PayPal’s Outlook Downgraded: What It Means for Investors

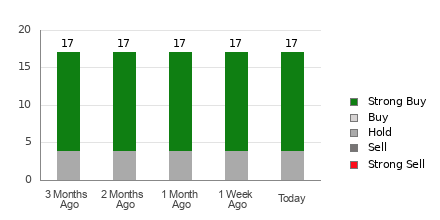

On November 1, 2024, Phillip Securities adjusted their rating for PayPal Holdings (BRSE:PYPL), moving it from Buy to Accumulate.

Current Fund Sentiment on PayPal

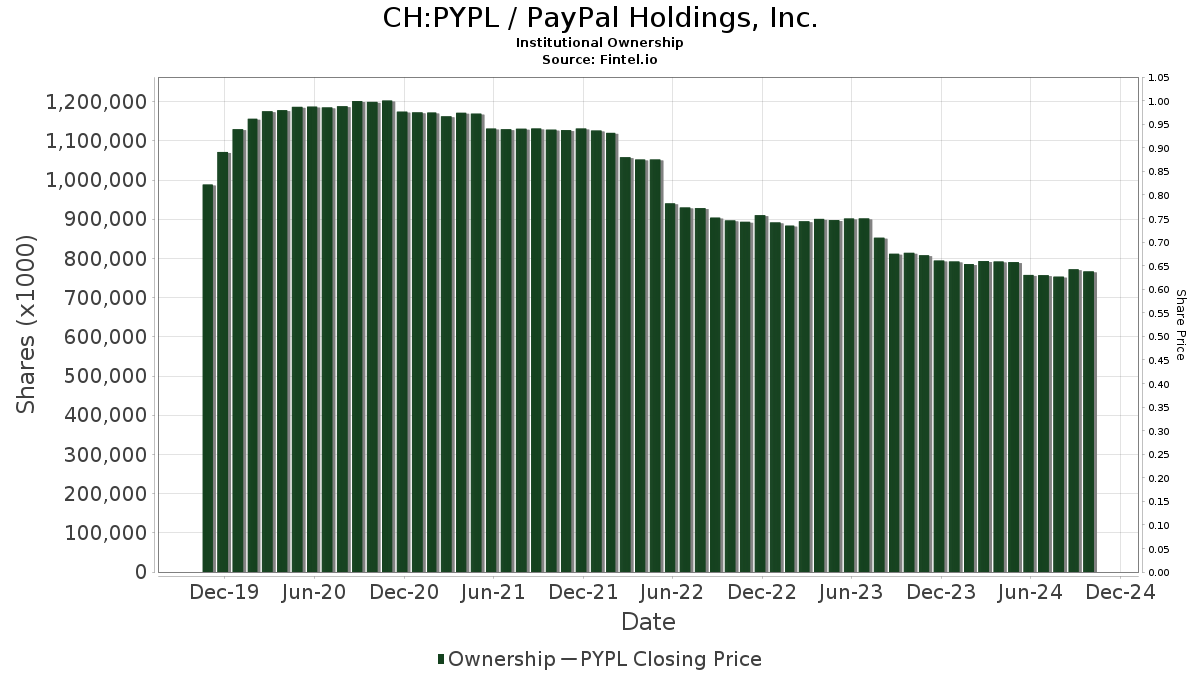

PayPal Holdings has 2,726 funds and institutions tracking their stock, reflecting a slight increase of 6 owners, or 0.22%, over the past quarter. The average portfolio weight for all funds invested in PYPL now stands at 0.39%, which marks an increase of 1.23%. Institutional ownership has also grown, with total shares rising 2.38% in the last three months to 771,282K shares.

Actions of Major Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares holds 33,070K shares, accounting for 3.30% of PayPal’s ownership, down from 33,735K shares, highlighting a reduction of 2.01%. Their portfolio allocation in PYPL has also decreased by 17.42% this past quarter.

Comprehensive Financial Management maintains 28,164K shares, representing 2.81% ownership, with no recent changes noted.

Vanguard 500 Index Fund Investor Shares has a stake of 26,847K shares, or 2.68% of PayPal. Previously, it owned 27,008K shares, marking a decline of 0.60%. Their allocation in PYPL dipped by 18.49% last quarter.

Geode Capital Management’s holdings include 21,714K shares, accounting for 2.17%. This is slightly lower than their previous ownership of 21,731K shares, indicating a decrease of 0.08%. Notably, their portfolio allocation in PYPL fell drastically by 57.11% during the last quarter.

Lastly, Invesco QQQ Trust, Series 1 bolsters 20,147K shares, which constitutes 2.01% ownership, slightly up from 20,089K shares. However, their overall allocation in PYPL has reduced by 21.80% within the last quarter.

Fintel serves as a robust platform for investment research, supporting investors, advisors, and hedge funds with a wealth of data, including analyzed reports, ownership details, fund sentiment, and much more.

This article was originally featured on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.