Piper Sandler Downgrades Expedia Group to Underweight Amid Mixed Fund Sentiment

Fintel reports that on May 9, 2025, Piper Sandler downgraded their outlook for Expedia Group (LSE:0R1T) from Neutral to Underweight.

Analyst Price Forecast Indicates 17.75% Growth Potential

As of May 7, 2025, the average one-year price target for Expedia Group stands at 202.53 GBX/share. Forecasts range from a low of 141.26 GBX to a high of 297.83 GBX. This average target suggests a potential increase of 17.75% from its most recent closing price of 172.00 GBX/share.

Expedia Group’s Projected Revenue and Earnings

The expected annual revenue for Expedia Group is 15,621 million, reflecting a growth rate of 13.28%. The projected annual non-GAAP earnings per share (EPS) is 13.48.

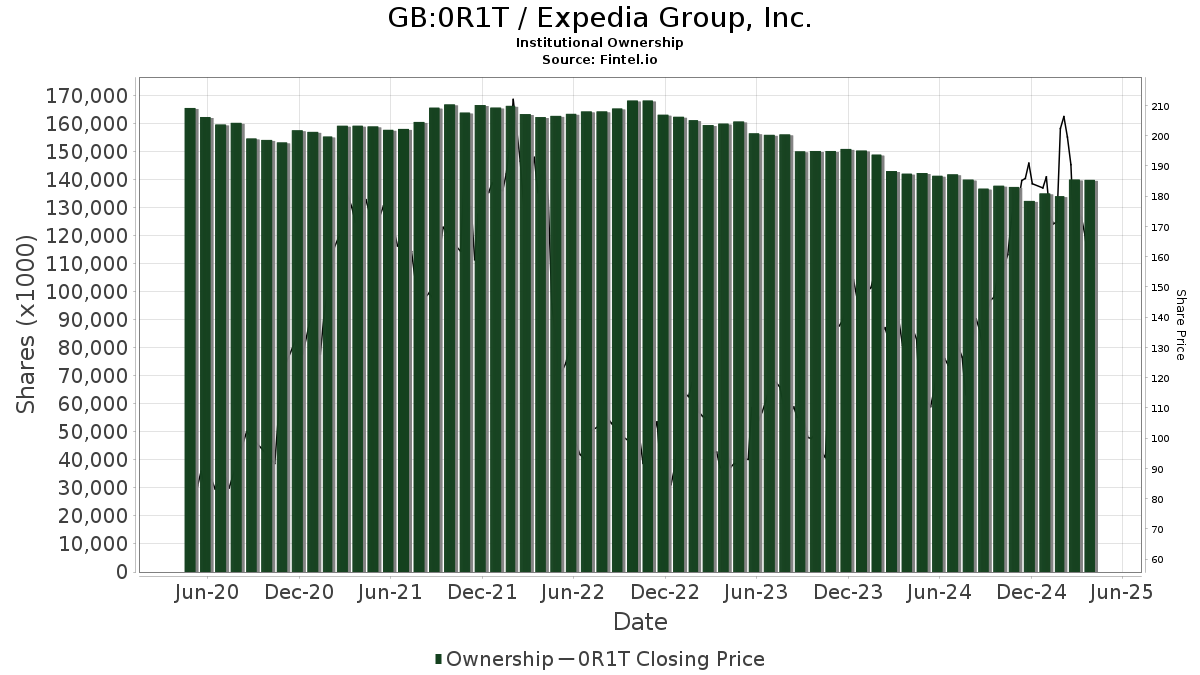

Fund Sentiment Overview

Currently, 1,694 funds or institutions report positions in Expedia Group, marking an increase of 101 owners or 6.34% from the last quarter. The average portfolio weight of all funds invested in 0R1T is 0.31%, which has risen by 10.35%. Over the past three months, total shares owned by institutions increased by 5.66% to 141,894K shares.

Institutional Holdings Changes

Windacre Partnership currently holds 4,066K shares, accounting for 3.33% ownership of the company. This represents a decrease from its previous holding of 4,324K shares, a reduction of 6.35%. Nevertheless, the firm has increased its portfolio allocation in 0R1T by 30.61% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) retains 3,857K shares, translating to 3.16% ownership. This is down from 3,961K shares previously, reflecting a decrease of 2.71%. The fund, however, increased its allocation in 0R1T by 20.78% last quarter.

Norges Bank holds 3,599K shares, now representing 2.95% ownership, up from 0K shares previously, indicating a complete increase of 100.00%.

JPMorgan Chase has 3,502K shares, or 2.87% ownership. This is a decrease from 3,842K shares, down by 9.71%, although its portfolio allocation in 0R1T increased by 12.43% in the last quarter.

Invesco holds 3,406K shares, representing 2.79% ownership, down from 3,444K shares, which shows a decrease of 1.11%. The firm has significantly reduced its portfolio allocation in 0R1T by 89.23% over the past quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.