Pfizer PFE announced that it is launching a new cost-restructuring program to reduce its spending. Spanning across multiple years, the program intends to reduce the company’s costs of goods sold in a multi-phased effort.

The first phase of the program, which is focused on operational efficiencies, is expected to save nearly $1.5 billion by the end of 2027. Management expects to start realizing these savings next year.

Pfizer expects to incur about $1.7 billion as one-time costs for the first phase of the program. This also includes severance for an unspecified number of layoffs. While management expects to record the majority of these charges this year, the cash outlay is expected in the next two years.

Though Pfizer did not provide any information on the other phases, it did mention that the program will also focus on ‘product portfolio enhancements’ and changes to its network structure. More details of this program would likely be disclosed at future earnings calls and investor events.

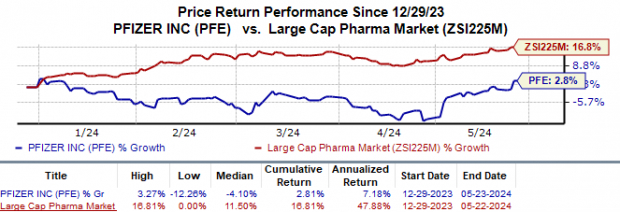

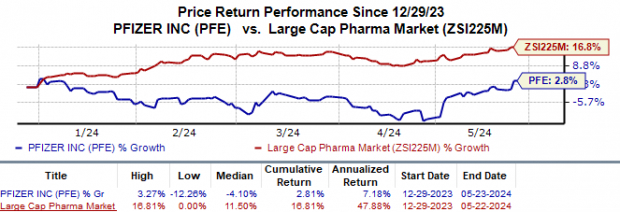

Pfizer’s shares have risen 2.8% year to date compared with the industry’s 16.8% growth.

Image Source: Zacks Investment Research

Management is restructuring its operations, likely in response to a significant drop in sales of its COVID-19 products. The 2024 revenue guidance includes $8 billion from the combined global sales of its COVID-19 vaccine and treatment pill, which is significantly lower than the combined revenues of $12.5 billion in 2023.

The new program is separate from the company’s multibillion-dollar ‘enterprise-wide cost realignment program,’ which was announced last year. Management expects cost cuts and internal restructuring, including layoffs, to deliver savings of $4 billion by this year’s end.

Pfizer Inc. Price

Pfizer Inc. price | Pfizer Inc. Quote

Zacks Rank & Key Picks

Pfizer currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Arcutis Biotherapeutics ARQT, Marinus Pharmaceuticals MRNS and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have improved from $1.77 to $1.14. Year to date, shares of Arcutis have surged 205.0%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 14.93% on average. In the last reported quarter, Arcutis’ earnings beat estimates by 46.67%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have improved from $2.44 to $1.87. During the same period, loss estimates for 2025 have narrowed from $1.97 to 90 cents.

Earnings of Marinus Pharmaceuticals beat estimates in two of the last four quarters and met the mark on one occasion while missing the mark on another. Marinus delivered a four-quarter average earnings surprise of 3.27%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per sharehave improved from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, shares of HRTX have surged 104.7%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.