“`html

CoreWeave’s Performance and Recent Developments

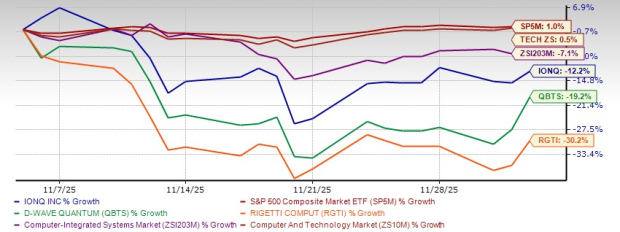

CoreWeave (NASDAQ: CRWV), a cloud computing company, has seen significant changes in its market position following a close relationship with Nvidia (NASDAQ: NVDA). In September, Nvidia announced a $6.3 billion deal to purchase excess AI capacity from CoreWeave, enabling the rapid construction of new data centers. However, CoreWeave’s fourth-quarter revenue guidance was lowered due to supply chain delays from one of its providers, causing its shares to drop by over 50% from October highs.

Coatue Management’s Investment Strategy

Billionaire Philippe Laffont’s hedge fund, Coatue Management, made CoreWeave its largest marketable equity holding in mid-2025 after a major purchase. Laffont criticaly sold the majority of these shares last quarter, with shares sliding since then. Concurrently, Coatue has shifted focus to Alphabet (NASDAQ: GOOG), purchasing over 7 million shares, which now represents the fund’s largest marketable equity position.

Market Context

Despite the recent downturn, CoreWeave remains relatively expensive with an enterprise-value-to-sales multiple above 12, down from over 30 during its peak. Meanwhile, Alphabet’s share price has risen significantly, supported by strong revenue growth in its cloud division and favorable outcomes in its ongoing antitrust case.

“`