Fed Faces Tough Decision on Interest Rates Amid Economic Concerns

Recent weeks have seen a positive trajectory in the stock market, yet Wall Street finds itself in a holding pattern. Investors are keenly awaiting the Federal Reserve’s decision on interest rates following its May Federal Open Market Committee (FOMC) meeting this week.

While details will be elaborated in a Market 360 report later this week, it’s worth noting that the futures market indicates a over 95% likelihood that there will be no rate cut. This forecast stems from the consensus that the Fed is bracing for inflation that has yet to appear.

Despite this, Wall Street is hoping for a dovish tone in the Fed’s policy statement, as well as during Fed Chair Jerome Powell’s press conference.

Current Economic Indicators Suggest a Possible Rate Cut

Recent economic data certainly provides reasons for the Fed to reconsider its stance. Significant indicators include:

- The latest Beige Book survey highlights a deteriorating outlook in several U.S. regions amid increasing economic uncertainty, especially due to tariffs.

- The Conference Board’s consumer confidence index dipped to 86 in April, down from 93.9 in March, marking the fifth consecutive decline.

- The Institute for Supply Management (ISM) reported a reduction in its manufacturing index, falling to 48.7 in April from 49 in March. This second consecutive monthly drop follows months of expansion.

- Preliminary first-quarter GDP estimates from the Commerce Department indicated a 0.3% annual contraction, with a significant trade deficit reducing GDP by 4.8%.

- The Labor Department reported the creation of 177,000 jobs in April, surpassing the forecast of 133,000 jobs. However, revisions to payrolls for February and March lowered the total by 58,000 jobs, and wage growth remained stagnant at just 0.2%.

Adding to the conversation, officials from the European Central Bank (ECB) have suggested potential interest rate cuts in the near term, with other global central banks likely to follow suit.

As previously mentioned in Market 360, Treasury yields have begun to ease. Observations suggest the Fed may need to implement at least two rate cuts to align with the two-year Treasury rate. A falling 10-year Treasury yield could heighten pressure on the Fed to reduce rates.

Rethinking Inflation: Deflation Might be the Real Concern

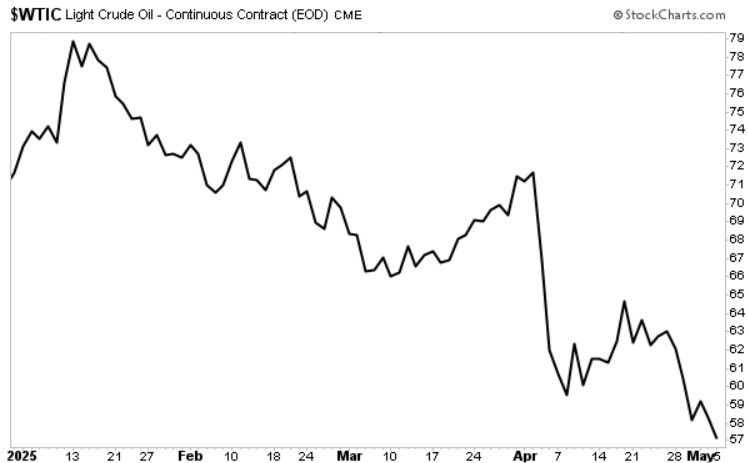

Critics argue that the Fed is too focused on anticipated inflation due to tariffs. Treasury Secretary Scott Bessent recently testified, emphasizing the issue of falling prices, particularly in energy. West Texas Intermediate crude oil prices have dropped from nearly $80 per barrel at the year’s start to approximately $57 now.

Moreover, recent inflation data shows that owners’ equivalent rent—used to measure real estate inflation—has essentially plateaued. This is concerning because real estate costs have traditionally been a primary driver of inflation.

With the Fed’s continued focus on tariff-induced inflation, some argue that deflation should be a more pressing concern. This notion has been echoed by President Trump, who believes the Fed is intertwining politics with its decisions in anticipation of inflation that may never arrive. Slowing growth and falling prices present a compelling case for reconsideration.

If this trend continues, the Fed risks appearing tardy in its response to economic reality.

It is clear that if the Fed is to operate effectively, a rate cut seems necessary. However, their historical reluctance to adjust policies leaves uncertainty about immediate action.

If no dovish language is presented in the upcoming statement, the market may react negatively. The evidence of rising deflation is apparent; disregarding this could lead to unhappiness among investors.

Key Concerns Moving Forward

My perspective advocating for immediate rate cuts—potentially four times this year—might raise eyebrows. Yet, over my four-decade career, I have endeavored to guide investors through tumultuous financial climates.

Through countless investment briefings, my focus has been on helping individuals avoid market pitfalls and seize opportunities in varying environments. However, the current economic landscape suggests something unprecedented is unfolding—triggered by President Trump’s tariffs and emerging initiatives.

Structural shifts in policy appear poised to initiate one of the most significant wealth transfers in modern American history. Understanding these developments and preparing for them is crucial for investors.

This situation transcends politics; it concerns individual financial futures.

Sincerely,

Louis Navellier

Editor, Market 360