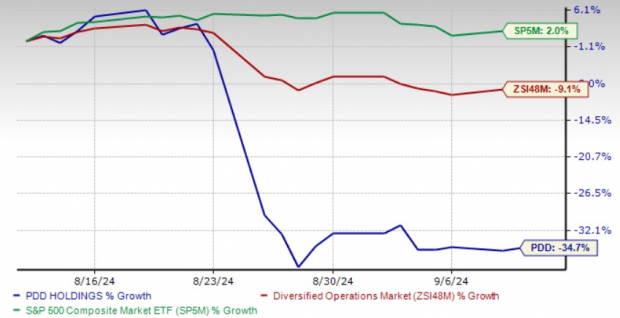

As the curtain rises on PDD Holdings, investors brace themselves for a rollercoaster ride marked by a 34.7% plunge in stock value within a mere month. The cacophony of macro headwinds – global uncertainties, shifting consumption dynamics, recessionary whispers, erratic market swings, and China’s economic quagmire – create an unsettling symphony haunting PDD’s stock.

The Rollercoaster of One-Month Price Performance

The past month’s route diverges sharply for PDD Holdings against the backdrop of an industry-wide 9.1% tumble and the S&P 500 index’s resilient 2% surge.

A tableau of competition unfolds with giants like Amazon, JD.com, and Alibaba casting formidable shadows over PDD Holdings in the e-commerce arena, both home and away.

The Bright Side of PDD’s Long-Term Growth Story

PDD’s resilience rests on the stalwarts of its e-commerce model, epitomized by the robust Pinduoduo platform.

The company’s potent presence in the agriculture sector adds another layer of strength, tapping into fertile business prospects by empowering small-scale farmers with digital inclusion.

Exploring PDD’s Attractive Valuation

Trading at a discount with a forward 12-month Price/Earnings of 7.12X, PDD Holdings beckons investors with a tantalizing opportunity amidst a sea of industry competitors.

Its Value Score of A and Growth Score of A underline a compelling case for investment.

Weathering the Storm of Macro Worries

PDD navigates the stormy seas of evolving consumer desires, diversifying preferences, and the ripples of the US-China geopolitical tussle. Adaptation, investment, and strategic collaborations mark its response to the tempest.

As investors grapple with uncertainties, downward revisions in earnings estimates underscore the tumultuous terrain ahead.

Concluding Thoughts on PDD

Amidst the tempest, PDD Holdings stands tall on the pillars of strong fundamentals, growth potential, and an enticing valuation proposition. Holding on to this stock could be a prudent move amidst the current volatility.

PDD Holdings’ Zacks Rank #3 (Hold) augurs well for the journey ahead, as investors watch keenly for signals amidst the macro storm.