Pinterest Reports Mixed Earnings in Q4 2024 Amid Revenue Growth

Pinterest, Inc. PINS recently announced its fourth-quarter 2024 financial results, revealing a mixed performance. Adjusted earnings lagged behind analysts’ expectations, while revenue figures exceeded projections.

Stay updated with the latest EPS estimates and surprises on Zacks Earnings Calendar.

Strong Revenue Growth Despite Sector Challenges

Based in San Francisco, Pinterest has reported notable revenue growth driven by robust performance across all regions. The company’s emphasis on enhancing shoppability and monetization, alongside the introduction of advanced AI-powered tools, has aided in this success. However, the food and beverage sector continues to present challenges.

Net Income Soars

Pinterest’s GAAP net income reached $1.85 billion, or $2.68 per share, a significant increase from $201.2 million, or 29 cents per share, in the same quarter last year. The increase in revenue and a favorable income tax benefit contributed to this improvement.

Non-GAAP net income for the quarter was reported at $385.6 million, or 56 cents per share, marking a rise from $370.7 million, or 53 cents per share, in the previous year. Nevertheless, this figure fell short of the Zacks Consensus Estimate by 7 cents.

For the entire year of 2024, GAAP net income stood at $1.86 billion, or $2.67 per share, compared to a loss of $35.6 million, or a loss of 5 cents per share, in 2023. The non-GAAP net income rose to $901 million, or $1.29 per share, from $783.5 million, or $1.13 per share, the previous year.

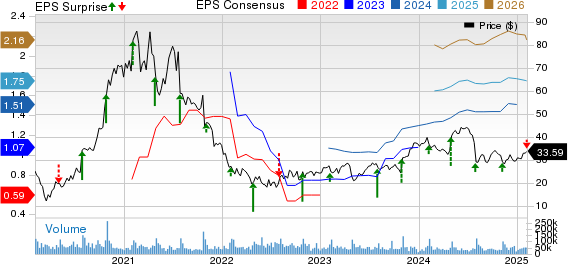

Pinterest Performance Indicators

Pinterest, Inc. price-consensus-eps-surprise-chart | Pinterest, Inc. Quote

Revenue Milestones

In Q4 2024, Pinterest’s revenues totaled $1.15 billion, surpassing the prior-year figure of $981.3 million and the Zacks Consensus Estimate of $1.14 billion. Monthly active users (MAUs) also saw impressive growth, increasing 11% year over year to reach a record 553 million.

This quarter also marked the launch of the Pinterest Performance+ suite, comprising new AI-driven advertising tools designed to streamline lower-funnel advertising for global clients. These features allow advertisers to better manage budgets and optimize campaigns, effectively halving the time needed for campaign setup.

The increase in user engagement is attributed to enhanced content relevance and personalization stemming from these new products. Collaborations with companies such as Amazon and Google are helping Pinterest tap into previously unexplored revenue opportunities.

For the full year, total revenues climbed to $3.65 billion, marking a 19% increase from $3.06 billion in 2023. Revenue from the U.S. and Canada reached $900 million, growing 16% from the previous year, while European revenues totaled $196 million, a 21% increase.

Operating Expenses and Adjusted EBITDA

Adjusted EBITDA for the fourth quarter was reported at $470.9 million, an increase from $369.3 million in the prior-year quarter, due to focused cost management. Total costs and expenses rose to $892.5 million, up from $785 million a year earlier. Research and development expenses escalated to $320.8 million, growing from $268 million the previous quarter.

Cash Flow and Liquidity Position

Pinterest generated $964.6 million in cash from operating activities in 2024, a significant leap from $613 million in 2023. As of December 31, 2024, the company held $1.14 billion in cash and equivalents.

Guidance for the Future

Looking ahead to Q1 2025, Pinterest anticipates revenues between $837 million and $852 million, representing year-over-year growth of 13% to 15%. Management also expects adjusted EBITDA between $155 million and $170 million.

Pinterest’s Stock Rating

Currently, Pinterest holds a Zacks Rank #3 (Hold).

Upcoming Earnings Announcements

Keysight Technologies, Inc. KEYS will release its first-quarter fiscal 2025 results on February 25, with an earnings estimate of $1.69 per share, a projected growth of 3.68% from last year.

Zillow Group, Inc. ZG is set to report fourth-quarter earnings on February 11, with a consensus estimate of 34 cents per share, indicating a 50% increase from the prior year.

Light and Wonder LNW will also unveil its fourth-quarter earnings on February 25, with an expected earnings figure of $1.08 per share, reflecting a growth of nearly 48% compared to last year.

Insights on Future Growth Potential

The demand for innovative advertising solutions continues to shape the landscape for companies like Pinterest.

“`html

The Rise of Nuclear Energy: A Golden Opportunity for Investors

Nuclear energy is rapidly gaining ground as the world seeks to shift away from fossil fuels like oil and natural gas. As electricity demand skyrockets, nuclear power emerges as a promising alternative.

Global Leaders Unite to Boost Nuclear Energy

Recently, leaders from the US and 21 other nations pledged to TRIPLE global nuclear energy capacity. This bold initiative could bring substantial gains for nuclear-related stocks, especially for early investors.

Discover Key Players in Nuclear Energy

In our exclusive report, Atomic Opportunity: Nuclear Energy’s Comeback, we delve into the major players and technologies fueling this transition. We highlight three standout stocks poised to benefit significantly from the nuclear energy resurgence.

Download Atomic Opportunity: Nuclear Energy’s Comeback for free today.

Stock Analysis: Top Companies to Watch

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Light & Wonder, Inc. (LNW) : Free Stock Analysis Report

Read more about this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`