Joe_Potato/iStock Editorial via Getty Images

Phillips 66 (NYSE:PSX) is actively discussing the sale of its non-core assets, without a fixed timeline for any potential sale, stated CEO Mark Lashier on Thursday.

The refinery company has revealed plans to monetize $3 billion in non-core assets by 2024, as part of an initiative to enhance returns through cost reductions and asset management.

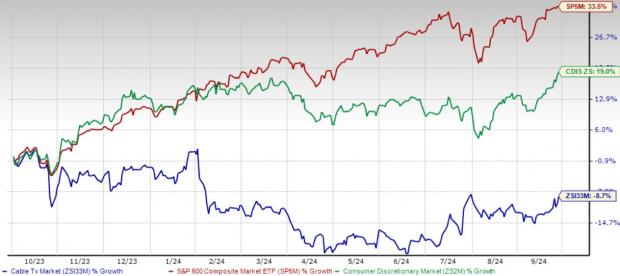

Despite the industry’s benefit from increased fuel demand, Phillips 66 (PSX) has trailed behind its competitors. In November, activist investor Elliott Investment Management acquired a $1 billion stake in the company, citing underperformance.

Elliott Investment Management expressed its belief that Phillips 66 (PSX) has the potential to generate $15 billion to $20 billion in after-tax cash proceeds from divesting the company’s CP Chemical stake, European convenience stores, and some non-operated midstream stakes.

While expressing “good, strong conviction” about the long-term prospects of the CPChem joint venture with Chevron, Lashier also acknowledged hitting bottom in 2023 and anticipates continuous improvement in fundamentals going forward.