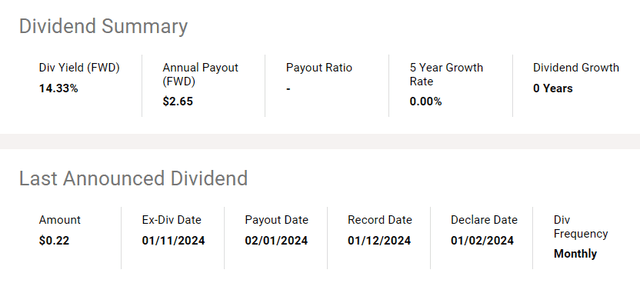

Investors have been keeping a keen eye on the PIMCO Dynamic Income Fund (NYSE:PDI) as it continues to prove its mettle as an income-producing asset. Throughout 2023, PDI has demonstrated resilience, maintaining its monthly distribution rate at $0.2205. Despite volatile market conditions, the fund has sustained a distribution yield of 14-15%, offering stability to its shareholders. As we move into 2024, the outlook for PDI remains positive, with potential for both income generation and capital appreciation.

Reflections on PDI Movement

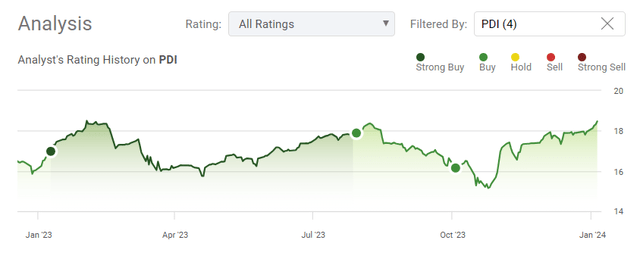

Since my previous analysis of PDI in October, the fund has seen an increase of 9.29%, outperforming the S&P 500’s appreciation of 10.01%. Considering the distributions, the total return stands at an impressive 13.51%. This steady performance further bolsters my confidence in the potential of PDI to deliver both stable income and future growth. With a clearer understanding of the Federal Reserve’s stance, the investment landscape looks increasingly favorable for PDI’s underlying assets.

Assessing Investment Risks

While optimistic about PDI’s prospects, it’s important to acknowledge the potential risks. Fluctuations in the macroeconomic environment or an unexpected shift in the Federal Reserve’s policy could impact PDI’s performance. A sustained high-rate environment could lead to increased bond rates, negatively affecting PDI’s underlying assets, particularly in the real estate sector. Investors must also consider the impact of leverage and the possibility of elevated losses in a credit crunch scenario. Additionally, PDI’s anticipated returns may not outpace those of other investments in the long run, posing an opportunity cost risk for shareholders.

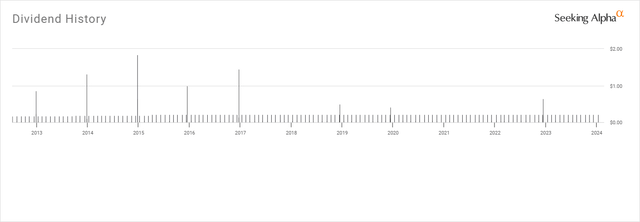

Resilience in Income Generation

PDI has remained steadfast in its income generation, maintaining its monthly distribution at $0.2205 since September 2015. Despite prevailing concerns, the stability of PDI’s distributions reflects the fund’s robust performance in the face of economic and geopolitical uncertainties. Its unwavering distribution rate over the past eight years, a period encompassing various tumultuous events, underscores its resilience in generating consistent income for investors.

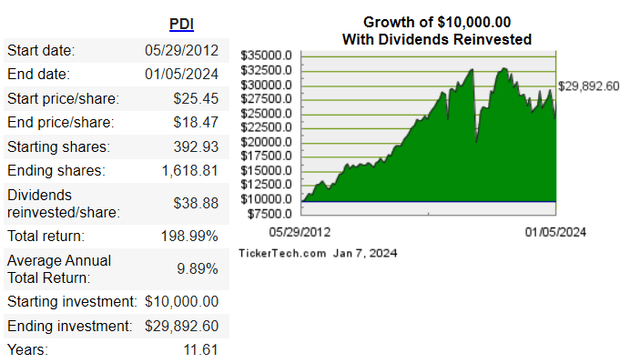

Since its inception on 5/30/12, despite a decline of -26.12% in share value, PDI has distributed $38.83 in income to shareholders. This remarkable feat translates to a yield of approximately 13% on an annualized basis, showcasing its commitment to income provision amidst market fluctuations.

Looking to the future, the potential for income growth through dividend reinvestment presents an attractive proposition for long-term investors. With a strategic focus on continuously expanding income-producing assets, PDI holds promise for sustained income generation, aligning with the goals of many investors seeking long-term financial security.

Why Prospect Development Inc. (PDI) Presents a Bright Investment Prospect in 2024

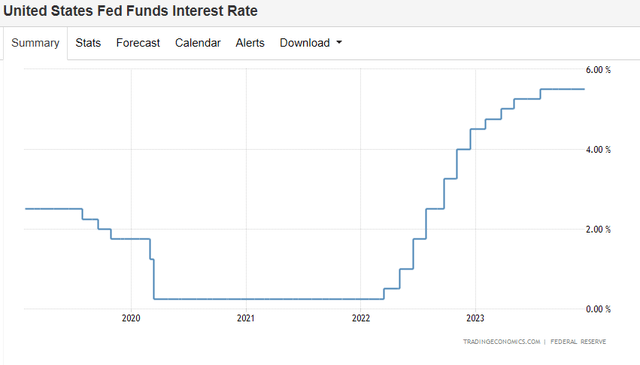

PDI’s investment profile has long been intertwined with the fortunes and vicissitudes of the interest rate environment. As a primarily income-generating holding, the company has traditionally been a refuge for investors seeking yield, particularly when the return on risk-free assets comfortably exceeded 5%. In such times, phrases like “T-bill and chill” became emblematic of the allure of high interest rates to certain segments of the investment community. PDI’s portfolio is composed of a diverse array of debt obligations and income-producing securities, including mortgage-backed securities, investment grade and high-yield corporates, as well as developed and emerging markets corporate and sovereign bonds. It also includes related derivative instruments. Historically, a higher interest rate environment has not boded well for PDI’s underlying assets. Indeed, during periods of rising interest rates, PDI’s stock has experienced a decline from the mid-$20s to the mid-teens.

The allure of corporatized debt instruments wanes amid a climate of increasing risk-free rates, leaving investors with a plethora of alternatives such as money markets and long-term rate locking through CDs and treasuries. For instance, in the case of a 5-year, 5% coupon bond with a par value of $1,000, an increase in interest rates would cause a decline in the bond’s value. This phenomenon arises from the fact that newer bonds with a 7% coupon would lead the 5% coupon bonds to trade at a discount to their face value. Consequently, the apparent high yield of PDI is a reflection of the fact that its underlying assets have depreciated, driving down share prices and inflating yields.

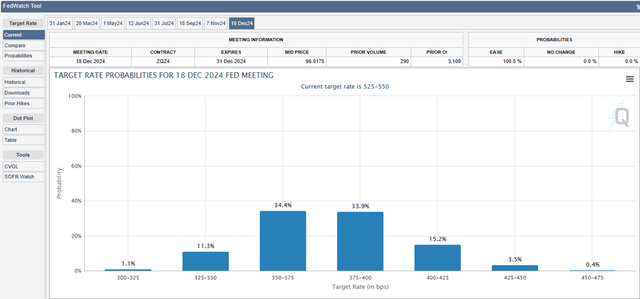

Last year, at the Federal Open Market Committee (FOMC) meeting, Jerome Powell indicated that the Fed is likely near or at the peak of its tightening cycle. He disclosed individual Fed members’ assessments, which suggested a Fed Funds Rate of 4.6% by the end of 2024, 3.6% by the end of 2025, and 2.9% by the end of 2026. The CME Group FedWatch Tool has indicated a 68.3% likelihood that rates will range between 350 basis points and 400 basis points at the close of 2024. Market pricing has suggested the potential for more cuts than the Fed is currently communicating, underscoring the expectation for multiple cuts in 2024, regardless of when they commence. As rates decline, risk-free returns will continue to diminish, prompting a resurgence of interest in corporatized debt instruments at the expense of risk-free options. If, and when, the rate cut cycle begins, discounted yield instruments will likely experience heightened demand, potentially catalyzing an appreciation of PDI’s net asset value (NAV) and shares, thus auguring well for the company in 2024.

The Promising Path Ahead

Investors are advised to adopt a favorable long-term outlook on PDI, particularly during the forthcoming rate cut cycle. As the Fed gradually implements rate cuts, a rush to procure discounted yield instruments is anticipated, especially in the context of new debt issuances with lower coupons. Despite the multifaceted risks associated with PDI, it stands to benefit from a multi-year tailwind driven by the rate cutting cycle, thereby presenting an opportune moment to secure PDI at discounted prices. By diligently reinvesting distributions, the powers of compounding are poised to work their magic, potentially enabling PDI to deliver substantial income alongside modest capital appreciation to investors in 2024.

In Conclusion

My stance on PDI is decidedly bullish, and I intend to bolster my position throughout 2024. With the impending commencement of the Fed’s rate cuts, a surge in demand for discounted yield instruments is expected, particularly as new debt issues feature reduced coupons. Although investing in PDI is not without its attendant risks, I firmly believe that it is poised to benefit from a sustained tailwind derived from the rate cutting cycle and, as such, I am eager to acquire more PDI at advantageous prices. By harnessing the force of compounding through reinvesting every distribution, PDI has the potential to deliver capital appreciation with a yield on cost in excess of 14%, contingent on the timing of share acquisition. Thus, in 2024, PDI appears to be an income investment primed to offer substantial income entwined with a measure of capital appreciation to discerning investors.