Phillip Securities Upgrades Bank of America Preferred Stock to Accumulate

Fintel reports that on October 18, 2024, Phillip Securities upgraded their outlook for Bank of America Corporation – Preferred Stock (NYSE:BAC.PRM) from Neutral to Accumulate.

Current Fund Sentiment Surrounding BAC.PRM

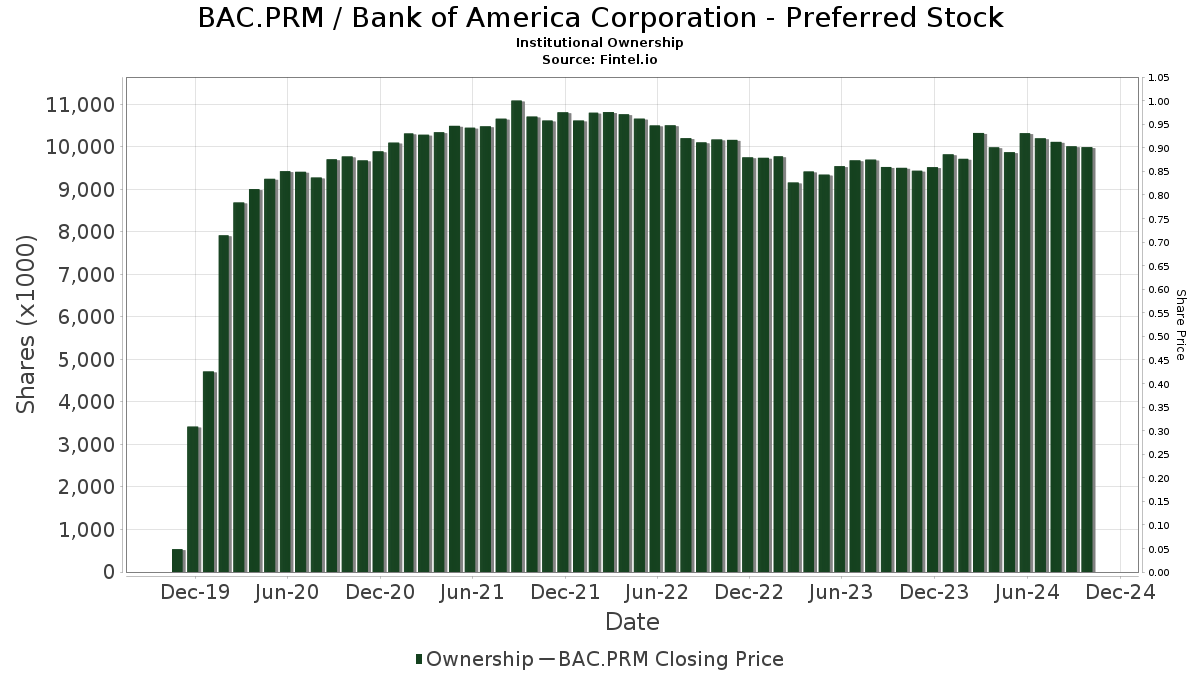

Currently, 28 funds and institutions are positioned in Bank of America Corporation – Preferred Stock. This number has stayed steady over the past quarter. On average, these funds allocate 0.39% of their portfolios to BAC.PRM, which is a rise of 0.84%. However, the total number of shares owned by these institutions has decreased by 1.84% in the last three months, amounting to 10,011K shares.

Actions of Other Shareholders

The iShares Preferred and Income Securities ETF (PFF) currently holds 2,681K shares, down from the previously reported 2,773K shares, reflecting a drop of 3.44%. Their allocation in BAC.PRM has also decreased by 2.17%.

Invesco Preferred ETF (PGX) retains 2,423K shares, down from 2,479K shares, marking a decline of 2.31%. Their portfolio share for BAC.PRM increased slightly by 0.48% this quarter.

First Trust Preferred Securities and Income ETF (FPE) holds 1,010K shares, a decrease from 1,046K shares, showing a reduction of 3.61%. Their portfolio allocation in BAC.PRM was also lowered by 2.43%.

Global X U.S. Preferred ETF (PFFD) has 959K shares compared to 986K shares previously, representing a decline of 2.86%. Their portfolio allocation in BAC.PRM remained unchanged.

Cohen & Steers Preferred Securities & Income Fund, Inc. (CPXAX) holds 778K shares, a slight increase from 775K shares, which is an increase of 0.37%. They raised their allocation in BAC.PRM by 1.34% over the last quarter.

Fintel provides extensive investment research tools to individual investors, traders, financial advisors, and small hedge funds. Our platform offers data on fundamentals, analyst reports, ownership statistics, fund sentiments, and insights into insider trading.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.