Piper Sandler Downgrades Becton, Dickinson to Neutral

On May 2, 2025, Piper Sandler announced a downgrade in its outlook for Becton, Dickinson and Company (BMV: BDX) from Overweight to Neutral.

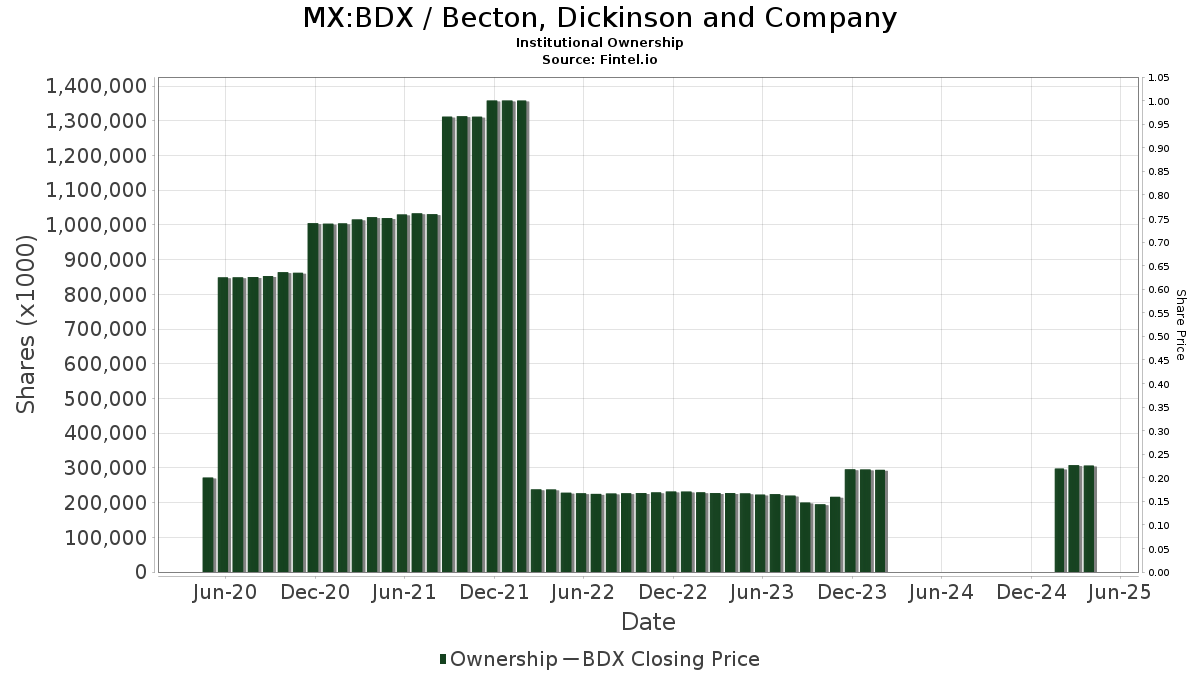

Institutional Ownership Changes

Price T Rowe Associates now holds 12,347K shares, which represents 4.30% ownership of Becton, Dickinson. Previously, this firm owned 13,598K shares, marking a decrease of 10.14%. Over the previous quarter, Price T Rowe decreased its portfolio allocation in BDX by 14.46%.

T. Rowe Price Investment Management, in contrast, has increased its holding to 12,127K shares, representing 4.22% ownership. Last quarter, the firm reported owning 8,907K shares, reflecting an increase of 26.55% in ownership. Its allocation in BDX rose by 31.05% during the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently holds 9,058K shares, equating to 3.15% ownership. This is a slight decrease from the prior quarter, where it reported 9,160K shares, indicating a drop of 1.13%. The fund’s portfolio allocation in BDX saw a decline of 8.31% in the past quarter.

The T. Rowe Price Capital Appreciation Fund (PRWCX) holds 7,982K shares, or 2.78% ownership. Previously, the fund reported 5,911K shares, showing an increase of 25.95%. Its allocation in BDX increased by 28.94% over the last quarter.

Lastly, the Vanguard 500 Index Fund Investor Shares (VFINX) owns 7,824K shares, which is 2.72% of the company. This is an increase from 7,570K shares reported earlier, reflecting a 3.25% increase. However, its portfolio allocation in BDX has decreased by 7.99% in the past quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.