Palantir Reports Strong Q1 2025 Earnings Amid Stock Decline

Palantir Technologies (PLTR) announced impressive results for Q1 2025, revealing a 39% year-over-year revenue increase to $884 million. Adjusted earnings per share (EPS) matched expectations at $0.13. Following this report, the company raised its full-year revenue guidance, projecting figures between $3.89 billion and $3.90 billion—exceeding analyst estimates.

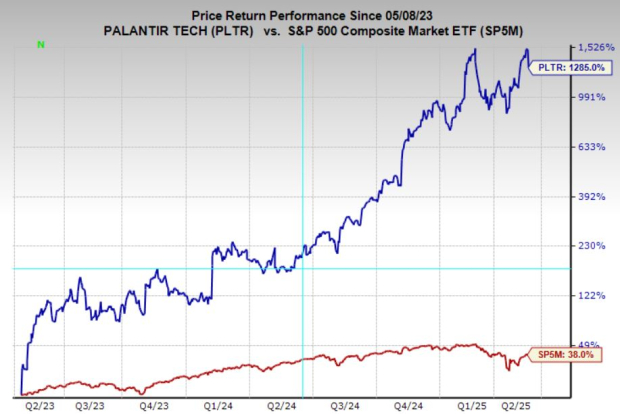

Despite these robust earnings, Palantir’s stock has fallen by 13% as of this writing. The stock has experienced an astonishing 1,200% increase over the last two years, leading to a striking valuation of 200 times forward earnings. This decline may reflect profit-taking by investors and a shift towards more attractively priced options.

Growth Outlook and Current Ratings

Palantir maintains strong long-term growth projections, with earnings expected to rise over 30% annually for the next three to five years. However, recent downgrades in earnings estimates have led to a Zacks Rank #4 (Sell) rating, indicating potential caution in the short term. While I share a guarded perspective, I will provide a tactical trading setup for investors interested in PLTR.

Image Source: Zacks Investment Research

Palantir’s Rise in the AI Sector

Palantir has become a standout “cult stock,” often compared to Tesla during its growth phase. Over the last two years, the stock’s more than 10x increase illustrates both investor enthusiasm for artificial intelligence and Palantir’s distinctive market position.

The company’s Gotham and Foundry platforms are regarded as industry leaders in data integration and critical decision-making. These tools have become integral for government agencies and private enterprises, ensuring long-term contracts with organizations such as the US Department of Defense and Fortune 500 companies.

Palantir’s perceived technological edge and long-term growth potential attract a devoted investor base, many of whom continue purchasing shares despite high valuations. Trading at over 200x forward earnings, the stock remains costly compared to other growth peers, making it unsuitable for valuation-focused investors.

Nonetheless, for those who believe in Palantir’s vision or want to leverage market momentum, the investment story remains intriguing. A few companies are as closely linked to AI trends as Palantir, drawing both retail and institutional interest.

Investors seeking a tactical approach might find opportunities to participate in Palantir’s next movement without risking capital at current highs. Below, I will outline a potential technical setup.

Tactical Trading Setup for Palantir Stock

Palantir Technologies stock has established a wide trading range between $65 and $125. Within this range, a bullish wedge pattern previously identified has led to notable upward movement. The stock recently hit its resistance level near the previous all-time high.

For investors focusing on technical analysis, I see two main strategies. It’s not advisable to purchase shares within this broad range at the moment. However, if the price continues to drop, the $65 support level—though still distant—has shown strong buying activity, presenting a better risk-reward ratio.

Alternatively, for those comfortable with momentum trading, a recovery and consolidation above $125 could signal a breakout. Using tight risk management in this context would be prudent.

Image Source: TradingView

Is It Time to Invest in PLTR Shares?

At current prices, acquiring Palantir shares involves significant risk. With high valuations and sentiment-driven gains, much of the potential upside may already be reflected in the stock price. However, the stock could continue to increase, similar to its past performance, despite claims of overvaluation.

That said, the Zacks Rank #4 (Sell) signals caution. This reflects a trend of declining earnings estimates, which could maintain selling pressure in the near future. If this trend persists—and it appears likely—investors should consider waiting for a lower support level before entering a position.

Importantly, any new long position should be validated by an improvement in the Zacks Rank. This measure has previously been an effective indicator, and if a rally is imminent, the Zacks Rank should provide early signals. Patience and strategic planning are essential.