Bright Prospects Ahead: The Future of Solar Stocks in a New Trump Administration

Hello, Reader.

As winter chills much of the United States, Punxsutawney Phil’s shadow has promised six more weeks of cold. However, spring is on the horizon, and so is renewed optimism for the solar industry.

The anticipation for warmer days brings hope not just for the weather but also for solar stocks, which have recently faced challenges yet may be poised for a comeback.

Solar Stocks Amid Political Changes

A cloud of uncertainty has loomed over solar stocks since President Trump’s reelection in November. Investors worried he might repeal the Inflation Reduction Act, which provides crucial loans and grants for the solar sector. This concern has been heightened by Trump’s decision to freeze these distributions since taking office.

Interestingly, solar stocks thrived during Trump’s first term, outperforming their performance under President Biden. A possible repeat of this success seems plausible.

In this edition of Smart Money, we’ll explore why Trump’s return could bring renewed vigor to the solar industry and how you might benefit from it.

The Growth of Solar Energy

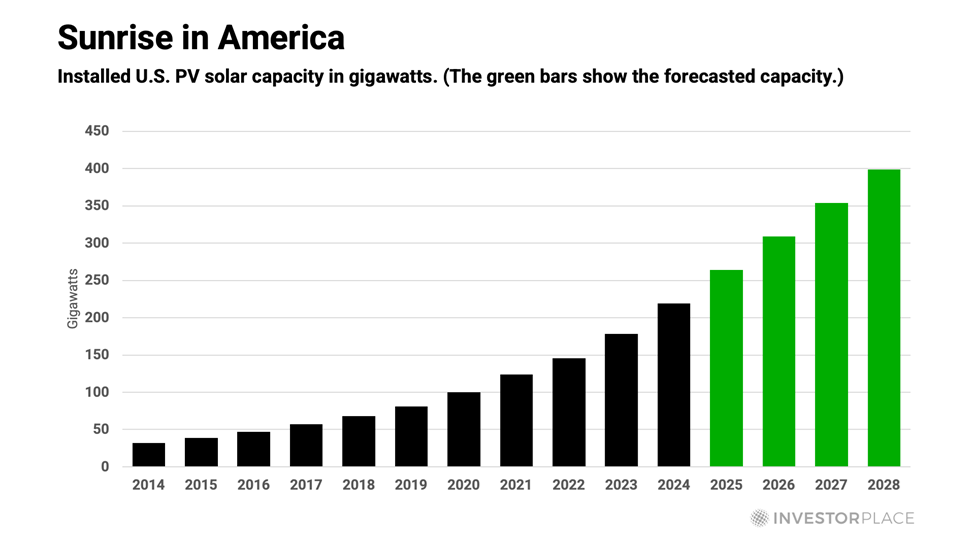

During Trump’s first administration, the U.S. solar power capacity doubled, and it repeated this growth under Biden. New forecasts indicate a potential for similar growth in a second Trump term.

This growth suggests that solar energy continues to expand regardless of which party is in power. Last year, the sector added about 40 gigawatts of new capacity—more than the total capacity ten years ago. Solar energy now generates enough electricity to power one-quarter of all U.S. homes.

The need for energy is also increasing, with solar presenting one of the most cost-effective solutions. Even if Trump promotes oil and gas, it’s unlikely he will actively hinder solar development.

A Favorable Environment for Solar

Transitioning from rhetoric to reality, Trump’s early policies could be beneficial for solar. While he has paused funding from the Inflation Reduction Act, he is also keen to expedite energy projects by cutting through red tape and offering government support.

The main barriers to solar growth are often logistical, not political. The National Energy Emergency Act aims to streamline energy infrastructure to bolster national security, potentially making it easier to develop solar projects.

The integrity and expansion of our Nation’s energy infrastructure — from coast to coast — is an immediate priority for the protection of the United States’ national and economic security…

Despite Trump’s inclination toward fossil fuels, solar energy will still play a critical role, especially as it becomes increasingly affordable. Data from Ernst & Young shows solar energy costing at least 29% less than the cheapest fossil fuel options.

Solar power is no longer a niche market; it has established itself as a viable energy source. For example, in 2019, I highlighted Daqo New Energy Corp. (DQ), which saw a 148% return shortly after my recommendation.

With promising signs for the solar sector, I am excited about new investment opportunities as we navigate this solar revival at Fry’s Investment Report. We’ve recently added a promising solar investment to our portfolio that shows potential for significant growth. To find out more about this opportunity, click here to join me at Fry’s Investment Report.

Regards,

Eric Fry