The Invesco Aerospace & Defense ETF (NYSEARCA:PPA) has flexed its muscles, outperforming its peers over the historical time horizons of the past three, five, and 10 years. As a playground for investors enthusiastic about defense equities, PPA stands tall, boasting a dynamic strategy that sets it apart in the aerospace and defense investment landscape.

Strategic Brilliance

PPA is the brainchild of fund sponsor Invesco (NYSE:IVZ), designed to mirror the SPADE Defense Index. The Fund’s mandate? To invest at least 90% of its assets in common stocks constituting the illustrious Index, spotlighting companies entrenched in the production, operations, and maintenance of US defense, homeland security, and aerospace operations. A quarterly rebalancing mechanism ensures refreshment and relevance for the Fund and Index.

The adventure began in 2005, and the ETF now lords over $2.9 billion in assets under management (AUM).

Defense Stocks: A Fortified Fortress

Defense stocks beckon investors with their solid business relationships and technical prowess, catering to stable and substantial clientele such as the U.S. government and other national bodies. The complexity of manufacturing military-grade equipment like fighter jets and missiles forms a formidable moat around these companies, shielding them from competitive turbulence. Moreover, the often non-correlated nature of defense spending with the broader economic landscape provides a sanctuary of sorts for investors.

A Cornucopia of Aerospace and Defense Assets

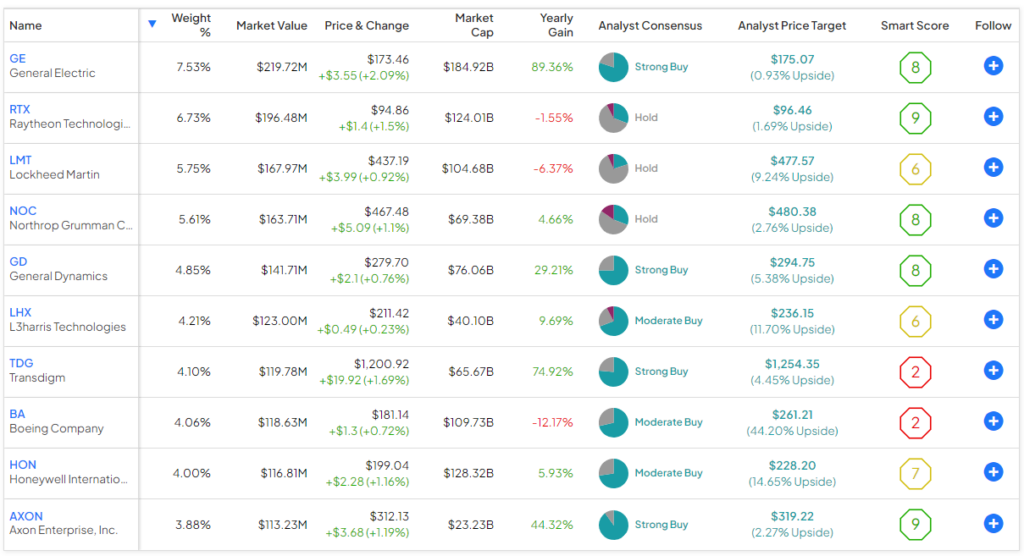

PPA offers a savory mix of 53 stocks in the aerospace and defense realm, with its top 10 holdings accounting for 50.7% of its assets. This breadth sets PPA apart from competitors like the SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR) and the iShares U.S. Aerospace & Defense ETF (BATS:ITA), which hold 34 and 38 stocks, respectively.

The cast of PPA’s top 10 holdings, brimming with stalwarts like Lockheed Martin (NYSE:LMT), RTX Corporation (NYSE:RTX), and Northrop Grumman (NYSE:NOC), adds intrigue with the inclusion of industrial behemoths like General Electric (NYSE:GE) and Honeywell (NASDAQ:HON). This eclectic mix lends PPA a unique edge, expanding its investment horizon beyond conventional aerospace and defense boundaries.

General Electric’s leading presence within PPA, capturing a 7.5% share, symbolizes the fund’s knack for integrating innovative stocks like Palantir (NYSE:PLTR) that add a dash of futurism to its portfolio. Despite Palantir’s modest exposure, its impressive 198.1% surge in the past year amplifies PPA’s growth narrative.

A noticeable omission: PPA’s lighter Boeing (NYSE:BA) stake in comparison to competitors like ITA. With Boeing constituting only 4.1% of PPA’s weight, the ETF sidesteps heavy exposure to the troubled aerospace giant, charting a more balanced course.

Unmatched Performance Benchmark

PPA’s track record of generating annualized returns of 14.2% over three years and 11.4% and 12.7% over five and 10 years, respectively, lays a solid foundation for its apex performance status. Surpassing peers like XAR and ITA, PPA’s recent triumphs highlight its prowess in the aerospace and defense investment domain.

For instance, XAR’s subdued returns of 5.4%, 8.2%, and 11.3% over the past three, five, and 10 years pale in comparison to PPA’s soaring performance. Similarly, ITA’s lackluster showing of 11.2%, 5.3%, and 10.1% across the same intervals underscores PPA’s supremacy.

Fee Dynamics: The PPA Dilemma

PPA’s price tag of 0.58% rings a costlier bell for investors, demanding $58 in annual fees for every $10,000 investment. While this figure mirrors the average expense ratio for index ETFs (0.57%), it overshadows the thriftier structures of XAR and ITA, levying 0.35% and 0.40%, respectively.

Nevertheless, PPA’s triumphant run against its cost-efficient counterparts over the prior three and five years propels a case for justifying the higher fee. If the trend persists, investors are unlikely to fret over the additional expense.

Dividend Delight

PPA extends its charm as a dividend payer, offering a modest 0.6% yield as a cherry on top for investors. Since its inception in 2005, the fund has nurtured a consistent dividend streak, adding allure to its investment proposition.

Analyst Lens: A Beacon of Optimism

Wall Street’s verdict? PPA commands a Moderate Buy consensus rating, comprising 41 Buys, 11 Holds, and two Sell ratings from the past three months. The average price target of $107.49 implies an 8.6% uptick, painting a rosy picture for PPA investors.

The Final Verdict: PPA – A Titan in the Aerospace and Defense Arena

My outlook for PPA remains bullish on account of its stellar performance, both in the short and long terms, coupled with its dominant position vis-a-vis the competition. Offering a broader horizons and a kaleidoscope of investment possibilities, PPA’s buffet encompasses aerospace and defense treasures uncharted by its rivals, such as General Electric, Honeywell, and Palantir. In an ever-evolving defense landscape, PPA stands tall as a beacon for investors seeking a vantage point into aerospace and defense stocks.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.