Insights from Coatue Capital: Billionaire Investments in Tech Stocks

Large money management firms must report their trades and holdings, allowing smaller investors to gain insights from seasoned professionals. While billionaires typically have different investment goals compared to everyday individuals saving for retirement, observing their choices can offer valuable inspiration.

Billionaire Philippe Laffont heads Coatue Capital, an investment firm that diversifies its investments across various sectors. By the end of the third quarter, Coatue held positions in 81 stocks, with a focus on technology.

Technology Stocks Dominate Coatue’s Portfolio

Coatue’s largest investments lean heavily towards technology. Below are its five biggest holdings:

- Meta Platforms (NASDAQ: META): 3,694,259 shares, 7.9% of the total portfolio

- Amazon (NASDAQ: AMZN): 11,269,029 shares, 7.8% of the total portfolio

- Constellation Energy (NASDAQ: CEG): 7,726,108 shares, 7.5% of the total portfolio

- Microsoft (NASDAQ: MSFT): 3,852,860 shares, 6.2% of the total portfolio

- Taiwan Semiconductor (NYSE: TSM): 9,365,760 shares, 6% of the total portfolio

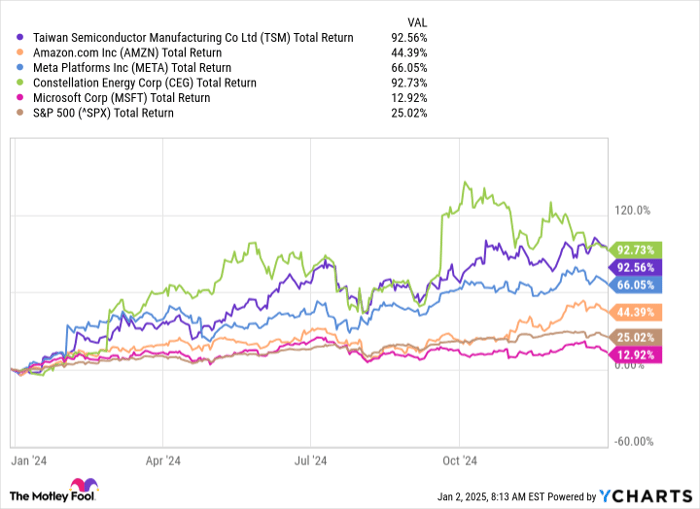

These selections indicate Laffont and his team’s focus on stocks involved in artificial intelligence (AI) trends. Most of these stocks performed well in 2024, except for Microsoft, which lagged behind the S&P 500.

TSM Total Return Level data by YCharts

Interestingly, Constellation Energy, the only non-tech company in this top five, plays a crucial role in powering the tech sector and generative AI with its energy services.

Investing alongside Coatue may require significant capital, so those interested in AI might consider diversifying their portfolios with the highlighted stocks, each offering unique access to the technological future.

Is Amazon a Smart Investment Right Now?

Before you decide to invest in Amazon, it’s important to evaluate the situation:

The Motley Fool Stock Advisor team has identified their 10 best stocks for investors, and Amazon does not make the list. These selected stocks are projected to deliver substantial returns in the coming years.

For example, when Nvidia was recommended on April 15, 2005… a $1,000 investment then would now be worth $885,388!*

Stock Advisor simplifies investment decisions by providing a clear strategy for building a profitable portfolio, complete with regular updates from analysts, and new stock picks each month. Since 2002, the service has more than quadrupled the return of the S&P 500*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook, is also on the board. Jennifer Saibil does not own shares in these stocks. The Motley Fool recommends Amazon, Meta Platforms, Microsoft, and Taiwan Semiconductor Manufacturing while recommending Constellation Energy. They also advise on options involving Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.