Federal Reserve Rate Cuts: Implications for the Market Ahead

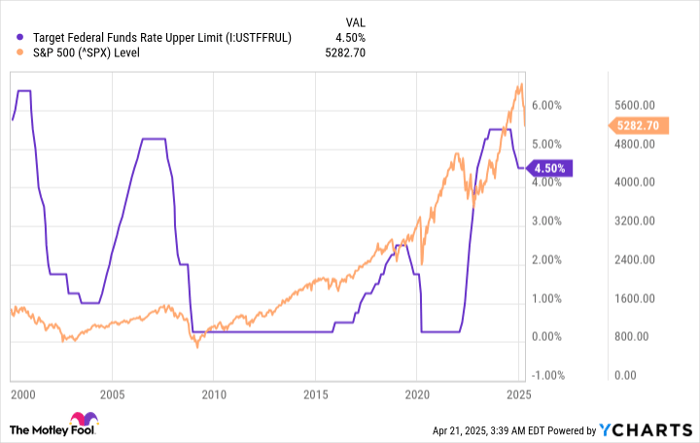

The U.S. Federal Reserve reduced the federal funds rate (overnight interest rate) multiple times in September, November, and December last year, totaling a 100 basis points decrease. This adjustment reversed some of the aggressive rate hikes implemented in 2022 and 2023, aimed at curbing inflation that reached its highest levels in four decades, as measured by the Consumer Price Index (CPI).

While the CPI continues its decline towards the Fed’s 2% annual target, uncertainty in the U.S. economy arises from escalating global trade tensions. As a result, Wall Street is predicting several additional rate cuts throughout this year.

According to the CME Group‘s FedWatch tool, which evaluates the probability of the Fed’s decisions based on interest rate futures, there is potential for four cuts before the end of 2025. This scenario would significantly impact the S&P 500 index, though perhaps not in the anticipated manner.

Image source: Getty Images.

Tariffs Impacting Fed’s Decisions

In March, the CPI showed an annual increase of 2.4%, marking the slowest growth since 2021. This would typically open the door for further interest rate cuts. However, on April 2, President Donald Trump announced new tariffs on all imports from the U.S.’s trading partners, complicating the Fed’s options.

The tariffs include a sweeping 10% charge on imports across the board, along with higher “reciprocal tariffs” targeting specific countries with significant trade imbalances with the U.S. While these reciprocal tariffs are currently on a 90-day pause pending negotiations, some Chinese imports remain subject to tariffs as high as 245%.

Increased tariffs can raise consumer prices, compelling Fed policymakers to await additional CPI data before confirming that interest rate cuts are advisable. Tariffs could also slow economic activity sharply, potentially leading the Fed to cut rates even in a high-inflation environment. According to Reuters, several top Wall Street banks have increased the likelihood of a U.S. recession due to these tariffs.

Goldman Sachs now estimates a 45% chance of recession within the next 12 months, up from 35% prior to the tariff announcement. Meanwhile, JPMorgan Chase has raised its recession probability to 60% from 40%.

Consequently, some institutions have revised down their forecast for the federal funds rate in 2025, indicating that rate cuts may occur more frequently than previously predicted by year-end. The CME Group’s FedWatch tool suggests that the Fed might implement four rate reductions of 25 basis points each during its meetings in June, July, September, and December.

Rate Cuts and Market Volatility

Interest rate reductions typically benefit the corporate sector. Lower borrowing costs can enhance company growth and profit margins. Additionally, diminished interest rates usually shift investor focus from risk-free assets like cash to equities, potentially boosting market performance.

Historically, however, the onset of any rate-cutting cycle since the early 2000s has been predictive of corrections in the Stock market—this situation appears no different. The S&P 500 is already down 12% from its recent peak, even with three rate cuts at the end of 2024.

Data by YCharts.

Ongoing global trade tensions, combined with their ability to potentially weaken the economy, are the primary factors behind the S&P 500’s recent decline—not the preceding year’s interest rate cuts. The Fed often cuts rates in response to economic weakness, and trends suggest that initial cuts in a cycle may predict temporary market declines.

Furthermore, the Fed has a documented pattern of lagging behind economic shifts. Historical data indicates that recessions (noted by shaded areas) typically follow periods of rising rates, suggesting misjudgments on the Fed’s part regarding the need to reduce rates in times of economic distress.

Data by YCharts.

Market Responses and Future Prospects

The future of the S&P 500 amid this correction depends largely on economic indicators in the upcoming months. A technical recession—characterized by two consecutive quarters of declining GDP—could further reduce investors’ stock exposure.

Ultimately, long-term market performance is closely tied to corporate earnings. During recessive phases, companies generally see reduced revenues due to factors like increased unemployment and diminished consumer spending, leading to lower Stock prices.

Further cuts in interest rates might provide a boost to revive any economic downturn. Given that the Stock market is inherently forward-looking, these cuts could encourage long-term investors to seize potential buying opportunities. Historically, despite facing several economic challenges over the past 25 years, the S&P 500 has consistently reached new all-time highs.

Current negotiations for new trade agreements with the Trump administration may provide a silver lining. Consequently, short-term weakness in the Stock market could present attractive long-term buying chances.

Investment Considerations in the S&P 500 Index

Before considering an investment in the S&P 500 Index, it’s essential to evaluate the situation carefully. Currently, analysts have highlighted the 10 best stocks to invest in, which do not include the S&P 500 Index. These stocks are projected to offer significant returns in the coming years.

Consider the performance of Netflix: had you invested $1,000 based on our recommendation on December 17, 2004, you’d now have $594,046!* Similarly, investing in Nvidia on April 15, 2005, would have turned that $1,000 into $680,390!*

Notably: Returns from our advisory service average an impressive 872% compared to the S&P 500’s 160% returns. Stay informed about our latest top 10 investment opportunities.

*Stock Advisor returns as of April 21, 2025

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.