Phillips 66 (XTRA:R66) is on the rise, with the average one-year price target now standing at an impressive 141.10 per share. This marks a substantial 6.03% increase from the prior estimate of 133.08, as of January 18, 2024.

Analysts have been fervently revising their targets, projecting a range from a modest low of 124.57 to an ambitious high of 162.12 per share. The average price target signifies a notable 13.97% surge from the latest closing price of 123.80 per share.

The Fund Sentiment Landscape

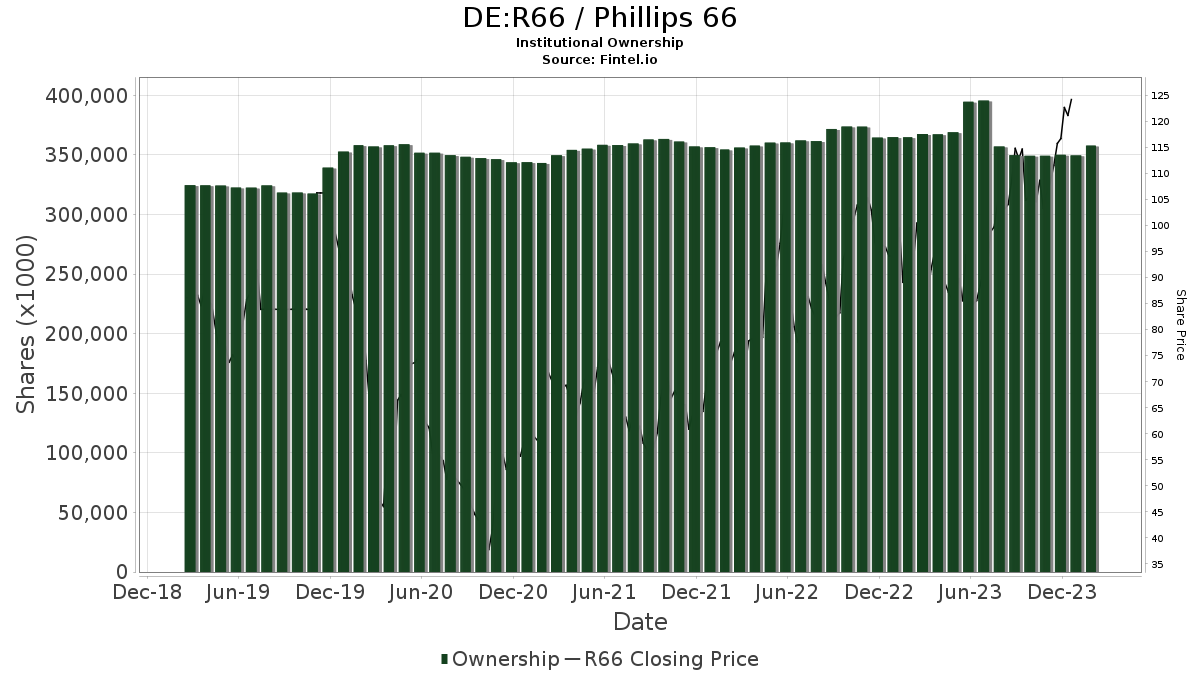

With 2718 funds or institutions now reporting positions in Phillips 66, there has been a remarkable increase of 144 owners or 5.59% in the past quarter. The overall average portfolio weight among these funds dedicated to R66 stands at 0.37%, showing a solid increase of 5.63%. Total shares owned by institutions have also seen a notable uptick in the last three months, climbing by 1.83% to 357,968K shares.

Actions of Other Shareholders

Wells Fargo, a key player in the investment landscape, holds 16,949K shares, representing 3.94% ownership of the company. In its previous filing, the firm disclosed ownership of 17,121K shares, indicating a slight decrease of 1.02%. They have scaled back their portfolio allocation in R66 by 2.33% over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has 13,864K shares, accounting for 3.22% ownership. In its prior filing, the firm reported owning 14,364K shares, reflecting a decrease of 3.61%. However, the fund increased its portfolio allocation in R66 significantly by 26.20% over the last quarter.

The Energy Select Sector SPDR Fund (XLE) holds 12,363K shares, representing 2.88% ownership. In the previous filing, the firm held 12,113K shares, marking an increase of 2.02%. The fund has raised its portfolio allocation in R66 by 9.96% over the last quarter.

Wellington Management Group Llp boasts 10,903K shares, owning 2.54% of the company. The firm reported owning 9,061K shares in the previous filing, showcasing an impressive increase of 16.90%. However, the firm has decreased its portfolio allocation in R66 by 82.14% over the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 10,703K shares, representing 2.49% ownership. In its prior filing, the firm held 10,925K shares, a dip of 2.07%. Nevertheless, the firm has increased its portfolio allocation in R66 by 26.36% over the last quarter.

Fintel stands as a premier investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds. Our extensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are backed by advanced, backtested quantitative models, ensuring improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.