Key Points

- President Trump has allowed Nvidia to sell downgraded Hopper GPUs in China for a 15% revenue cut, with a potential similar arrangement for Blackwell GPUs.

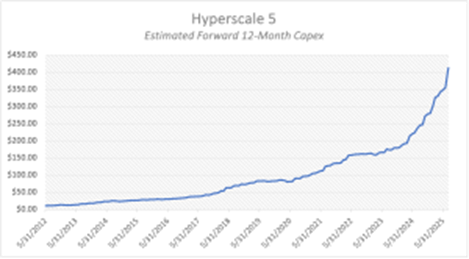

- Capital spending by hyperscalers on AI infrastructure in 2025 is now projected at $445 billion, a 56% increase from last year, with AI spending in data centers expected to grow at 26% annually through 2030.

- Wall Street forecasts Nvidia’s adjusted earnings growth at 43% annually through fiscal 2027, valuing the company at 57 times adjusted earnings.

Nvidia (NASDAQ: NVDA) shares have surged by 35% year-to-date, buoyed by recent news that President Trump agreed to permit the sale of Nvidia’s H20 GPUs in China in exchange for a 15% revenue cut. This shift opens up significant opportunities in the Chinese AI market, projected to grow to nearly $50 billion.

Additionally, data from Morgan Stanley indicates that capital spending among the 11 largest hyperscalers is set to reach $445 billion this year, exceeding expectations and signaling a strong trend in AI infrastructure investments. This uptick is crucial as Nvidia holds substantial market shares—80% in AI accelerators and over 50% in generative AI networking equipment.