Stable Income and Growth: Analyzing PPL and Ameren Utilities

The Zacks Utility – Electric Power industry provides a stable income through its regulated structure. This framework allows utilities to recover costs and generate consistent returns, which reduces earnings volatility. Steady electricity demand and appealing dividend yields make utilities a resilient choice for income investors.

In the U.S., electric utilities are shifting from traditional income roles to embracing clean energy initiatives. Significant investments in grid modernization and renewable energy are underway. Federal incentives and climate policies are reshaping this sector, positioning forward-thinking utilities like PPL Corporation (PPL) and Ameren Corporation (AEE) for long-term growth, thereby offering a relatively low-risk investment in green energy.

PPL Corporation specializes in infrastructure upgrades and clean energy, yielding reliable cash flows and dividends. Its regulated nature allows for predictable revenues, supporting consistent dividend distributions and overall financial stability. With a focus on improving grid reliability and sustainability, PPL is set for steady earnings growth.

Ameren Corporation, serving Missouri and Illinois, also offers consistent cash flows and dividends. The favorable regulatory environment and capital investment strategy emphasize modernizing the grid and transitioning to clean energy. Its prudent financial management and strong credit ratings attract investors.

Both companies stand out in the utility sector. Let’s compare their fundamentals to determine which stock may be a better investment.

Earnings Growth Projections for PPL and AEE

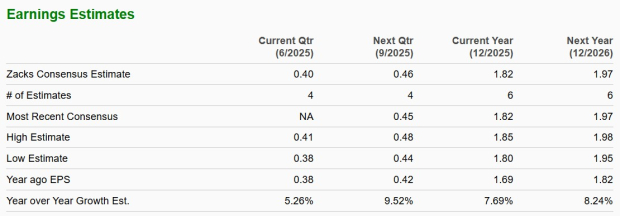

The Zacks Consensus Estimate predicts PPL’s earnings per share will grow by 7.69% in 2025 and 8.24% in 2026. Long-term earnings growth per share is projected at 7.46%.

PPL’s Earnings Estimates

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for AEE shows earnings per share growth of 6.48% in 2025 and 7.61% in 2026. Its long-term earnings growth is estimated at 6.95%.

AEE’s Earnings Estimates

Image Source: Zacks Investment Research

Return on Equity (ROE)

Return on Equity (ROE) measures a company’s ability to generate profits from shareholder investment. PPL’s current ROE is 9.14%, while AEE’s is 10.40%, surpassing the industry average of 10.13%.

Debt to Capital

The Zacks Utilities sector requires considerable capital investment for ongoing upgrades and expansion. As a result, utilities often utilize market borrowing alongside internal cash flow for long-term funding.

PPL’s debt-to-capital ratio is 52.71%, significantly lower than AEE’s 59.78%. The industry’s average stands at 54.57%, indicating that PPL manages its debts more conservatively.

PPL & AEE’s Dividend Yield

Dividends provide shareholders with a direct return on investment and indicate a company’s financial health. Utilities typically offer reliable dividends.

PPL Corporation’s dividend yield is currently 3.19%, higher than Ameren Corporation’s 2.98%. PPL also surpasses the industry yield of 3.17%.

Valuation

On a Price/earnings Forward 12-month basis (P/E-F12M), PPL appears less expensive than AEE. AEE trades at 18.75X while PPL trades at 18.19X, compared to the industry average of 15.13X.

Long-Term Capital Expenditure Plans

Capital expenditure drives infrastructure growth, reliability, and sector expansion. Utilities must continuously invest to meet increasing demand and regulatory standards.

PPL plans to invest nearly $20 billion from 2025 to 2028 to enhance infrastructure and clean electricity generation. Ameren intends to invest $27.4 billion from 2025 to 2029 for electric transmission, distribution, and generation improvements. Both companies’ strong capital strategies benefit from declining interest rates, reducing their capital service costs.

Conclusion

PPL offers a balanced approach to income and long-term value, supported by rising earnings estimates and stable dividends.

Currently, both PPL and AEE have a Zacks Rank #3 (Hold). PPL is favored for its lower valuation and debt levels compared to Ameren.

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.