Bank of America Preferred Stock Gets a Positive Lift

On October 18, 2024, Phillip Securities upgraded their outlook for Bank of America Corporation – Preferred Stock (NYSE:BAC.PRK) from Neutral to Accumulate.

Fund Sentiment Overview

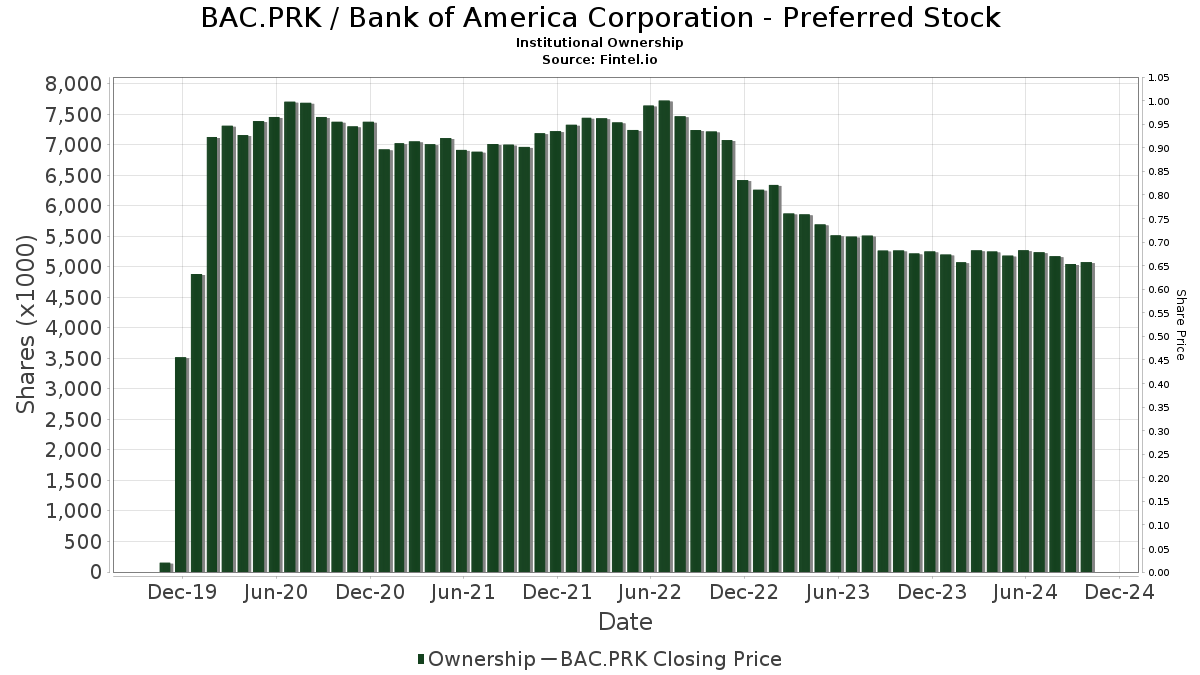

Currently, 21 funds and institutions hold positions in Bank of America Corporation – Preferred Stock. This reflects a decrease of one owner, or 4.55%, compared to the previous quarter. The average portfolio weight for all funds invested in BAC.PRK is now 0.36%, which marks an increase of 11.48%. However, total shares owned by institutions fell by 3.05% over the last three months to reach 5,081K shares.

Actions of Other Shareholders

PFF – iShares Preferred and Income Securities ETF owns 1,638K shares, a drop from 1,689K shares, which is a 3.11% decline. Notably, the firm increased its portfolio allocation in BAC.PRK by 1.73% over the last quarter.

PGX – Invesco Preferred ETF holds 1,430K shares, down from 1,463K shares, indicating a decrease of 2.31%. This firm also raised its portfolio allocation in BAC.PRK by 2.04% last quarter.

PFFD – Global X U.S. Preferred ETF has 590K shares in its holdings, down from 607K shares, amounting to a 2.88% decrease. They increased their allocation in BAC.PRK by 1.53% over the last quarter.

PGF – Invesco Financial Preferred ETF holds 403K shares, reduced from 407K shares, reflecting a 1.18% decrease. This institution slightly decreased its allocation in BAC.PRK by 0.15%.

CPXAX – Cohen & Steers Preferred Securities & Income Fund, Inc. reports 355K shares after a significant decline from 434K shares, which is a 22.39% drop. Their portfolio allocation in BAC.PRK decreased by 14.51% over the last quarter.

Fintel is recognized as a leading platform for investment research, assisting individual investors, traders, financial advisors, and small hedge funds.

Our extensive data sets include fundamentals, analyst reports, ownership information, fund sentiment, options sentiment, insider trading, options flow, unusual option trades, and more. Our exclusive stock picks utilize advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.