Analysts Project Strong Upside for iShares U.S. Small-Cap ETF

Analyzing the underlying holdings of the ETFs in our coverage universe at ETF Channel, we compared the trading price of each holding against the average analyst 12-month forward target price. We calculated the weighted average implied target price for the iShares U.S. Small-Cap Equity Factor ETF (Symbol: SMLF), which stands at $79.05 per unit.

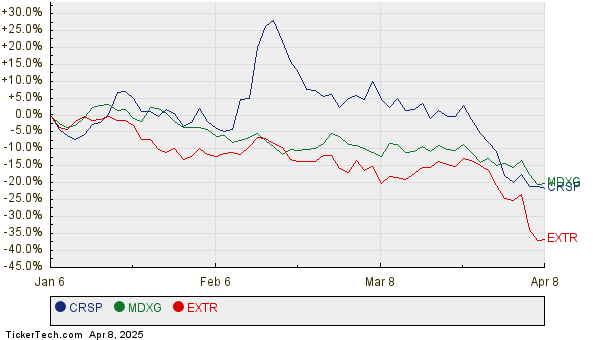

Currently trading at approximately $55.65 per unit, analysts anticipate a potential upside of 42.04% for SMLF based on the target prices of its underlying holdings. Among these, three companies show significant upside potential compared to their analyst targets: CRISPR Therapeutics AG (Symbol: CRSP), MiMedx Group Inc (Symbol: MDXG), and Extreme Networks Inc (Symbol: EXTR).

CRISPR Therapeutics AG recently traded at $32.38 per share, while its average analyst target reaches $83.96 per share, suggesting a remarkable upside of 159.29%. Similarly, MiMedx Group Inc stands at $7.09, with a target of $13.33, indicating an upside of 88.05%. Extreme Networks Inc, priced at $11.09, has an analyst target of $19.80, reflecting a potential gain of 78.54%. Below, you can see a twelve-month price history chart comparing the stock performance of CRSP, MDXG, and EXTR:

Here’s a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Small-Cap Equity Factor ETF | SMLF | $55.65 | $79.05 | 42.04% |

| CRISPR Therapeutics AG | CRSP | $32.38 | $83.96 | 159.29% |

| MiMedx Group Inc | MDXG | $7.09 | $13.33 | 88.05% |

| Extreme Networks Inc | EXTR | $11.09 | $19.80 | 78.54% |

Are analysts justified in these optimistic targets, or are they overestimating where these stocks will trade in 12 months? Investors should consider whether analysts’ projections are grounded in recent industry and company developments. A high target price compared to a stock’s current trading price may suggest optimism about the future; however, it may also signal potential target price downgrades if those targets do not reflect recent trends. Further research is needed to navigate these considerations.

![]() Explore 10 ETFs With Most Upside To Analyst Targets »

Explore 10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• Top Ten Hedge Funds Holding EGOX

• Funds Holding NTRB

• Top Ten Hedge Funds Holding ACOG

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.