PPG Industries Reports Q1 2025 Earnings with Mixed Results

PPG Industries, Inc. announced a profit of $396 million for the first quarter of 2025, translating to $1.64 per share. This is a decrease from the $443 million or $1.71 per share recorded in the same period last year.

Barring one-time items, the adjusted earnings per share (EPS) fell to $1.72, down from $1.87 in the prior year. This amount exceeded the Zacks Consensus Estimate of $1.62.

The company’s revenues totaled $3,684 million for the quarter, reflecting a decline of approximately 4% year over year. This decrease was primarily attributed to unfavorable currency translations and divestments. However, revenue exceeded the Zacks Consensus Estimate of $3,655.9 million.

PPG Industries’ Segment Performance

In the first quarter, the Global Architectural Coatings segment experienced an 11% year-over-year decline in sales, totaling $857 million. This result fell short of our estimate of $967.9 million. Sales volumes decreased due to adverse foreign currency translation, although mitigated somewhat by increased selling prices.

Conversely, the Performance Coatings segment reported a 7% year-over-year increase in sales, reaching $1,265 million. This figure outperformed our estimate of $1,199.3 million. A 6% rise in sales volumes, driven by demand in aerospace coatings, protection and marine coatings, and traffic solutions, fueled this growth.

The Industrial Coatings segment saw sales drop by 8% year over year to $1,562 million, although this figure also exceeded our estimate of $1,556.8 million. The decline was influenced by foreign currency impacts and the divestment of the silicas products business in 2024.

PPG’s Financial Position

As of the end of the first quarter, PPG reported cash and cash equivalents of $1,830 million, marking a 56.7% increase year over year. Meanwhile, long-term debt stood at $5,574 million, down approximately 6.2% compared to the same quarter last year.

The company repurchased approximately $400 million in shares during the quarter.

Forward Outlook for PPG

PPG has reaffirmed its adjusted earnings per share guidance for the full year of 2025, estimating a range of $7.75 to $8.05. This forecast is supported by recognized growth potential and ongoing self-improvement efforts while considering global economic conditions, foreign exchange variations, and mixed regional demand across its various segments.

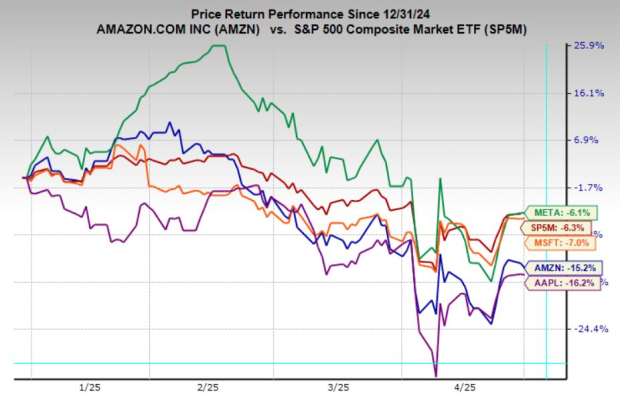

Stock Performance Overview

Over the past year, PPG’s shares have declined by 19.5%, contrasting with a 3.3% decrease in the industry overall.

Image Source: Zacks Investment Research

Zacks Rank and Stock Recommendations

PPG currently holds a Zacks Rank #3 (Hold). Better-ranked companies in the basic materials sector include Hawkins, Inc. (HWKN), SSR Mining Inc. (SSRM), and Intrepid Potash, Inc. (IPI). Hawkins has a Zacks Rank #1 (Strong Buy), whereas SSRM and IPI hold a Zacks Rank #2 (Buy).

Hawkins is set to report its fiscal fourth-quarter results on May 21, with a consensus estimate of 74 cents per share. Over the last four quarters, Hawkins has beaten expectations once but has missed three times, averaging an earnings surprise of 6.1%.

SSR Mining is expected to release its first-quarter results on May 6, with a consensus estimate of 8 cents per share. It has achieved an impressive average earnings surprise of 155.7% over its trailing four quarters.

Intrepid Potash will report its first-quarter results on May 5, with analysts anticipating a loss of 12 cents per share, consistent over the past two months.

Disclaimer

The views and opinions expressed herein are the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.