Piper Sandler Downgrades Becton, Dickinson; Analysts See 62% Upside

Fintel reports that on May 2, 2025, Piper Sandler revised its outlook for Becton, Dickinson and Company (BIT:1BDX) from Overweight to Neutral.

Analyst Price Forecast Indicates Significant Upside Potential

As of April 24, 2025, Becton, Dickinson’s average one-year price target is €238.81 per share. This forecast ranges from a low of €214.54 to a high of €292.68, suggesting a potential increase of 62.46% from its last reported closing price of €147.00 per share.

Financial Overview

The projected annual revenue for Becton, Dickinson stands at €21.845 billion, marking a 4.69% increase. Additionally, the forecasted annual non-GAAP EPS is €15.10.

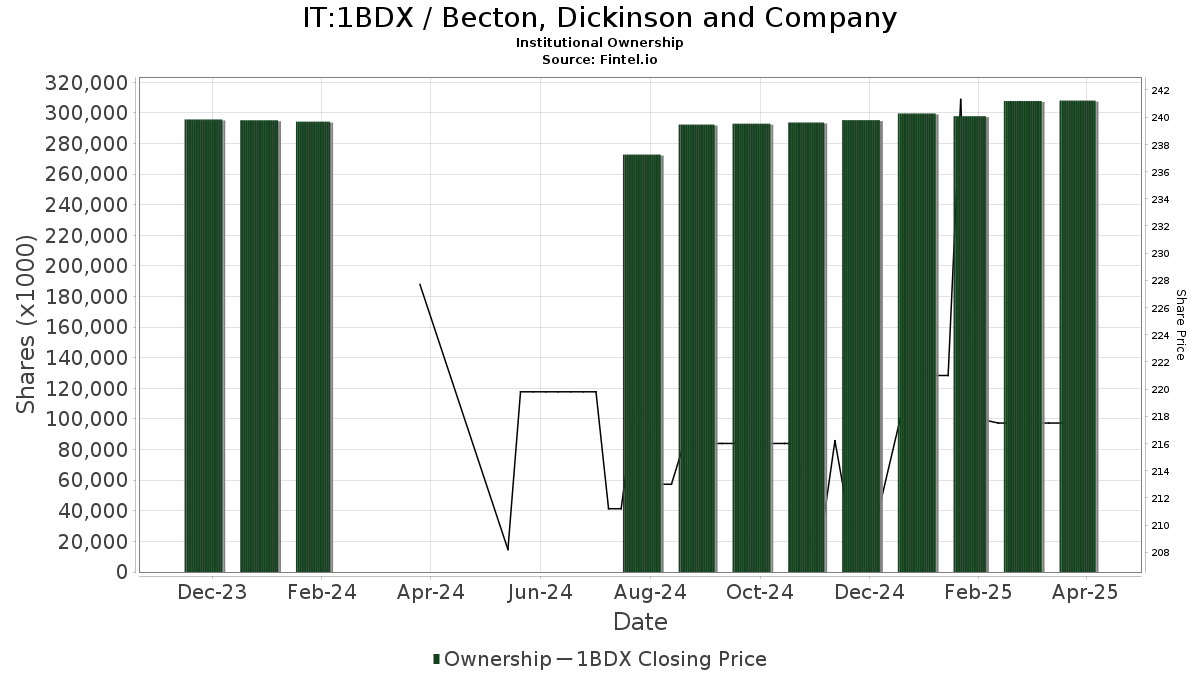

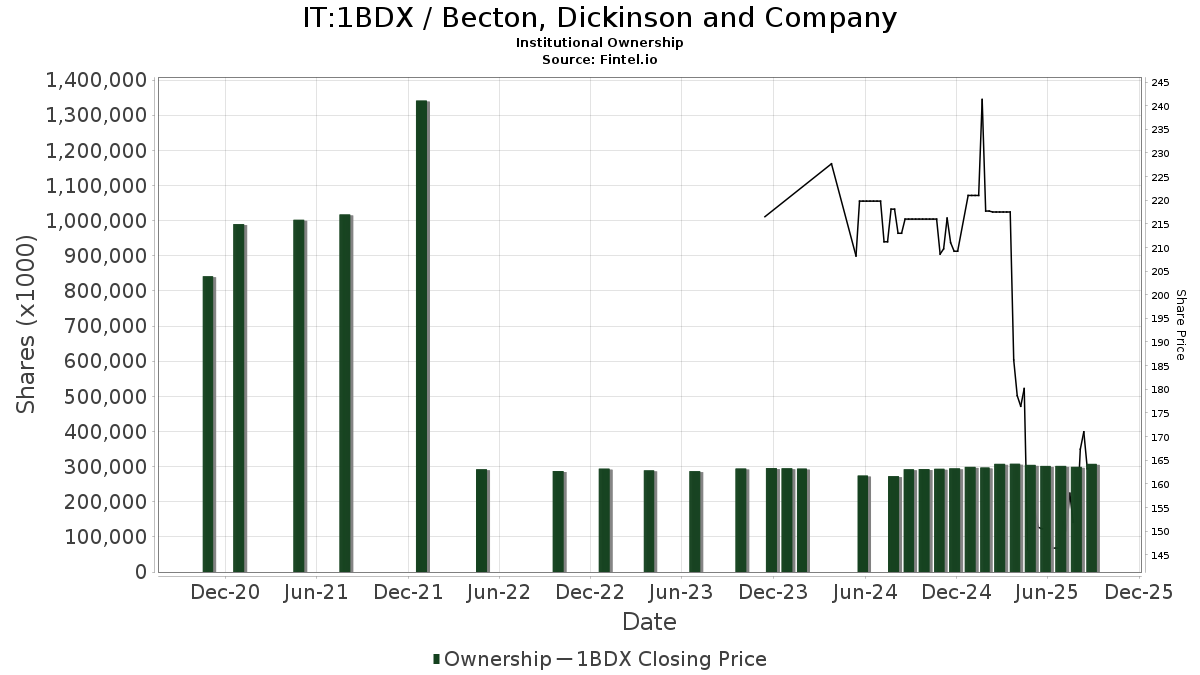

Fund Sentiment Analysis

A total of 2,549 funds or institutions have reported positions in Becton, Dickinson, an increase of 76 owners or 3.07% from the previous quarter. The average portfolio weight of all funds dedicated to 1BDX is 0.39%, which is up by 1.75%. Total shares owned by institutions rose by 2.64% over the last three months, now totaling 305,222K shares.

Institutional Shareholder Activity

Price T Rowe Associates currently holds 12,347K shares, representing a 4.30% ownership of the company. The firm previously reported 13,598K shares, reflecting a decrease of 10.14%. Overall, its portfolio allocation in 1BDX has decreased by 14.46% over the last quarter.

T. Rowe Price Investment Management has 12,127K shares, accounting for 4.22% ownership. In its last filing, the firm owned 8,907K shares, showing an increase of 26.55%. The portfolio allocation increased by 31.05% over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 9,058K shares, or 3.15% of the company, down from 9,160K shares previously, marking a decrease of 1.13%. The portfolio allocation decreased by 8.31% over the last quarter.

T. Rowe Price Capital Appreciation Fund (PRWCX) holds 7,982K shares, giving it 2.78% ownership. This is an increase from 5,911K shares previously reported, reflecting a rise of 25.95%. The firm’s portfolio allocation rose by 28.94% in the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 7,824K shares, representing 2.72% ownership. The previous quarter’s ownership stood at 7,570K shares, indicating an increase of 3.25%. However, the portfolio allocation decreased by 7.99% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.