Piper Sandler Downgrades Zscaler Outlook to Neutral

On May 30, 2025, Piper Sandler lowered its rating for Zscaler (XTRA:0ZC) from Overweight to Neutral.

Analyst Price Forecast Indicates Decline

As of May 7, 2025, the average one-year price target for Zscaler is €216.49 per share, with targets ranging from a low of €175.07 to a high of €317.34. This average reflects a potential decrease of 10.28% from its most recent closing price of €241.30 per share.

Projected Revenue and Earnings

Zscaler is forecasted to generate annual revenue of €2,624 million, representing an increase of 3.03%. The projected annual non-GAAP EPS is €2.64.

Fund Sentiment Overview

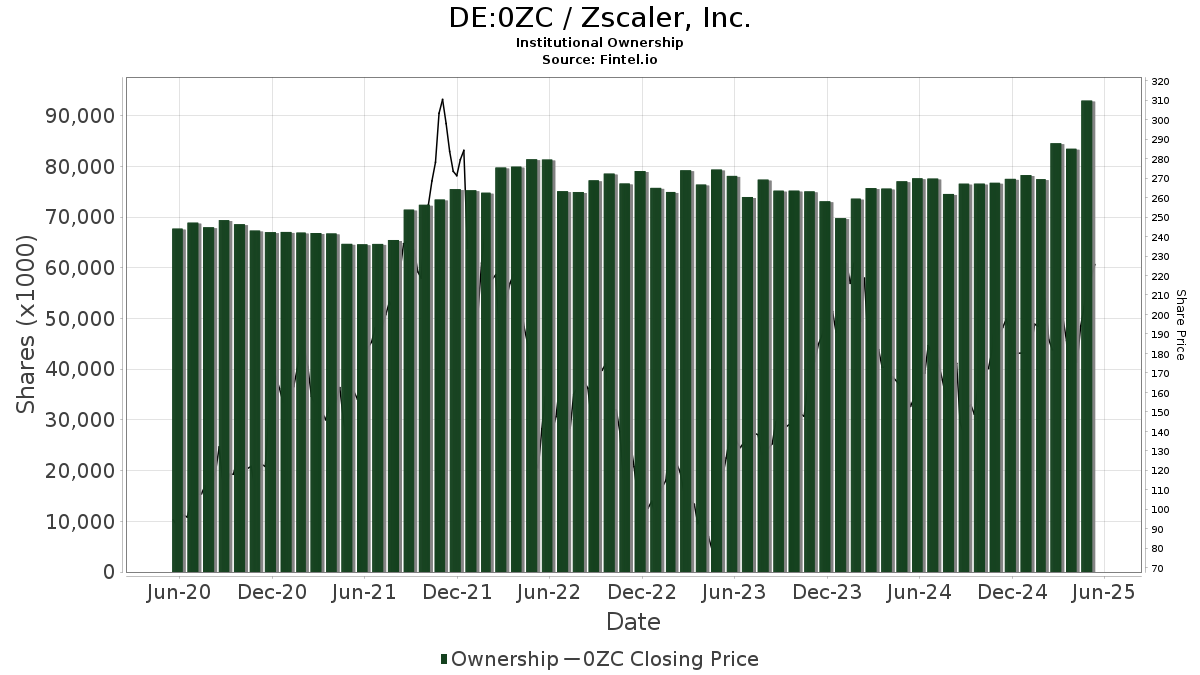

Currently, 1,285 funds hold positions in Zscaler, a growth of 20 investors or 1.58% over the last quarter. The average portfolio weight of these funds dedicated to 0ZC is 0.25%, up 74.89%. Institutional ownership rose by 9.94% in the past three months, totaling 92,975K shares.

Activity Among Major Shareholders

Invesco QQQ Trust, Series 1 increased its holdings from 3,112K shares to 3,158K shares, now representing 2.04% ownership, a rise of 1.45%.

UBS Asset Management Americas holds 3,128K shares, up from 2,601K shares, equating to 2.02% ownership, but decreased its allocation by 80.40% this quarter.

American Century Companies now owns 2,938K shares, an increase of 2.57% from the previous 2,862K shares, representing 1.90% ownership with a 20.58% rise in allocation.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 2,910K shares, reflecting a modest increase of 0.72%, now accounting for 1.88% ownership with a 15.56% increase in allocation.

Goldman Sachs Group holds 2,842K shares, up from 2,480K shares, representing 1.84% ownership, though it decreased its allocation by 66.71% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.