The Enigma of PDD Holdings (PDD)

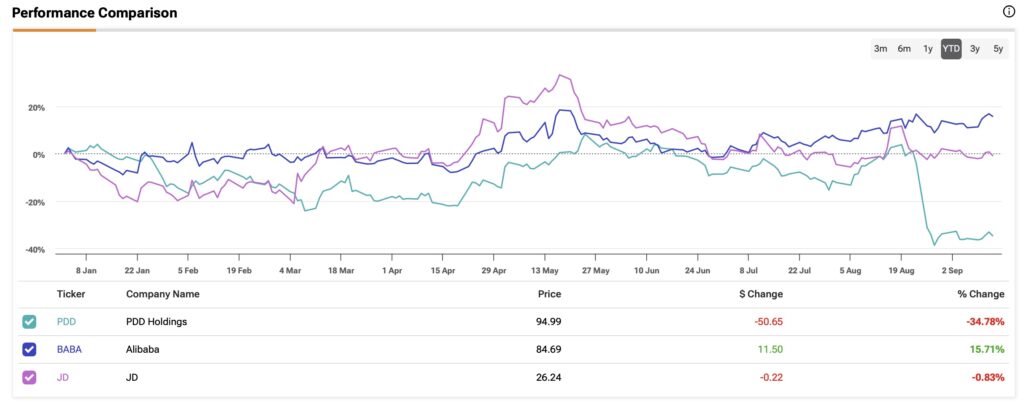

Starting with PDD Holdings, the pandemic birthed the rise of this e-commerce star, yet it struggles to sprint alongside the market, with its shares taking a beating by 32% this year. This stock, trading at a modest forward P/E ratio of 10, belies an unflattering high 2.8 times P/S ratio—a cautionary sign for the vigilant investor.

PDD’s Temu app, a gallant U.S. crowd-pleaser, has not translated success to the balance sheet, with second-quarter revenue falling disappointingly shy of expectations. Although the market anticipates a 65.5% revenue surge this year, concerns loom large: a looming cloud of U.S. trade talks and uncertain tariffs cloud the horizon, casting shadows of doubt on PDD’s future.

The Divided Sentiment: Wall Street’s Verdict on PDD

Despite the air of caution, the voices on Wall Street echo a siren call of Strong Buy for PDD, with a constellation of 13 analysts singing the chorus. With an average price target of $159.91, towering at a potential 68.34% lift, the stars seem to align favorably, but Citigroup’s Alicia Yap plays the party pooper, waving flags of trade turbulence for the wary investor.

The Resilience of Alibaba (BABA)

Alibaba, the behemoth of China’s e-commerce realm, exudes a mosaic of resilience, growth, and cash solidity. Despite recent earnings falling below expectations, Alibaba’s forward P/E of 9.7 and P/S ratio of 1.6 earn nods of approval, painted against a backdrop of muted optimism.

Flush with $55.8 billion in net cash, a war chest envied by many, Alibaba’s $31.9 billion buyback dance amplifies its allure to investors looking for a pirouette of shareholder value.

The Oracle’s Opinion: BABA’s Bullish Run

The bullish notes continue to ring for Alibaba, with 16 keen-eyed analysts penning the Stock Opera in the key of Strong Buy. Eyes gleam with dreams of a 29.33% rise as the average price target of $109.53 beckons the faithful. Jefferies’ Thomas Chong dances to Alibaba’s tune, lauding its clear strategic dance and the grand finale of its dual-listing spectacle in Hong Kong.

The Undisputed Champion: JD.com (JD)

Lastly, the crown jewel of the trio, JD.com, emerges as the phoenix from the ashes of Chinese e-commerce. With a direct retail model painting the town red, JD.com prances ahead with a shimmering promise of reliability, efficiency, and untapped potential, drawing gazes from the discerning investor.

The Bullish Case for JD.com: A Jewel in the Chinese Tech Market

JD.com’s Resilient Position in the Market

As consumers navigate the maze of e-commerce giants, JD.com shines as a beacon of stability and resilience. While Alibaba dazzles with its broad portfolio and PDD dances ahead with rapid growth, JD.com holds its ground with an 8.9% annual revenue increase over the last three years. This may pale compared to PDD’s meteoric 58.4% surge, but in the realm of Chinese tech, JD.com’s steady growth is akin to a sturdy oak amidst gusty winds.

The Financial Fortitude of JD.com

What sets JD.com apart from its competitors is its robust financial stance. With a hefty $28.8 billion in cash and meager debts, JD.com stands tall, with cash reserves comprising more than half of its $42 billion market capitalization. Despite the tempest of macroeconomic conditions, the company consistently surpasses earnings per share (EPS) expectations over the past 20 quarters. With a modest valuation, boasting a meager seven times P/E ratio and a P/S ratio of 0.27 times, JD.com’s stock sparkles as a diamond in the rough amidst its industry peers.

JD.com’s Appeal to Wall Street Analysts

Even the harshest critics on Wall Street can’t resist the allure of JD.com. With a consensus Strong Buy rating from twelve seasoned analysts, JD.com emerges as a phoenix in the realm of Chinese tech stocks. The robust average price target of $38.09 hints at a staggering 45.16% potential upside, making JD.com the belle of the ball for investors.

Barclays analyst Jiong Shao joins the chorus of praise for JD.com, noting the company’s remarkable performance in the face of net product revenue slowdowns. With soaring general merchandise sales and substantial improvements in gross and adjusted operating margins, JD.com’s financial health shines brighter than a summer sunrise.

JD.com: A Standout Investment

In a market bustling with giants, JD.com emerges as a diamond in the rough. While Alibaba remains a steadfast choice for investors seeking diversity and stability, JD.com’s solid financial foundation and discounted valuation make it a compelling investment. PDD Holdings, with its eye-popping growth potential, dances on a riskier tightrope due to its elevated valuation and regulatory hurdles. A neutral stance toward PDD Holdings seems prudent in the ever-fluctuating landscape of Chinese tech stocks.

The views expressed herein are solely those of the author and not Nasdaq, Inc.