Amazon.com Receives Encouraging Buy Rating from Pivotal Research

On October 11, 2024, Pivotal Research began their coverage of Amazon.com (BRSE:AMZN) with a strong Buy recommendation.

Growing Fund Interest in Amazon.com

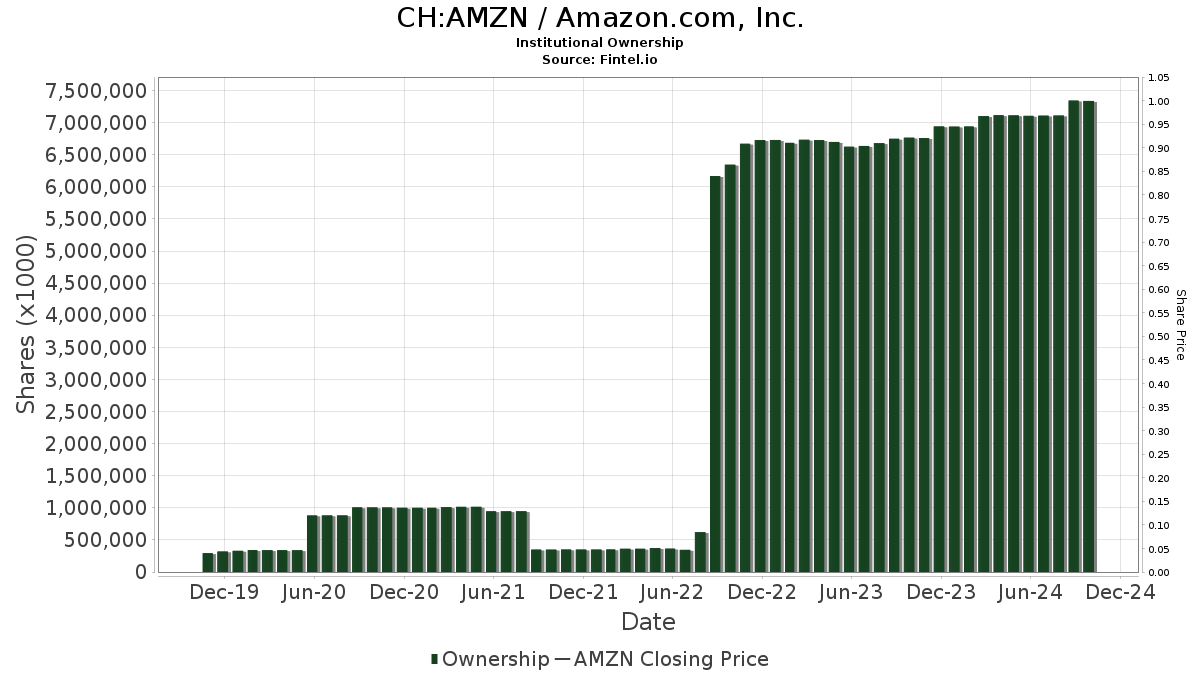

A total of 6,846 funds and institutions have reported their positions in Amazon.com, marking an increase of 117 owners, or 1.74%, from the previous quarter. The average portfolio weight of all funds dedicated to AMZN is now at 2.50%, reflecting a growth of 2.19%. Notably, total shares owned by institutions rose by 5.67% over the last three months, totaling 7,337,459K shares.

Institutional Shareholder Actions

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 295,886K shares, equating to 2.82% ownership. This reflects an increase of 0.68% from their previous total of 293,875K shares and signifies a 4.90% boost in their portfolio allocation for AMZN this quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) owns 235,043K shares, amounting to 2.24% ownership. Previously, they reported 230,356K shares, marking a growth of 1.99% and a 3.48% increase in their portfolio allocation in AMZN.

Geode Capital Management holds 193,369K shares, representing 1.84% ownership. This is an increase from 187,843K shares, showcasing a 2.86% growth and a 4.66% rise in their overall portfolio allocation for AMZN over the last quarter.

Price T Rowe Associates has 181,610K shares, reflecting 1.73% ownership. This shows a decrease from their previous holding of 189,705K shares, representing a drop of 4.46%. However, they still managed to increase their portfolio allocation in AMZN by 0.13% over the last quarter.

JPMorgan Chase possesses 172,868K shares, equal to 1.65% ownership. This total has increased from 171,742K shares, indicating a rise of 0.65%, alongside a 4.72% increase in their portfolio allocation in AMZN.

Fintel serves as a comprehensive platform for investment research tailored for individual investors, traders, financial advisors, and small hedge funds.

Our expansive data encompasses fundamentals, analyst reports, ownership trends, fund sentiment, and more, including exclusive stock picks powered by advanced quantitative models designed for improved profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.