Piper Sandler Boosts Nektar Therapeutics Outlook with New Coverage

Analyst Sightings Point to Significant Potential Growth

Fintel reports that on November 4, 2024, Piper Sandler initiated coverage of Nektar Therapeutics (NasdaqCM:NKTR) with a Overweight recommendation.

Price Target Suggests Substantial Upside

As of October 22, 2024, the average one-year price target for Nektar Therapeutics stands at $2.70/share. Projections vary, with a low of $1.31 and a high of $4.20. This average indicates a potential increase of 101.72% from its latest closing price of $1.34/share.

For further insights, check our leaderboard showcasing companies with the largest price target upside.

Nektar’s Revenue and Earnings Expectations

The anticipated annual revenue for Nektar Therapeutics is projected at $100 million, reflecting a 7.53% increase. The estimated annual non-GAAP earnings per share (EPS) is -0.96.

Fund Sentiment Towards Nektar

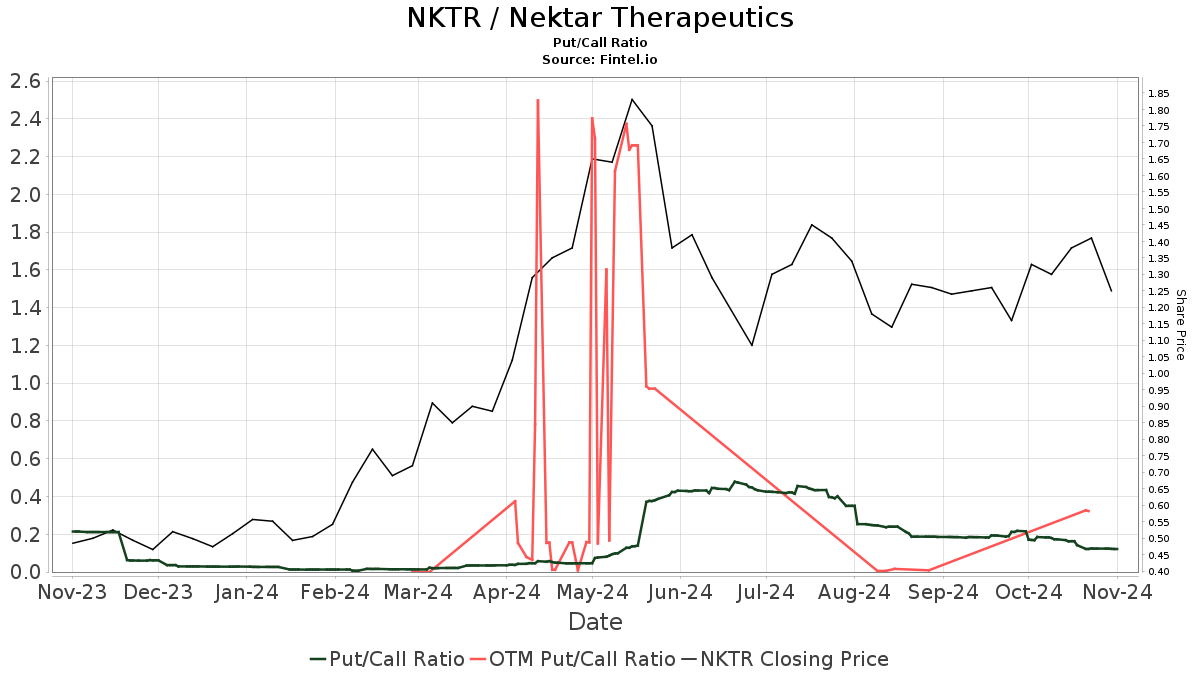

Currently, 226 funds or institutions report holdings in Nektar Therapeutics, marking an increase of 41 owners, or 22.16%, in the previous quarter. The average portfolio weight dedicated to NKTR is 0.03%, up by 25.74%. Total institutional shares owned surged by 27.66% in the past three months to 154,064K shares.  The put/call ratio for NKTR is currently at 0.12, signaling a bullish outlook.

The put/call ratio for NKTR is currently at 0.12, signaling a bullish outlook.

Actions by Other Notable Shareholders

Deep Track Capital holds 17,875K shares, which is 9.71% of Nektar. This represents a slight decrease from the previously reported 18,400K shares, equating to a decline of 2.93%. However, the firm has increased its allocation in NKTR by 34.37% over the last quarter.

Samlyn Capital maintains 9,458K shares, signifying 5.14% ownership.

ETAHX – Eventide Healthcare & Life Sciences Fund Shares holds 7,529K shares, representing 4.09% ownership. Similarly, Eventide Asset Management holds the same amount, while Citadel Advisors has 6,955K shares, or 3.78% of the company. Citadel has notably increased its position from 3,194K shares, representing a remarkable 54.08% gain, with a 203.37% boost in allocation during the last quarter.

Nektar Therapeutics at a Glance

(This description is provided by the company.)

Nektar Therapeutics is a biopharmaceutical company focused on developing investigational medicines in oncology, immunology, and virology, alongside approved partnered medicines. The company is based in San Francisco, California, with operations also in Huntsville, Alabama, and Hyderabad, India.

Fintel provides an extensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global fundamentals, analyst insights, ownership details, fund sentiment, options sentiment, insider trading, and unique stock picks supported by advanced quantitative models for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.