New Coverage Initiated for Amazon: Analysts Predict Strong Growth Ahead

On October 11, 2024, Pivotal Research commenced its coverage of Amazon.com (LSE:0R1O) with a Buy recommendation.

Analyst Price Forecast Indicates Potential Growth

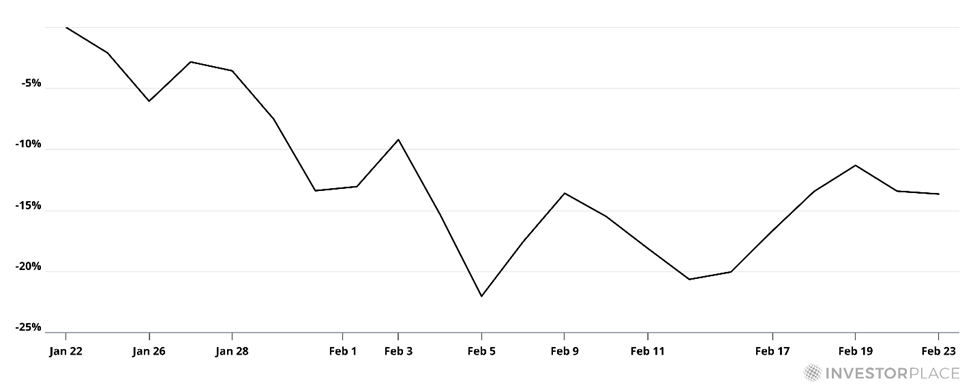

As of September 25, 2024, the consensus one-year price target for Amazon.com stands at 221.48 GBX/share. This target reflects a range from a low of 180.51 GBX to a high of 276.27 GBX. Compared to its recent closing price of 188.75 GBX, this average price target suggests a potential upside of 17.34%.

Insights into Amazon’s Projected Revenue

Forecasts for Amazon’s annual revenue reach approximately 638,843MM, marking a growth of 5.71%. Analysts also project an annual non-GAAP EPS of 2.56.

Fund Sentiment Reflects Increased Interest

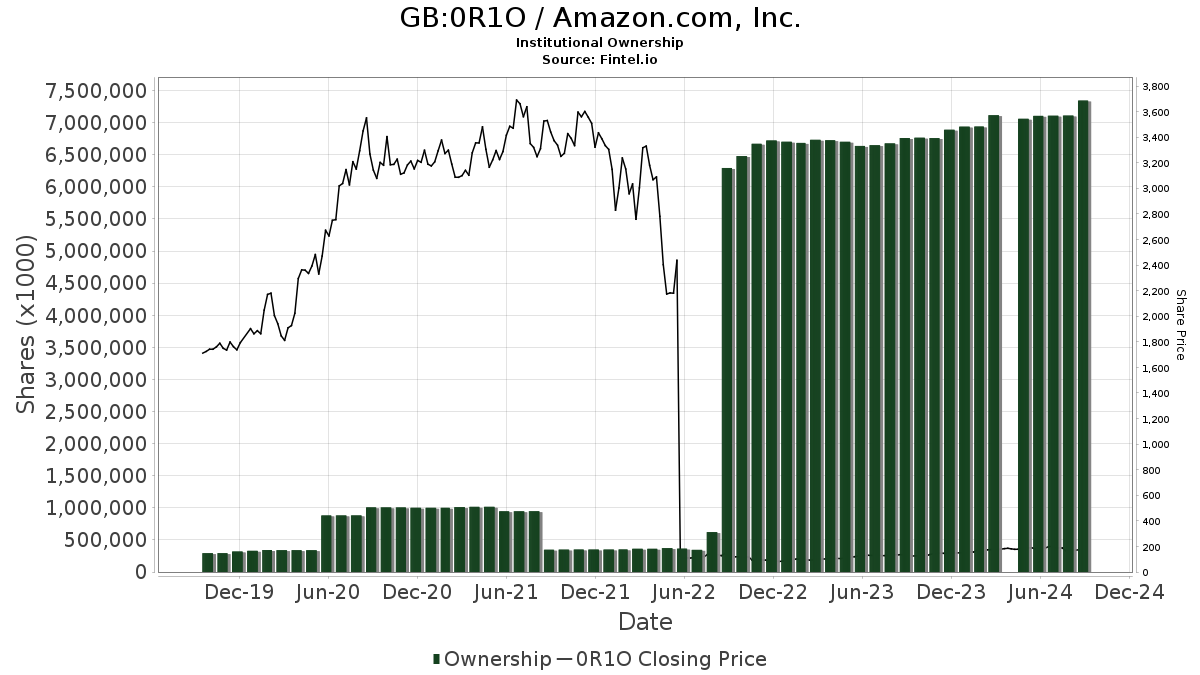

A total of 6,846 funds and institutions now report stakes in Amazon.com, showing an increase of 117 owners, or 1.74%, from the previous quarter. The average portfolio weight for these funds allocated to 0R1O is 2.50%, which is up by 2.22%. Additionally, institutional shares owned rose by 5.67% over the last three months, totaling 7,337,459K shares.

Shareholder Activity Highlights Key Investors

The Vanguard Total Stock Market Index Fund Investor Shares holds 295,886K shares, representing 2.82% ownership, up from 293,875K shares previously reported, reflecting an increase of 0.68%. This fund has also boosted its allocation in 0R1O by 4.90% over the last quarter.

Vanguard 500 Index Fund Investor Shares owns 235,043K shares, or 2.24% of the company, which is an increase of 1.99% from 230,356K shares. Their allocation in 0R1O has also grown by 3.48% recently.

Geode Capital Management maintains 193,369K shares, representing 1.84% ownership, up by 2.86% from 187,843K shares. Allocation in 0R1O increased by 4.66% last quarter.

Price T Rowe Associates reports 181,610K shares, reflecting 1.73% ownership. This is a decrease of 4.46% from 189,705K shares previously held. However, their allocation for 0R1O has grown slightly by 0.13% over the last quarter.

JPMorgan Chase holds 172,868K shares, or 1.65% ownership, which is an increase from 171,742K shares, up by 0.65%. Their portfolio allocation in 0R1O has risen by 4.72% over the last quarter.

Fintel provides extensive investing research tools for individual investors, traders, financial advisors, and small hedge funds. Their wide range of data includes fundamentals, analyst insights, ownership statistics, fund sentiment, and options information, supporting enhanced investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.