Case for Investment

In this editorial, I’ll lay out the compelling reasons for considering Petrobras (NYSE:PBR, NYSE:PBR.A) as a substantial investment. This Brazilian energy company has demonstrated exceptional operational and financial performance, with a strong focus on sustainability. My confidence stems from their record-breaking production, efficient refining processes, robust financials – characterized by a healthy EBITDA and manageable debt levels. Petrobras’ commitment to sustainable practices and foray into renewable energy complements its strategic investments in both traditional and emerging energy sectors. With a management team dedicated to shareholder value through dividends and low-carbon initiatives, Petrobras emerges as an enticing investment prospect, offering growth and stability in the evolving energy landscape.

Company Overview

Petróleo Brasileiro S.A., commonly known as Petrobras, is a publicly traded energy company, playing a significant role in the global oil and gas industry from its base in Brazil. Petrobras specializes in exploring, producing, refining, and distributing oil and gas, with operations spanning onshore and offshore across Brazil. The company is actively diversifying its energy portfolio by investing in renewable energy sources. Beyond its core energy activities, Petrobras significantly contributes to the Brazilian economy through job creation and technological development, highlighting its dedication to innovation and sustainability.

Financial Performance and Future Outlook

Petrobras’ latest earnings call reaffirms its strategic direction and robust financial health, reinforcing the buy rating for the stock. CEO Caio Paes de Andrade’s comments depict a company excelling in the present while poised for future success. The company’s record-breaking production figures, particularly in high-margin pre-salt areas, and impressive refining plant utilization signify excellence in execution. Financially, Petrobras exhibits a solid EBITDA of $13.6 billion, consistent net profit, and robust operating cash flow, underpinning its financial stability. The company’s commitment to sustainability and diversification aligns it with the global energy transition, positioning it for future growth in both traditional and emerging energy sectors. Petrobras’ resilience amidst market volatility accentuates the attractiveness of its investment opportunity.

Notably, Petrobras maintains a shareholder-centric approach, evident in its attractive dividend payouts and strategic positioning as a major low-carbon player. By prioritizing dividends and adapting to industry shifts, Petrobras strengthens its investment appeal, aligning with energy transition trends. As the company progresses in production, investments, and technology, it anticipates continued commercial success.

Significant Recent Contracts

Petrobras’ collaboration with TechnipFMC for the Mero 3 project in Brazil’s pre-salt field exemplifies a milestone that enhances its investment appeal. This contract, valued above $1 billion, extends beyond financial implications, featuring Petrobras’ patented HISEP technology. This innovative approach signifies a major leap in responsible oil extraction, setting new standards for sustainable practices. Additionally, the strategic significance of the Mero field reinforces Petrobras’ production capabilities while pioneering environmentally responsible extraction practices, further solidifying confidence in its investment potential.

Moreover, Petrobras’ multi-year contract with Valaris, worth $519M, for offshore drilling in Brazil underscores its evolving investment potential. This forward-looking move augurs well for Petrobras’ future prospects, reflecting its commitment to innovation and strategic growth initiatives.

Fueling Growth: Petrobras Pushes Ahead with Ambitious Expansion Plans

The Rise of Drillship Day Rates

Petrobras is set to experience a significant surge in its drillship day rate, effectively doubling from the low $200,000s to the high $400,000s. This elevation is a clear reflection of the robust market demand, underscoring Petrobras’ unwavering commitment to bolstering and expanding its exploration capabilities.

Focusing on Petrobras’ 5-Year Plan

Petrobras is embarking on an ambitious $102 billion investment plan through 2028, marking a remarkable 30% increase in spending. The plan distinctly prioritizes oil and gas exploration and production, with the overarching goal of achieving an average output exceeding 3 million barrels daily by 2028. This strategic capital allocation propels Petrobras on a value-accretive trajectory, utilizing its financial prowess to enhance output potential in core hydrocarbon operations, fostering profitable expansion.

This plan also entails a momentous doubling of low-carbon and decarbonization investments to $11.5 billion, showcasing Petrobras’ astute foresight and commitment to future-proofing its operations. By leveraging oil profits to bolster its presence in renewables, Petrobras adeptly balances profitability with a responsible transition amidst evolving clean energy priorities.

Moreover, Petrobras’ reentry into the fertilizer sector further diversifies its portfolio and taps into another critical industry, underlining the company’s dedication to preserving its valuable assets that contribute to core business operations and future growth prospects.

Mixed Reactions to the Decision to Cut Diesel Prices

Petrobras’ recent announcement to reduce diesel prices by 6.7% while maintaining gasoline prices reflects a nuanced approach to managing its market strategy amid fluctuating global oil prices. This decision could potentially bolster Petrobras’ competitiveness in the domestic market and enhance its market presence in Brazil, fostering an increase in market share and sales volume. However, the decision also implies a cautious stance to safeguard profitability, potentially posing challenges in terms of competitiveness compared to imported products.

The broader financial implications of this decision for Petrobras and its investors are multifaceted. While aligning with global market dynamics and domestic demands, the reduction in diesel prices, alongside a cut in gasoline prices, presents potential challenges to the company’s revenue and profit margins in the short term, adding an element of uncertainty and volatility.

Untangling Risks in Petrobras’ Path

As Petrobras celebrates commendable operational and financial achievements, the company is not immune to risks. The solid reliance on global oil prices and susceptibility to external market conditions poses a significant risk to the investment. Additionally, the company’s ambitious expansion and diversification efforts introduce financial risk, potentially straining its resources in the short term, although crucial for long-term sustainability. Notably, increased capital expenditure and involvement in litigation and disputes further compound the financial uncertainty surrounding the company’s strategic path.

The Rise of Petrobras: A Stock Worth a Double-Take

Petrobras, the Brazilian state-run oil company, has been facing some choppy seas. However, despite the risks, the company has been making strategic moves to navigate the current challenges and seize future opportunities. With a gross debt of $61 billion and a net debt of $43 billion, both within its targeted range, Petrobras exhibits a well-structured and controlled debt profile. The company’s approach to balancing dividends with investments and cash reserves exemplifies prudent financial management, placing it in a solid position for resilience and growth in the future.

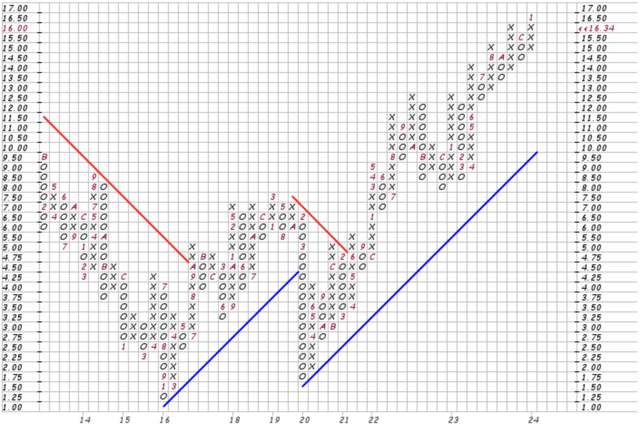

A Graphical Perspective

Taking a graphical lens to evaluate Petrobras’ stock, a Point and Figure graph reveals a compelling trend. Since June of 2023, the stock has shown an upward trajectory, with a recurring pattern of reaching new highs, falling to test support levels, and then surpassing previous peaks. This pattern, reminiscent of historical market behavior and Newton’s law of motion, suggests strong momentum in the stock. This unique pattern fuels optimism, leading to a strong buy rating in my analysis.

Complementing the graphical view, Petrobras’ valuation metrics present a compelling case for investment. The forward Price to Earnings (P/E) ratio stands at 4.16, dramatically lower than the sector median of 10.23, indicating an undervaluation with significant earnings potential. Furthermore, other metrics such as the forward Price to Sales (P/S) ratio, Price to Book (P/B) ratio, and Price to Cash Flow ratio reinforce the undervalued status of Petrobras’ stock. The trailing twelve-month (TTM) Dividend Yield of 4.25%, outpacing the sector’s average, further enhances its appeal to income-focused investors.

|

P/E (FWD) |

P/S (FWD) |

P/B (FWD) |

P/CF (FWD) |

Dividend Yield (TTM) |

|

|

Petrobras |

4.16 |

0.99 |

1.33 |

3.27 |

4.25% |

|

Sector Median |

10.23 |

1.33 |

1.60 |

4.59 |

3.88% |

|

Percent Difference |

-59.32% |

-25.24% |

-16.90% |

-28.73% |

9.61% |

In summary, these metrics collectively highlight Petrobras’ strong financial standing and undervaluation across various aspects, making a strong case for investment in the company.

A Compelling Investment Choice

In conclusion, Petrobras emerges as a solid investment choice, demonstrating operational excellence, financial resilience, and a profound commitment to sustainability. The company’s achievements in record production, efficient refining, robust financials, and strategic forays into renewable energy and sustainable practices position it as an attractive player in the energy landscape. The management’s focus on shareholder value and low-carbon initiatives further enhances the company’s appeal. For investors seeking stability and returns, Petrobras offers a compelling opportunity to partake in the evolving energy market, standing ready for the future.