NVIDIA’s Stock Rating Adjusted: Insights from Fund Management

NVIDIA (WSE:NVDA) received a downgrade in outlook from Buy to Accumulate by Phillip Securities on November 22, 2024.

Understanding Current Fund Sentiment

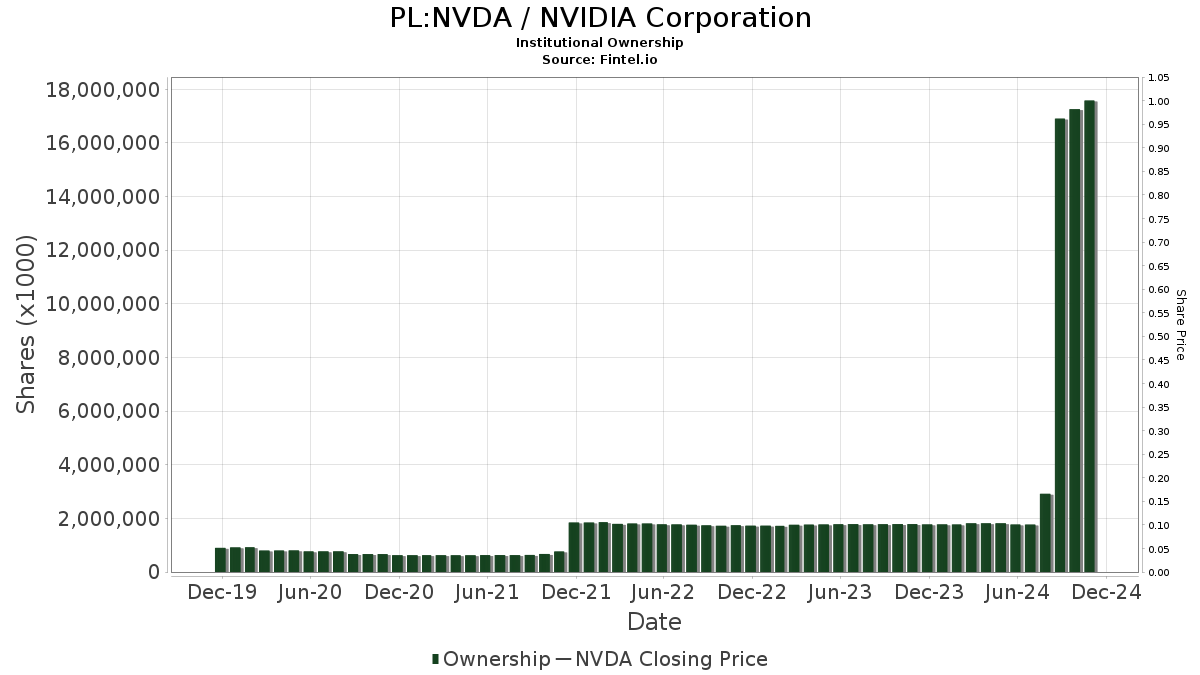

Currently, 6,619 funds or institutions report holding positions in NVIDIA. This marks an increase of 148 owners, or 2.29%, over the past quarter. The average portfolio weight for all funds invested in NVDA is 3.15%, up by 0.66%. Overall, institutional ownership rose by 13.77% in the last three months, totaling 17,756,746K shares.

Activity Among Major Shareholders

BlackRock holds 1,851,627K shares, equating to 7.56% ownership. In their previous filing, they reported 1,839,270K shares, indicating a modest increase of 0.67%. However, the firm has reduced its portfolio allocation in NVDA by 8.22% compared to the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) increased its holdings significantly, now owning 738,297K shares, which represents 3.01% ownership. Last reported, they owned 74,656K shares, reflecting a large increase of 89.89% with a 31.49% rise in portfolio allocation.

Likewise, Vanguard 500 Index Fund (VFINX) has raised its share count to 631,333K, representing 2.58% ownership and an impressive growth from 62,245K shares, a 90.14% increase, along with a 31.27% boost in portfolio allocation.

On the flip side, Geode Capital Management holds 546,079K shares, or 2.23% ownership, up from 534,554K shares, an increase of 2.11%. Yet, they have cut their NVDA allocation by a significant 51.50% in the last quarter.

Price T Rowe Associates reduced its holdings to 407,608K shares, representing 1.66% ownership, down from 444,582K shares, a decrease of 9.07%. This firm has also lowered its allocation in NVDA by 56.71% over the same period.

Fintel offers a wide range of investing research tools for individual investors, traders, financial advisors, and small hedge funds.

The platform gathers global data on fundamentals, analyst reports, ownership, fund sentiment, options activity, insider transactions, and more. Its unique stock picks utilize advanced, tested quantitative models to enhance investment success.

This article first appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.