Assessing the Company

Assessment Overview

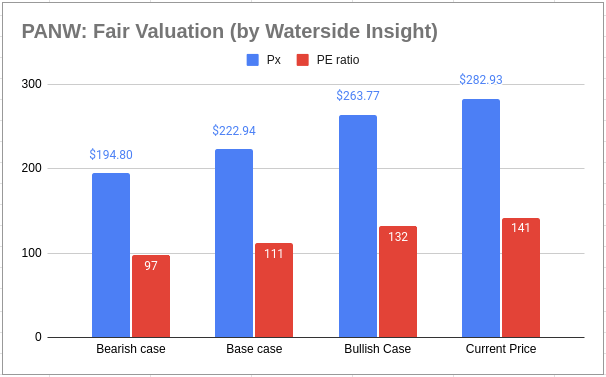

We previously analyzed Palo Alto Networks (NASDAQ:PANW) in “Palo Alto Networks: Performance Likely Reached A Near Term Peak”. Our analysis concluded that the increasing influence of the company’s contract acquisition costs on its free cash flow, combined with low cash ratios, indicated a potential near-term performance peak. While acknowledging the stock’s remaining potential, we recommended a hold. Since our assessment, the stock has surged by 23.78% to reach $283.30. We will now review how this aligns with our previous valuation target.

Evaluating the Progress

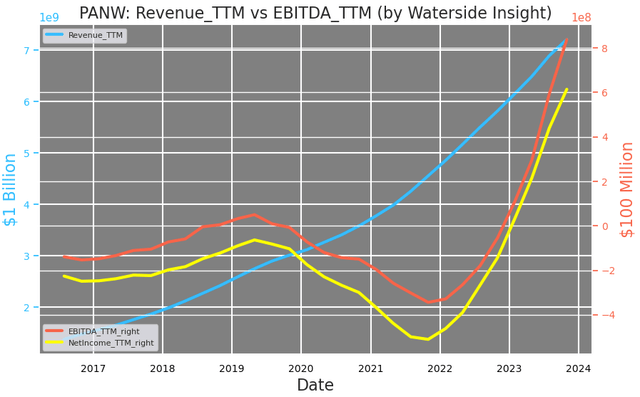

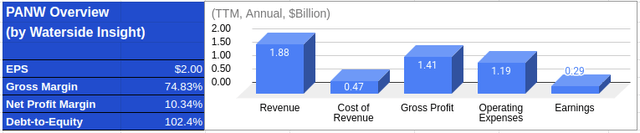

Examining Palo Alto Networks’ growth in ’23, a pivotal indicator is the chart reflecting the company’s top line and bottom line performance. The revenue continued its upward trajectory, and the earnings and net income notably outpaced their negative figures from a year ago.

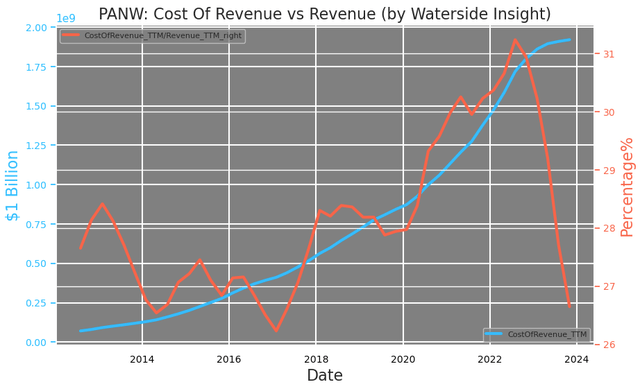

The improvement in net income and EBITDA can be attributed to the moderation of the cost of revenue. After nearly a decade, the growth in the cost of revenue flattened in ’23, resulting in an almost 5-percentage-point improvement as a portion of the revenue. However, it is unlikely that the cost of revenue can be further constrained as it has reached its lowest percentage of revenue in the past ten years at 26%. This indicates a potential peak in net income and earnings, echoing our previous analysis.

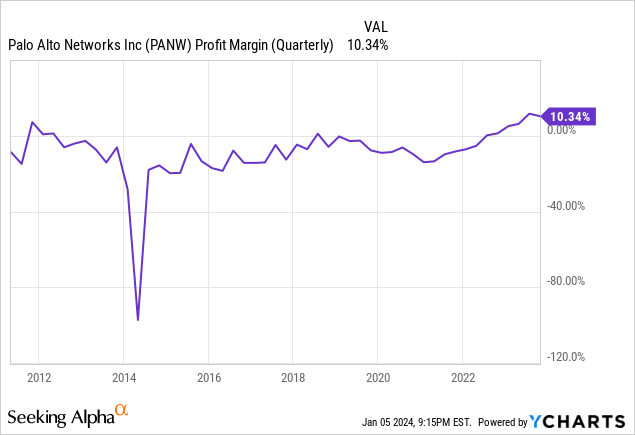

On a trailing twelve-month basis, its net profit margin has surged by about 10% since the end of 2022, reaching an unprecedented 10.34%. Factoring in the 4% decrease in the cost of revenue as a percentage of revenue, the net increase of the net profit margin during the same period was approximately 6%. Although this is an impressive figure, further examination is warranted.

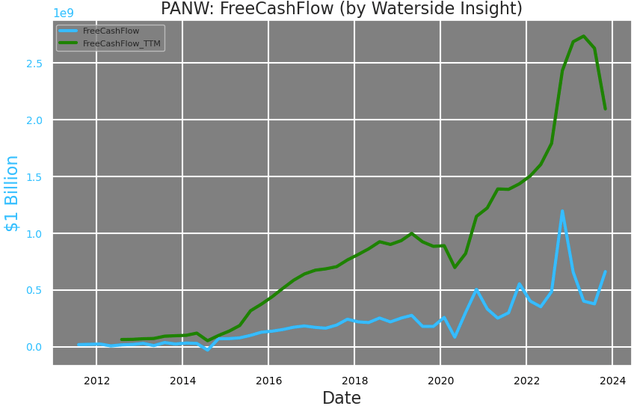

Previously, we noted the increasingly pronounced seasonality in Palo Alto Networks’ free cash flow, primarily linked to the structure of its sales incentives recorded as deferred contract costs. The latest quarterly report, ending in October of 2023 (the first quarter of FY ’24), exhibited a significantly lower quarterly free cash flow year-over-year, resulting in a downward trend on a trailing twelve-month basis. The typical seasonality indicated that its free cash flow peaked around October of the year, which is the first quarter of fiscal year 2024. Consequently, the second quarter’s free cash flow of FY ’24 is likely to experience a double-digit year-over-year decline.

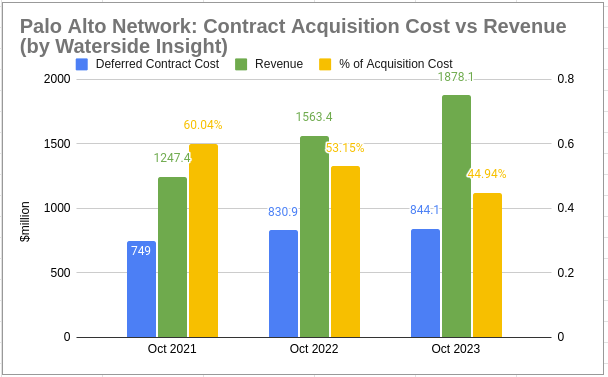

We previously examined its amortization of deferred contract cost versus net income. We have updated the chart to pair its total (short-term and long-term) deferred contract cost with its revenue, demonstrating Palo Alto Networks’ consistent revenue growth without significant increases in its contract acquisition cost. While this underscores its organic growth strength, it also underscores the implications of asset and company acquisitions contributing to its rapid top-line growth.

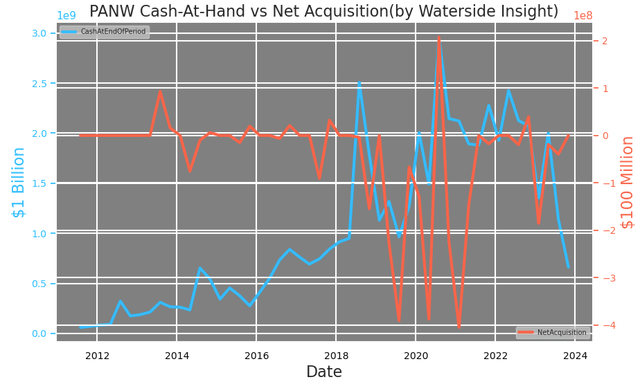

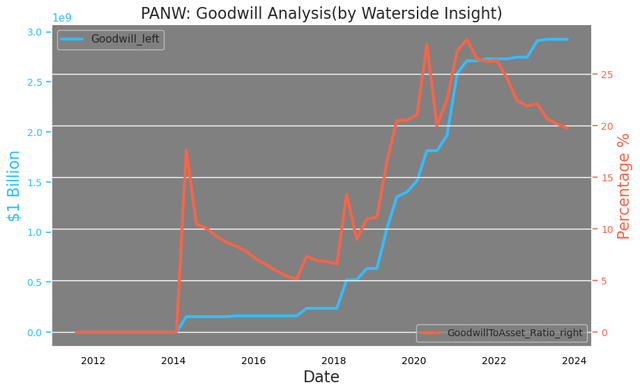

Across the past seven years, acquisitions have played a pivotal role in Palo Alto Networks’ growth. Since 2020, the company has not only ramped up its R&D expenses by almost 50% but has also made substantial acquisitions to bolster its competitiveness. However, its cash-at-hand by the end of the latest quarter has declined quarter-over-quarter by more than half, hitting one of the lowest levels since 2017. Notably, during previous periods of low cash, the company tended to make much smaller acquisitions. In contrast, acquisitions made during periods with higher cash levels were almost three times larger. The integration of these significant acquisitions has substantially contributed to the company’s recent years’ growth.

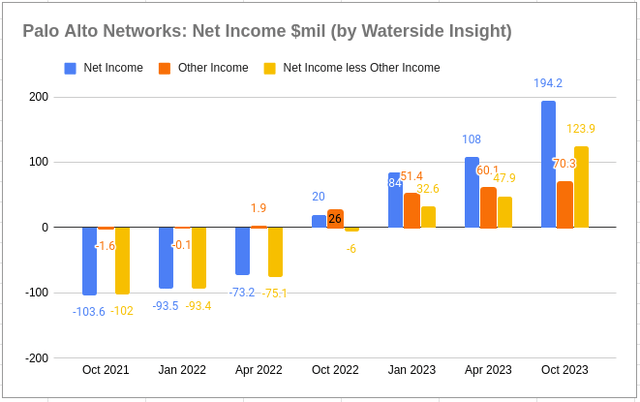

During the quarter ending in April ’23, the company made a substantial investment in the corporate bond market of about $2.1 billion, among other marketable securities, totaling around $5 billion. While the company has the option to hold this investment portfolio for later acquisition, we believe it will likely retain it to generate income. The interest from this investment, combined with a small contribution from Forex gain, is reported under the Other Income section. In the last quarter, this section accounted for one-third of its total net income, significantly higher than a year ago. Therefore, a deeper analysis is required to gauge the impact of these income sources on the company’s net margin increase.

Palo Alto Networks: Navigating the Stormy Waters of Acquisitions

Palo Alto Networks has long been steaming ahead on a voyage of acquisitions, propelling its financial performance through forceful expansion. Hitting the brakes on such a trajectory now may seem akin to steering a ship against a tempestuous current. Still, the signs are clear: the company may need to navigate these stormy waters with a more cautious hand on the throttle.

The company’s Other Income, holding steady at around 4%, serves as a shoulder to lean on for Net Income. This financial buffer acts as a safeguard against the choppy waters of escalating competition – a lifeline that Palo Alto Networks seems wise to hold onto rather than risk it on further acquisitions.

However, the company’s goodwill, now towering at over 20% of its assets, has undergone an alarming surge from a mere 5% in 2018. A historical precedent from 2014, when this figure reached approximately 18%, hints at the slow and laborious process of bringing the ratio back down. This indicates a pressing need for Palo Alto Networks to ease off on its acquisition spree and steady the ship through consolidation.

Financial Overview & Valuation

A dissection of the company’s financial overview and valuation indicates a slowdown in free cash flow growth since Q1 of FY 2024, aligning with earlier predictions of a performance peak. The imperative shift toward consolidation and organic R&D beckons, as the potential for sustained positive net income hinges on the company’s ability to rein in costs and derive contributions from its extensive investment portfolio. However, the anticipated growth rate may plateau, hovering at low single digits.

Conclusion

Reflecting on our previous analysis, it’s evident that Palo Alto Networks has strived to bolster its net profit margin through a trifecta of avenues – organic expansion, cost containment, and investment revenue. Yet, historical benchmarks and the unyielding competitive landscape suggest that further acceleration in growth may be approaching its zenith. The market’s premium valuation of the stock teeters on opulence, leading us to advocate for a prudent sell-off at this juncture.