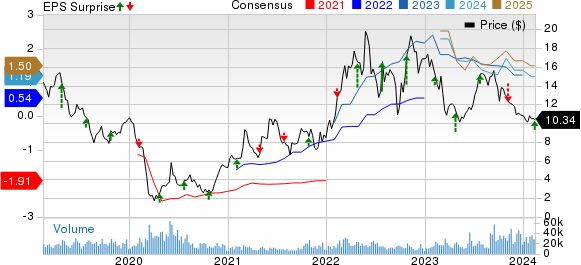

Patterson-UTI Energy, Inc. PTEN soared past expectations, reporting an adjusted net profit of 19 cents per share for the fourth quarter of 2023. This impressive performance exceeded the Zacks Consensus Estimate of 18 cents, largely fueled by outstanding results in the Completion Services and Drilling Services segments. However, the bottom line saw a decline from the preceding year, stemming from a meager contribution from the Other Operations segment.

While the adjusted net profit fell short compared to the year-ago quarter’s 46 cents, the total revenues of $1.6 billion exceeded the Zacks Consensus Estimate of $1.5 billion. This not only displayed an extraordinary improvement of 100.9% on a year-over-year basis but was also attributed to PTEN’s enhanced revenue contribution from the Completion Services segment during the same period.

Patterson-UTI’s Strong Revenue Segments

Drilling Services: Revenues in this segment totaled $463.6 million, exhibiting a 0.4% increase from the prior year’s figure. Marvellously, this figure surpassed expectations, underscoring the segment’s robust performance. Operating profit amounted to $92.7 million, demonstrating an upward trajectory from $81.2 million in the fourth quarter of 2022. However, the figure slightly missed our projected estimate.

Completion Services: This segment’s revenues of $1 billion witnessed a monumental spike of approximately 230.6% from the year prior, owing to improved pricing. Remarkably, this figure also surpassed our forecast of $949.6 million. Operating profit totaled $70.3 million, showcasing a notable rise from $58.6 million in the preceding year. Despite the increase, the figure was slightly lower than our estimate of $81.9 million.

Drilling Products: PTEN’s revenues totaled $88.1 million, yet, with an operating loss of $261,000. The fourth quarter marked the company’s first complete reporting period following its acquisition of Ulterra Drilling Technologies.

Other Services: Revenues amounted to $18.3 million, 9.4% lower than the year-ago quarter’s figure of $20.2 million, with operating profit amounting to $1 million compared with $3.5 million in the fourth quarter of 2022.

Capital Expenditure & Outlook

In the reported quarter, PTEN expended $205.3 million on capital programs compared with $119.2 million in the previous year. As of Dec 31, 2023, the company had cash and cash equivalents worth $192.7 million and long-term debt of $1.2 billion.

Looking ahead, Patterson-UTI foresees steady oil basin activity throughout 2024, with potential impacts on natural gas basins from prevailing low prices. It also anticipates maintaining an average of 120 U.S. rigs in operation for the first quarter of 2024, with expectations of relatively flat drilling services adjusted gross profit quarter over quarter.

For the Completion Services segment, revenues are projected to range between $940-$950 million, with approximately $750 million in direct operating costs and an anticipated adjusted gross profit of $190-$200 million. Demand in the Drilling Products segment is expected to remain stable through the first quarter, with projected revenues of approximately $90 million, $50 million in direct operating costs, and an expected adjusted gross profit of $40 million. The Other segment foresees flat sequential revenues and adjusted gross profit. Additionally, PTEN expects to incur selling, general, and administrative expenses of approximately $65 million and depreciation, depletion, amortization, and impairment expenses of approximately $280 million for the first quarter.

Looking further into 2024, PTEN foresees an effective tax rate of 24%, with anticipated annual cash taxes ranging from $35-$45 million. The company also estimates capital expenditures of approximately $740 million, including $285 million for Drilling Services, $360 million for Completion Services, $55 million for Drilling Products, and $40 million for Other and Corporate purposes.

Zacks Rank and Key Picks

With a Zacks Rank #4 (Sell) currently, PTEN presents an interesting perspective to a multitude of investors delving into the energy sector. For those intrigued by the sector, stocks like Subsea 7 S.A. SUBCY and Energy Transfer LP ET, both carrying a Zacks Rank #1 (Strong Buy), and Murphy USA Inc. MUSA, holding a Zacks Rank #2 (Buy) currently, might serve as better options. Subsea 7 is valued at $3.96 billion and pays an annual dividend of 38 cents per share, equating to 2.93%. The company specializes in offering offshore project services for the energy industry. Energy Transfer, valued at $43.91 billion, pays a dividend of $1.26 per share annually, or 9.03%. The company is an independent energy entity, primarily engaged in crude oil and natural gas acquisition, exploration, development, and production. Murphy USA, with a valuation of about $8.34 billion, has seen a remarkable 47% surge in its shares over the past year. The company is involved in the retail marketing of motor fuel products and convenience merchandise, operating retail stores under the brands Murphy USA, Murphy Express, and QuickChek.

Energy Transfer LP: A Timely Investment in the Oil and Gas Industry

The Rebirth of a Bear Market Low

Amidst the ebb and flow of the stock market, a phoenix metaphorically rises from the ashes to capture the attention of shrewd investors. Energy Transfer LP (ET) emerges from its bear market lows, highlighting a promising opportunity for investors to ride its resurgence. Given the company’s historical performance and its current position in the oil and gas industry, it has the potential to rival or even surpass other recent stocks that doubled in value. Notably, stocks such as Boston Beer Company and NVIDIA soared magnificently, presenting a compelling parallel for ET’s upward trajectory in the coming months.

The timing seems opportune; ET’s resurgence could prove to be a feather in the cap of investment portfolios, beckoning both seasoned and novice investors alike to seize the moment. The stars seem aligned for a meteoric rise in the stock’s value—a rising tide in the tumultuous sea of stock markets.

The Veritable Symphony of Investment Potential

If history is any indication, then the rebound of a company like Energy Transfer LP is akin to a crescendo in a symphony—a captivating rise heralding the promise of bullish times ahead. As the company steps onto the stage, its strategic position within the oil and gas industry elicits intrigue and curiosity from investors. The orchestrated movements of its financials, coupled with predictions of future performance, create a symphonic harmony that reverberates across the investment landscape.

A symphony often heralds a sense of awe, capturing the undivided attention of the audience. Similarly, investors are drawn to the captivating performance and potential of Energy Transfer LP, urging them to take heed and consider joining the ensemble of savvy investors who recognize the tune of earning opportunities. It is amidst this harmony that the allure of ET’s financial trajectory becomes too compelling to ignore.

A Harmonious Synchronization of Investment Opportunities

In the ever-changing world of stocks and bonds, the emergence of investment opportunities cannot be underestimated. Energy Transfer LP (ET) presents a unique opportunity for investors to partake in the fortunes of the oil and gas industry. The company’s resurgence from the bear market lows symbolizes a harmonic convergence, enticing investors to engage in a synchronized maneuver, aligning their investments with this rising star. It is akin to joining a symphony—an exquisite confluence of diverse instruments contributing to a coherent and resounding melody—where the company’s growth is a note that promises to resonate and elevate investment portfolios.

ET’s rise is not merely a stock market event; It is a chance for investors to synchronize their financial gains with the upward momentum of the oil and gas industry. The harmony of this investment opportunity cannot be sidelined amidst the cacophony of market fluctuations. It beckons investors to take note and join this synchronized rhythm towards potential financial prosperity.

Choosing the Right Tune in the Investment Symphony

As investors navigate through the labyrinth of investment options, the resurgence of Energy Transfer LP (ET) offers a compelling melody in the symphony of financial opportunities. Amidst the myriad of options, the prospect of joining the crescendo of ET’s upward trajectory is an enticing prospect. It presents an opportunity to intertwine investments with the harmonious rise of the oil and gas industry—a resounding tune that holds the promise of financial rewards.

Just as in a symphony, where the choice of tune is crucial, the decision to invest in a company like ET, poised for rejuvenation and resurgence, requires careful consideration. It is an invitation to discerning investors to be part of a harmonious journey toward potential financial prosperity—a melody of investments conducted by the backdrop of an evolving market.