Piper Sandler Upgrades Edwards Lifesciences to Overweight Status

On April 24, 2025, Piper Sandler raised its outlook for Edwards Lifesciences (BMV:EW) from Neutral to Overweight.

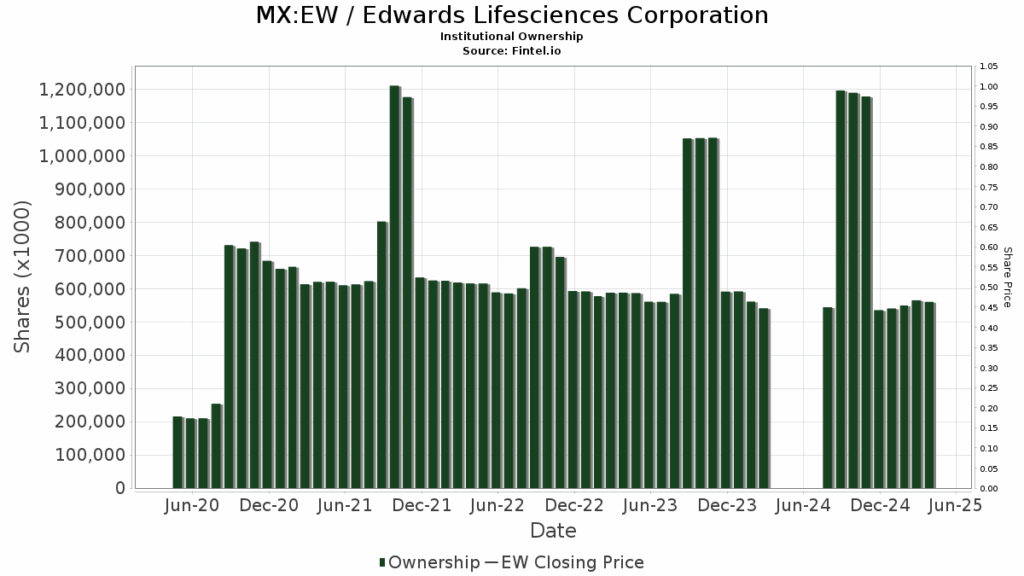

Fund Sentiment Overview

Currently, 2,212 funds or institutions hold shares in Edwards Lifesciences. This marks an increase of 16 owners, or 0.73%, from the previous quarter. The average portfolio weight of all funds dedicated to EW is now 0.48%, up by 0.28%. In the past three months, total shares held by institutions climbed 3.94%, reaching 713,834K shares.

Activity Among Other Shareholders

Wellington Management Group Llp has increased its stake, holding 33,211K shares, which amounts to 5.67% ownership. Previously, the firm reported owning 31,533K shares, reflecting a 5.05% increase. It has boosted its portfolio allocation in EW by 23.54% over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) currently possesses 18,493K shares or 3.16% ownership. This is a decline from the previous count of 19,120K shares, a decrease of 3.39%. However, the fund increased its portfolio allocation in EW by 6.93% last quarter.

Vanguard Health Care Fund (VGHCX) owns 18,392K shares, equivalent to 3.14% ownership—a significant 16.42% increase from 15,372K shares held previously. This firm raised its allocation in EW by 41.03% over the last quarter.

The Bank of New York Mellon holds 18,125K shares, representing 3.09% ownership. In its prior filing, it held 18,306K shares, showing a 1.00% decrease. Notably, the firm reduced its portfolio allocation in EW by 88.88% in the last quarter.

Vanguard 500 Index Fund (VFINX) has 15,965K shares, which is 2.73% ownership. This represents an increase from 15,777K shares previously, translating to a 1.18% increase. The fund raised its portfolio allocation in EW by 7.40% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.