Piper Sandler Starts Coverage of ANI Pharmaceuticals with Strong Outlook

Fintel reports that on October 11, 2024, Piper Sandler initiated coverage of ANI Pharmaceuticals (NasdaqGM:ANIP) with a Overweight recommendation.

Analyst Price Forecast Indicates Potential Growth

As of September 25, 2024, analysts predict an average one-year price target of $84.05 per share for ANI Pharmaceuticals. This estimate ranges from a low of $60.60 to a high of $98.70, representing a potential upside of 47.09% from its last closing price of $57.14 per share.

Annual Revenue Projection and Earnings Per Share

The projected annual revenue for ANI Pharmaceuticals stands at $414 million, reflecting a decrease of 23.11%. Additionally, the expected non-GAAP earnings per share (EPS) is $4.56.

Institutional Sentiment Towards ANI Pharmaceuticals

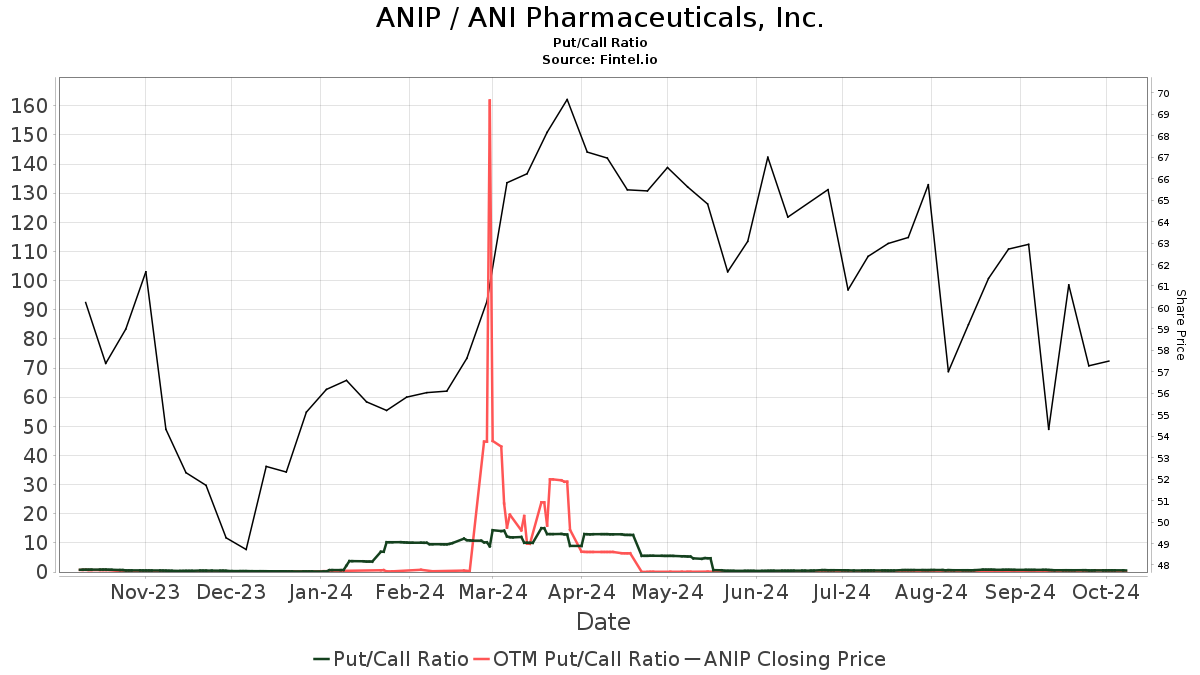

A total of 496 funds or institutions report positions in ANI Pharmaceuticals, showing an increase of 12 or 2.48% in the last quarter. The average portfolio weight allocated to ANIP is 0.18%, an increase of 0.68%. Over the last three months, total shares owned by institutions have risen by 7.71% to reach 17,536,000 shares.  The put/call ratio for ANIP is currently at 0.55, suggesting a bullish sentiment among investors.

The put/call ratio for ANIP is currently at 0.55, suggesting a bullish sentiment among investors.

Recent Movements by Major Shareholders

The iShares Core S&P Small-Cap ETF (IJR) holds 991,000 shares, which is 5.08% of the company. Previously, the fund owned 1,022,000 shares, marking a decrease of 3.09%, and a 7.20% reduction in its portfolio allocation in ANIP over the last quarter.

Rubric Capital Management holds 604,000 shares, equating to 3.09% ownership. This is down significantly from 959,000 shares previously held, a drop of 58.75%, with a 48.52% reduction in portfolio allocation over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 588,000 shares, making up 3.01% of the company. This is an increase from 508,000 shares previously, reflecting a 13.58% rise in ownership and a 3.66% increase in portfolio allocation during the last quarter.

Global Alpha Capital Management has 527,000 shares (2.70%), up from 391,000 shares, representing a 25.85% increase and a 21.81% rise in its portfolio allocation in ANIP.

William Blair Investment Management holds 489,000 shares, or 2.51%. Their previous ownership was 490,000 shares, indicating a minor decrease of 0.18% and a reduction of 6.68% in portfolio allocation over the last quarter.

About ANI Pharmaceuticals

ANI Pharmaceuticals Background Information

(This description is provided by the company.)

ANI Pharmaceuticals, Inc. is a specialized pharmaceutical company involved in developing, manufacturing, and marketing both branded and generic prescription medications. Its focus areas include narcotics, oncolytics (anti-cancers), hormones and steroids, as well as complex formulations that involve extended release and combination products.

Fintel is a comprehensive investment research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

Our services span a global reach, encompassing fundamentals, analyst reports, ownership insights, fund sentiment, options data, insider trading, and more. Our exclusive stock selections are informed by advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.