Phillip Securities Boosts Bank of America’s Rating to Accumulate

On October 18, 2024, Phillip Securities raised its outlook for Bank of America (BVC:BAC) from Neutral to Accumulate.

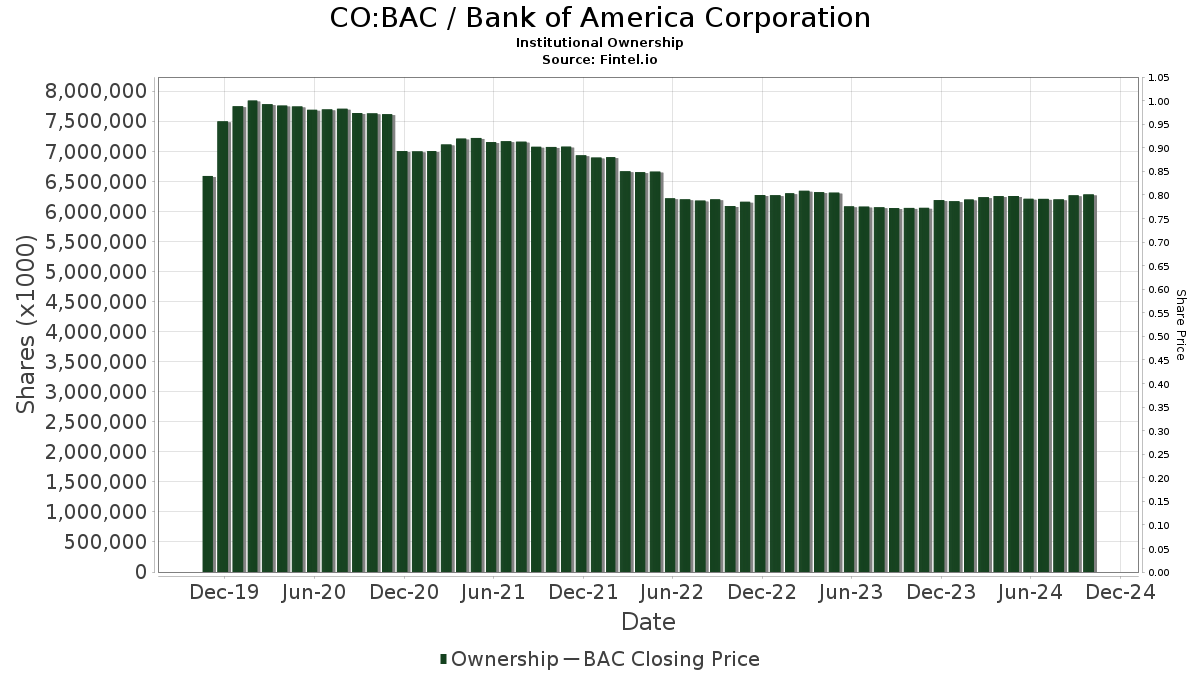

Institutional Investment Trends

Currently, 4,235 funds and institutions report holding positions in Bank of America, which shows an increase of 45 owners, or 1.07%, from the previous quarter. The average portfolio weight for all funds invested in BAC stands at 0.67%, marking an increase of 2.51%. Over the past three months, total shares owned by institutions rose by 2.94%, reaching 6,280,126K shares.

Key Shareholders and Their Moves

Berkshire Hathaway continues to hold 1,032,852K shares of Bank of America, representing 13.43% ownership, with no changes over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 209,897K shares, accounting for 2.73% ownership. This reflects a slight decrease of 0.17% from the previous quarter when the firm owned 210,263K shares, despite increasing its portfolio allocation in BAC by 1.81% during the same period.

Vanguard 500 Index Fund (VFINX) holds 174,622K shares, which equates to 2.27% ownership. This is a modest increase of 0.64% from the 173,507K shares it reported last quarter, although the portfolio allocation in BAC decreased by 0.08%.

JPMorgan Chase has increased its holdings to 147,816K shares, which represents 1.92% ownership. This is a 0.63% rise from the 146,885K shares reported in the last filing, with a 2.49% increase in its portfolio allocation in BAC.

Geode Capital Management now owns 138,556K shares, also reflecting a 1.80% ownership stake. This shows an increase of 1.10% from its previous total of 137,026K shares and a 0.63% rise in portfolio allocation over the last quarter.

Fintel is a leading investment research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

Our database includes global financial data, covering fundamentals, analyst reports, ownership statistics, fund sentiments, options sentiments, insider trading, options flow, unusual options trades, and more. Additionally, our exclusive stock selections are driven by sophisticated, backtested quantitative models intended to enhance returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.