Pony.ai Soars Amid Strategic Partnerships and Market Momentum

Understanding Pony.ai’s Business Model

Pony.ai (PONY) is carving a niche in the bustling autonomous driving technology landscape. Based in China, the company specializes in developing robotaxis for autonomous ride-hailing services, autonomous trucks for deliveries, and systems for personal vehicles.

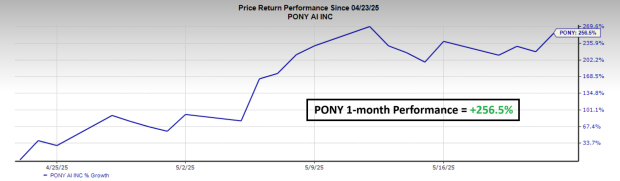

PONY: A Leading Performer Since Market Low

Pony.ai has demonstrated remarkable price strength on Wall Street. Since hitting a low of $4.11 on April 22, shares have surged to nearly $20, reflecting significant momentum and investor confidence.

Image Source: Zacks Investment Research

Pony.ai Forms Key Partnerships with Uber and Toyota

In its recent earnings call, Pony.ai announced strategic partnerships with Uber Technologies (UBER) and Toyota (TM). CEO James Peng highlighted the collaboration with Uber, which will allow users to access Pony.ai’s robotaxi service directly through Uber’s platform. Additionally, a deal with Toyota will initiate the mass production of its seventh-generation robotaxi lineup, enhancing both scale and distribution for Pony.ai.

PONY CEO Implements Voluntary Lock-Up Period

A voluntary lock-up period is a commitment that prevents early shareholders and insiders from selling shares post-IPO to stabilize stock prices. Recently, Pony.ai’s Chairman Dr. Jun Peng and co-founder/CEO Dr. Tiancheng Lou announced a 540-day voluntary lock-up period starting May 25. Such actions are rare and suggest strong confidence from management regarding the company’s future prospects.

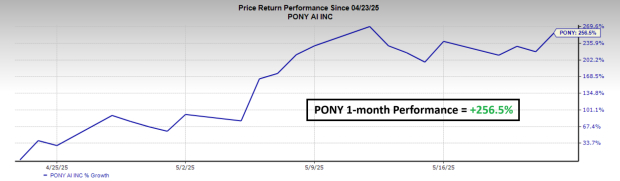

Pony.ai Exhibits Classic IPO U-Turn Structure

PONY shares are forming a traditional IPO U-turn structure, characterized by an initial spike, followed by a decline, and eventually rounding out a robust multi-week pattern. This structure is often seen before substantial price increases.

Image Source: TradingView

The recent performance of CoreWeave (CRWV) serves as an example of how powerful this pattern can be; the stock recently doubled within a month after a breakout. Historical context, such as Alphabet’s (GOOGL) IPO U-turn breakout in 2004, further underscores its potential.

Pony.ai Remains Tariff Immune

A current concern for investors is tariff uncertainty. However, Pony.ai’s management has confirmed that most of its supply chain is sourced locally, effectively insulating the company from most tariff impacts.

Conclusion

The outlook for Pony.ai’s stock appears promising due to its strong momentum, strategic partnerships with industry leaders, and an unusual voluntary lock-up period, indicating management’s confidence in its future success.