Microsoft and Apple Show Strong Cash Flow Resilience

Healthy cash flows indicate financial stability, enabling companies to reduce debt, explore growth, and provide dividends to shareholders. This financial strength also helps firms navigate economic downturns, presenting favorable conditions for long-term investors.

Two prominent tech giants exemplifying cash-generating prowess are Microsoft (MSFT) and Apple (AAPL). Here’s a closer look at their current performance.

Apple’s Financial Performance

Apple’s stock gained traction following tariff de-escalation, rebounding from 2025 lows. Recent quarterly results reported record Services revenue and earnings per share (EPS) of $1.65, an 8% year-over-year increase.

Sales rose 5% year-over-year during this period, reflecting robust demand. The following chart illustrates Apple’s quarterly sales trends.

Image Source: Zacks Investment Research

Apple has consistently generated significant cash, allowing for increased dividend payouts. The company announced a quarterly payout increase, marking the 13th consecutive year of higher dividends. Currently, shares yield 0.5%, with a five-year annualized dividend growth of 4.6% and $98.4 billion in free cash flow over the past year.

Microsoft’s Gains Fueled by AI

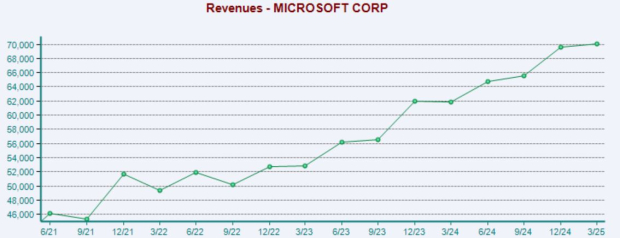

Microsoft’s stock gained 10% in 2025, outperforming the S&P 500, which rose only 0.6%. The latest earnings report showed an EPS of $3.46 and sales of $70 billion, both surpassing consensus expectations. Sales increased 13% year-over-year, while EPS grew 18%.

The following chart shows Microsoft’s quarterly sales growth.

Image Source: Zacks Investment Research

Driving these results was the strength of Microsoft Cloud and AI, with cloud revenue rising 20% year-over-year to $42.4 billion. The Intelligent Cloud segment, including Azure, contributed $26.8 billion, up 21% from last year. Microsoft also achieved $69.4 billion in free cash flow in the last twelve months and boasts a 10% five-year annualized dividend growth rate.

Final Thoughts

Strong cash-generating companies like Microsoft and Apple are attractive investment targets. Their financial strength supports growth, dividend payouts, and effective debt management. These factors position them well to endure economic challenges.