Alleviating Dental Woes for Big Canines

PetIQ, Inc. (PETQ), a prominent figure in the realm of pet medication and wellness, recently introduced Minties dental treats tailored specifically for large dogs. This new addition to the Minties line addresses the often-overlooked demographic of dogs over fifty pounds, serving a segment that grapples with limited dental hygiene solutions. Formulated with natural ingredients like alfalfa, peppermint, parsley, fennel, and dill, these treats not only combat bad breath but also aid in plaque and tartar removal, promoting overall dental health.

Strategic Brand Positioning

Emphasizing affordability and natural composition, PetIQ strategically positions Minties dental treats as a superior choice for pet parents concerned about their furry companions’ dental hygiene. By aligning with the values and preferences of pet owners, PetIQ strengthens its brand image and underscores its commitment to delivering top-notch products across various size categories.

Exploring Growth Avenues

Currently accessible online, Minties large dental treats are set to hit retail shelves later this year, offering consumers a range of package sizes and flavors. This strategic approach not only ensures widespread accessibility but also bolsters PetIQ’s standing as a key player in the veterinary products and services sector.

Image Source: Zacks Investment Research

Expanding Pet Care Market Landscape

According to a Grand View Research report, the global pet care market is poised for a Compound Annual Growth Rate (CAGR) of 5.1% from 2022 to 2030. The surge is attributed to factors such as the burgeoning trend of pet humanization, increased consumer expenditure, and a spike in small pet adoption rates. Technological advancements, evolving millennial and Generation Z preferences, and a shift towards pet health and sustainability contribute further to the sector’s expansion, with heightened pet adoptions during the pandemic amplifying the industry’s growth trajectory.

Performance Overview

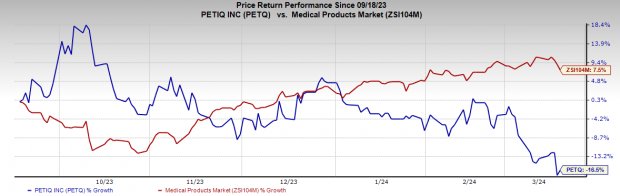

In the past year, PETQ shares have encountered a 16.5% dip, a contrast to the industry’s 7.5% upswing.

Zacks Rank and Noteworthy Picks

Presently holding a Zacks Rank #3 (Hold), PetIQ stands amidst notable stocks in the broader medical landscape like DaVita (DVA), Cardinal Health (CAH), and Stryker (SYK). While DaVita sports a Zacks Rank #1 (Strong Buy), Cardinal Health and Stryker boast a Zacks Rank #2 (Buy). DaVita’s stock has witnessed a profit surge of 81.9% in the past year, beating the industry’s growth rate of 26.9%. Moreover, Cardinal Health’s shares soared by 59.1% within the same period, with anticipated earnings upticks for fiscal years 2024 and 2025. Stryker experienced a 30.7% stock rise over the past year, illustrating consistent earnings surpassing estimates.

Unleashing the $2.3 Trillion Niche in Infrastructure Relics of Fortune to Be Made

The long-anticipated refurbishment of America’s aging infrastructure – a bipartisan, unavoidable endeavor. Prepare to witness multitudes drawn to the cash streams, chiseling out countless riches.

Question is, “Will you stake your chips on the table while the odds shine brightest?”

Ready your playing hand with Zacks’ Special Report, a roadmap to dig up potent stocks in the road, bridge, and building patch-ups, alongside transporting freight and revamping energy on an epic scale. Yours free for today’s taking.

Join Now: Blueprint to Profiting Off Billions in Infrastructure Spending >>

Words expressed reflect the author’s stance and do not necessarily mirror those of Nasdaq, Inc.