantir above competitors in the big data, analytics, and business intelligence markets. Furthermore, Palantir’s top-tier ranking in the 2023 AI, Data Science, and Machine Learning Market Study published by Dresner Advisory Services underscores its robust outlook, bolstered by its position as an industry frontrunner.

Palantir’s AIP Revolutionizes Commercial Strategy and Client Approach

The introduction of AIP propels Palantir’s efforts to expand its commercial segment, enhancing its potential to secure high-margin clients. Its module-based sales strategy, combined with AIP, is strategically designed to cater to specific client needs, projecting the company as a versatile and forward-thinking market player. As organizations increasingly adopt AI-driven solutions, the widespread adoption of AIP is set to catalyze the company’s commercial market expansion.

Christopher Cemper, an AI and cybersecurity expert, acknowledges Palantir’s leadership in AI/machine learning and its capability to customize and compare algorithms across various industries. This positions Palantir as a preferred choice for organizations seeking cutting-edge AI solutions. Despite fierce competition, Palantir’s emphasis on providing tailored modules to commercial clients adds a new dimension to its market approach, addressing client concerns about unnecessary features.

In light of the anticipated robust growth of the AI market, with projections indicating a staggering 17.0% CAGR from 2023 to 2030, Palantir’s AIP is strategically positioned at the forefront of this transformative industry shift.

The Market Undervalues PLTR’s Growth and AIP Potential

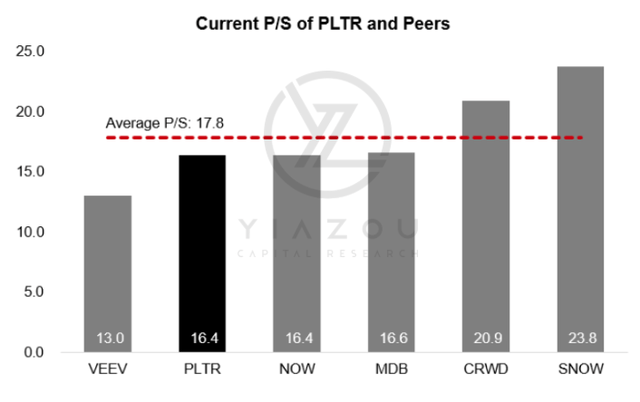

Despite its significant growth and transformative strategies, Palantir is undervalued in the market. As investors assess the company’s potential, the current price-to-sales ratio does not fully capture the unleashed potential of its AI platform and growth prospects. This underscores an opportunity for savvy investors to capitalize on Palantir’s undervaluation and its potential for sustained, robust growth in the dynamic AI and data analytics landscape.

Unlocking the Undervalued Potential of Palantir Technologies

The market’s current valuation of Palantir Technologies, as of 2024, stands at 16.4x. This figure suggests that the market values PLTR at a lower multiple relative to most of its peers, signaling an undervaluation.

This undervaluation may reflect the market underappreciating not only PLTR’s improved margin but also, crucially, the significant potential of AIP. The latter can expand the company’s market beyond government contracts and into diverse use cases within the commercial segment.

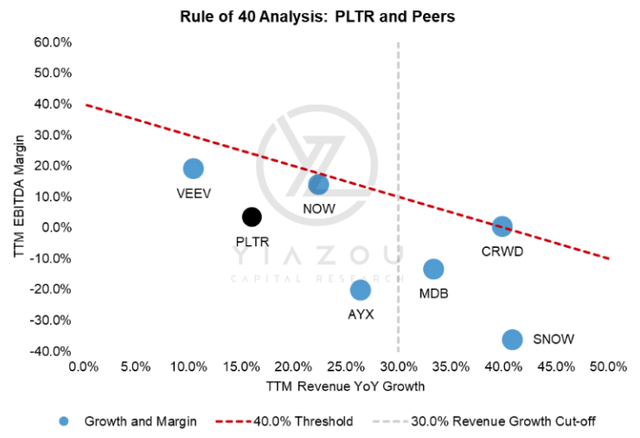

Rule of 40 analysis holds significance for software or SaaS companies, signifying that those attaining a combined score of 40.0% in revenue growth and margin (with EBITDA margin in this instance) are more likely to achieve sustainable growth. Based on TTM, PLTR has a YoY revenue growth of 16.1% and an EBITDA margin of 3.3%, leading to a combined score of 19.4%.

Even though there is a lot of progress to be made, Palantir could exceed the 40.0% threshold (sum of growth and margin) by revitalizing its revenue growth beyond the 30.0% mark and continuing the upward trend in its EBITDA margin, which seems highly likely given the company’s progress in the expansion of the commercial segment and AIP’s potential to cater to high margin clients.

Lastly, PLTR management raised their guidance revenue to USD $2.2 billion for FY24, which seems achievable, and there is a high possibility that they will beat their guidance given the traction in the commercial segment. Also, GAAP operating profit is to continue with the continuation of subdued opex intensity in Q4’23. Therefore, considering an expected USD $2.2 billion annual revenue, PLTR P/S stands below 16.0x, and given the company’s reacceleration of revenue growth towards above 20.0%, the company is trading at a bargain.

Emerging Stronger: Palantir’s Path to Value

Despite recent revenue growth challenges, Palantir’s innovative AI focus and expansion into the commercial sector, recognized by Dresner Advisory Services, position it for growth in an AI market projected to reach $739 billion by 2030. The recent stock correction to $15 levels offers an attractive entry point for long-term investors, considering Palantir’s solid fundamentals and potential in the expanding AI landscape.