Playa Hotels & Resorts Achieves Break-Even Earnings, But Faces Challenges Ahead

Playa Hotels & Resorts (PLYA) announced break-even earnings per share this quarter, outperforming the Zacks Consensus Estimate of a loss of $0.19. This performance marks an improvement from a loss of $0.06 per share during the same period last year. These results account for non-recurring items.

This performance represents a significant earnings surprise of 100%. Just three months ago, analysts anticipated a profit of $0.10 per share, while Playa actually reported earnings of $0.12, yielding a 20% positive surprise.

Over the past year, the company has consistently exceeded consensus EPS estimates across four quarters.

For the quarter that ended in September 2024, Playa Hotels generated revenues of $183.52 million, surpassing the Zacks Consensus Estimate by 15.11%. In contrast, the company reported revenues of $213.15 million in the previous year. Notably, Playa has topped revenue estimates in each of the last four quarters.

Looking forward, the sustainability of the stock’s recent performance will heavily depend on management’s insights during the upcoming earnings call.

Since the beginning of 2024, Playa Hotels’ shares have declined approximately 0.1%, while the S&P 500 has soared by 21.2%.

Future Prospects for Playa Hotels

As investors ponder the future of Playa Hotels, the pressing question arises: what lies ahead for the stock?

While clear answers remain elusive, examining the company’s earnings forecast can offer insights. This includes not just current earnings expectations for upcoming quarters, but also recent changes to these estimates.

Research indicates a strong link between short-term stock fluctuations and the trends in earnings estimate revisions. Investors can monitor these revisions independently or utilize tools like the Zacks Rank, known for its accuracy in predicting stock performance based on earnings estimate shifts.

Currently, the revision trend for Playa Hotels suggests an unfavorable outlook. This has resulted in a Zacks Rank #4 (Sell) for the stock, indicating that it may underperform the broader market in the near term. For further insights, you can explore today’s Zacks #1 Rank (Strong Buy) stocks.

Analysts will be eager to see how forecasts for the next quarters and the current fiscal year adjust following the recent results. Presently, the consensus EPS estimate stands at $0.08, alongside revenues of $219.96 million for the upcoming quarter and $0.40 on revenues of $912.89 million for the full fiscal year.

It’s important for investors to recognize that the overall industry climate significantly influences stock performance. Currently, the Hotels and Motels sector ranks in the bottom 12% of over 250 Zacks industries. Historical data suggests that stocks in the top 50% of Zacks-ranked industries tend to outperform those in the bottom 50% by more than two to one.

In the same sector, H World Group (HTHT) is anticipated to report its quarterly results soon.

This hotel operator is projected to post earnings of $0.69 per share in its upcoming report, reflecting a year-over-year increase of 23.2%. Notably, the consensus EPS estimate for this quarter has been revised 3.1% upward in the past month.

Revenue projections for H World Group stand at $933.86 million, representing an 8.5% increase compared to the previous year.

Expert Highlights Potential Top Performer

From a pool of thousands of stocks, five Zacks experts have each selected their top choice that has the potential for remarkable growth, targeting a +100% gain in the approaching months. Director of Research Sheraz Mian has identified one stock as having the clearest path to explosive growth.

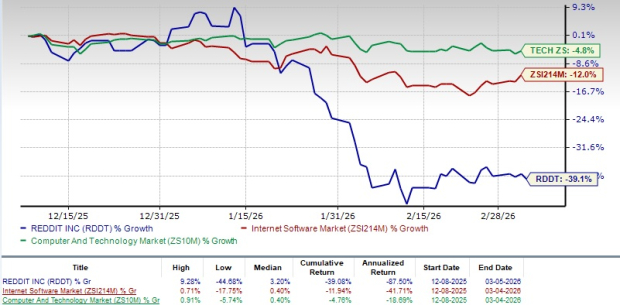

This particular company, which caters to millennial and Gen Z demographics, reported nearly $1 billion in revenue last quarter. Given its recent price pullback, analysts believe now might be an optimal time for investment. While not all selected stocks guarantee success, this one shows promise of exceeding the performance of previous Zacks’ high-flyers, such as Nano-X Imaging, which surged by +129.6% within just over nine months.

For complete details on this stock and others, you can download the report on 5 Stocks Set to Double.

Playa Hotels & Resorts N.V. (PLYA): Free Stock Analysis Report

H World Group Limited Sponsored ADR (HTHT): Free Stock Analysis Report

To access the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.