Papa John’s International, Inc. PZZA has been witnessing strong headwinds from a challenging macroeconomic environment, a decline in consumer confidence and uncertainty in international markets.

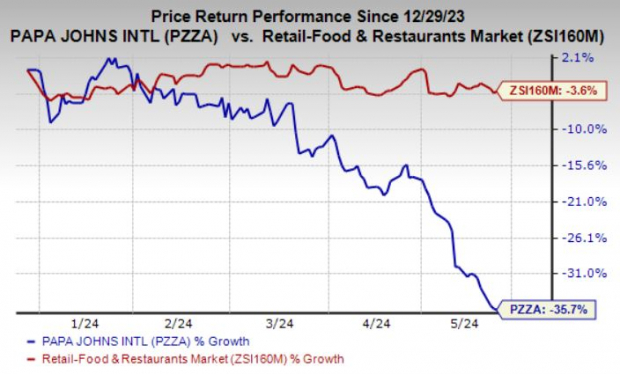

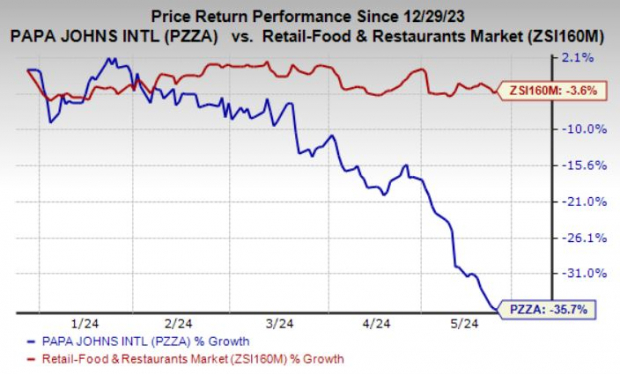

The company’s shares have declined 35.7% year to date compared with the industry’s 3.6% fall. Let’s look at PZZA’s earnings estimate revisions to get a clear picture of what analysts are thinking about the company. Earnings estimates for the fiscal 2024 and 2025 have been revised downward by 6.1% and 7.1%, respectively, in the past 30 days.

Let’s discuss the factors that are likely to impact this Zacks Rank #4 (Sell) company’s growth potential.

Primary Concerns

Challenges in Comps Performance: Dismal comps performance has been hurting investors’ confidence. In the fiscal first quarter, total comparable sales declined 2% year over year compared with a 1.3% fall reported in the prior-year quarter. Domestic company-owned restaurant comps in the quarter under review declined 3% year over year against 3.4% growth reported in the year-ago quarter. At North America franchised restaurants, comps dropped 1.5% year over compared with a 0.8% decline reported in the year-ago quarter. Comps growth at North America restaurants declined 1.8% year over year. Lower transactions and a decline in organic delivery primarily drove the downside.

Image Source: Zacks Investment Research

Impact of International Conflict on Comps: During first-quarter fiscal 2024, the company’s international comps were negatively impacted by ongoing conflict in the Middle East. During the quarter, comps at international restaurants were down 2.6% year over year compared with 5.8% in the prior-year quarter. The company is vigilant about international comparable sales due to the unpredictable international environment.

Cautious Outlook and Guidance Adjustment: The company’s outlook for the rest of the year indicates a cautious approach, with North America’s comparable sales experiencing a slight decline in the first four weeks of the second quarter. This trend may continue due to ongoing economic challenges and weakening consumer confidence. The company adjusted its full-year guidance to reflect this cautious outlook, anticipating North America’s comparable sales to range from flat to a slight decline for the entirety of 2024.

Macroeconomic Challenges and Uncertainty in International Markets: In the past two years, conflicts in Ukraine and the Middle East, coupled with a dynamic geopolitical landscape, have hindered the pace of new international restaurant openings for 2024. Despite reporting 23 new restaurant openings internationally in first-quarter 2024, this was partly offset by 29 closures, primarily in certain Middle Eastern markets and China. Looking ahead, PZZA is cautious about macroeconomic challenges and uncertainty in international markets.

Debt Concerns: PZZA’s weak liquidity position is also concerning. At the end of the fiscal first quarter, the long-term debt net totaled $761.3 million compared with $757.4 million at the end of fourth-quarter fiscal 2023. Its debt to capitalization at the end of first-quarter fiscal 2024 came in at 231.1%, almost flat sequentially. The company ended the fiscal first quarter with cash and cash equivalents of $27.8 million (down from $40.6 million as of fiscal 2022 end), which may not be enough to manage the high debt level.

Stocks to Consider

Some better-ranked stocks in the Zacks Retail-Wholesale sector include:

Wingstop Inc. WING sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has surged 84.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) suggests a rise of 27.5% and 36.7%, respectively, from the year-ago levels.

Brinker International, Inc. EAT carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 213.4%, on average. Shares of EAT have risen 62% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5% and 39.2% growth, respectively, from the year-earlier actuals.

El Pollo Loco Holdings, Inc. LOCO carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 19.4%, on average. LOCO’s shares have risen 14.5% in the past year.

The Zacks Consensus Estimate for LOCO’s 2025 sales and EPS indicates 3.8% and 9.4% growth, respectively, from the prior-year figures.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Papa John’s International, Inc. (PZZA) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.