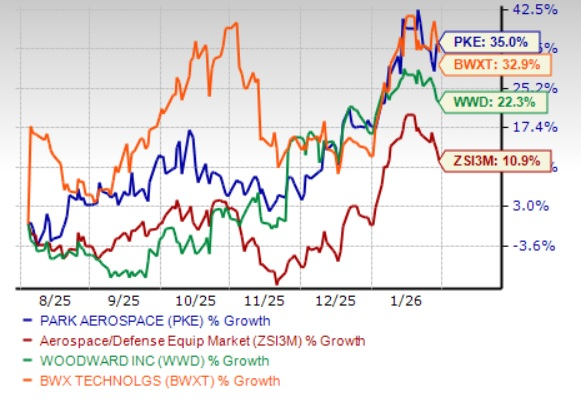

Park Aerospace Corp. (PKE) has experienced a 35% increase in share value over the past six months, significantly outperforming the aerospace and defense industry, which grew by 10.9%. By comparison, key competitors BWX Technologies, Inc. (BWXT) and Woodward, Inc. (WWD) saw gains of 32.9% and 22.3%, respectively. The company reported net earnings of $7.4 million for the 39-week period ending November 30, 2025, and has consistently paid quarterly dividends for 40 years, totaling $608.6 million since FY2005.

Operating from Newton, KS, Park Aerospace specializes in advanced composite materials for aerospace applications, including military aircraft and spacecraft. It recently secured a long-term agreement with ArianeGroup extending through 2033 for products used in rocket motors, enhancing revenue visibility. Gross profit margins rose to 32% from 28.1%, attributed to a favorable sales mix and improved operational efficiency.

Despite these successes, Park Aerospace faces challenges from rising input costs and inflation impacting its supply chain and customer contracts. Currently trading at a price-to-earnings ratio of 6.42, well below the industry average of 14.5, the company’s valuation may offer an attractive opportunity for investors amidst ongoing market pressures.