The U.S. Government Eyes Intel: Future Partnerships on the Horizon

The U.S. government may be scouting partners for Intel (INTC), as reported by Semafor. Policymakers are growing increasingly uneasy about the chipmaker’s stability.

Officials from the Commerce Department are responsible for overseeing CHIPS funding aimed at enhancing semiconductor production in America. Lawmakers, including Senator Mark Warner, are reportedly discussing whether Intel may require additional support. Such discussions, however, are described as “purely precautionary.” The U.S. views Intel as a key player in its supply chain, especially in the face of rising competition from China’s chip industry.

Possibility of Mergers: AMD and Marvell Interested

Consequently, several strategies are under consideration for Intel. This includes a potential merger of Intel’s chip design unit with either AMD (AMD) or Marvell Technology (MRVL). Such a partnership would enable Intel to concentrate on its essential manufacturing business, which is vital for receiving government backing through the CHIPS Act.

Under the CHIPS Act, Intel stands to gain approximately $30 billion in funding through grants and low-interest loans; however, these funds have not yet been distributed.

Additionally, Intel has explored the idea of splitting its design and manufacturing segments. Should a major chip company like AMD acquire the design side, government funding could be directed exclusively to bolster Intel’s manufacturing operations.

Assessing Intel Stock: Buy, Hold, or Sell?

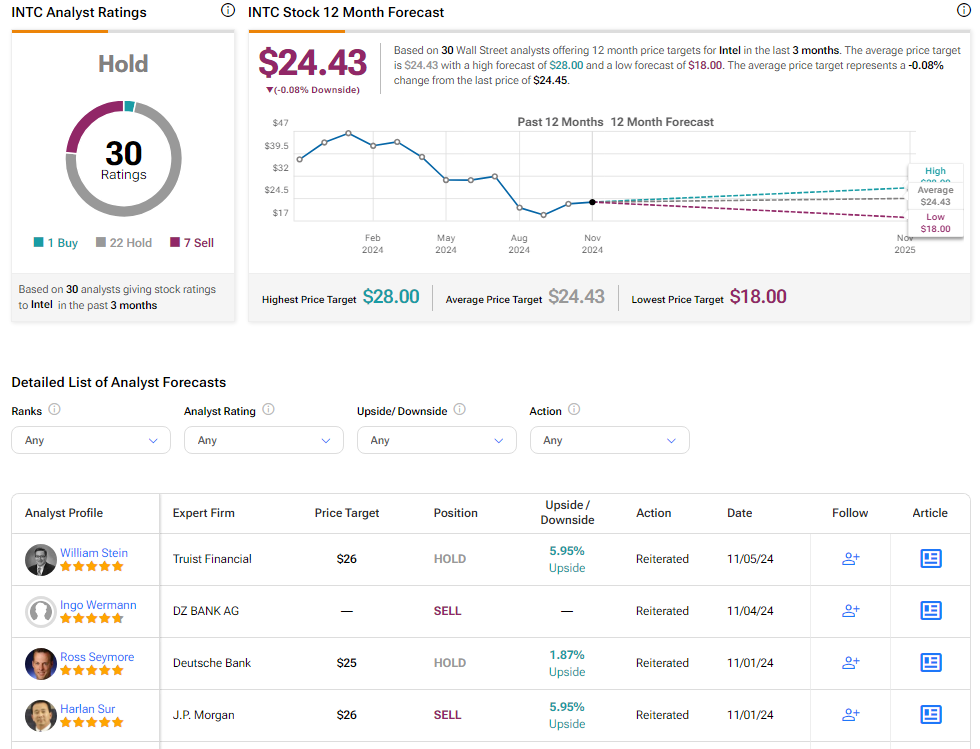

On Wall Street, analysts have given INTC stock a Hold rating consensus, combining one Buy, 22 Holds, and seven Sells in the past three months. As shown in the graphic below, Intel has witnessed a 34.5% drop in its share price over the past year. The average INTC price target stands at $24.43 per share, which suggests a slight downside potential of 0.08%.

See more INTC analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.