Qualcomm Set to Report Q2 Fiscal 2025 Earnings Amid Positive Outlook

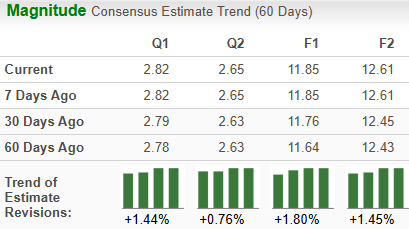

Qualcomm Incorporated (QCOM) is preparing to release its second-quarter fiscal 2025 earnings on April 30, 2025. The Zacks Consensus Estimate anticipates revenues of $10.64 billion and earnings of $2.82 per share. Over the last 60 days, earnings estimates for QCOM have seen a rise, increasing from $11.64 per share to $11.85 for fiscal 2025 and from $12.43 to $12.61 for fiscal 2026.

Earnings Estimate Trend

Image Source: Zacks Investment Research

Earnings Surprise History

The chipmaker has delivered a four-quarter average earnings surprise of 7.8%, exceeding estimates consistently. In the most recent quarter, Qualcomm achieved an earnings surprise of 16.4%.

Image Source: Zacks Investment Research

Earnings Whispers

Our analysis suggests Qualcomm is likely to beat earnings expectations for the fiscal second quarter. The company holds a positive earnings ESP and a Zacks Rank of #2 (Buy), enhancing the likelihood of surpassing earnings targets.

Currently, Qualcomm’s earnings ESP stands at +0.86%. This positions the company favorably ahead of the upcoming report.

Factors Shaping the Upcoming Results

Qualcomm is harnessing the momentum of 5G technology. Its investments in building a mobile licensing program are expected to yield long-term revenue growth. The company continues to advance in artificial intelligence (AI), meeting demands for products that support digital transformation in today’s cloud-centric economy. The Snapdragon portfolio is central to Qualcomm’s growth prospects in the mobile sector.

This quarter, Qualcomm introduced the Snapdragon X chip aimed at mid-range AI desktops and laptops. This latest addition to the Snapdragon X line follows previous successful launches and is built on a 4-nanometer process. Notably, it features an 8-core Oryon central processor and a neural processing unit (NPU) that processes 45 TOPS (trillions of operations per second), aligning with modern AI initiatives.

Additionally, Qualcomm announced that Samsung has integrated the Snapdragon 8 Elite Mobile Platform into its S25 series, enhancing 5G and WiFi 7 connectivity. Furthermore, the company expanded its gaming portfolio with new chipsets, including Snapdragon G3 Gen 3 and G2 Gen 2 chips. These developments are expected to impact upcoming performance positively.

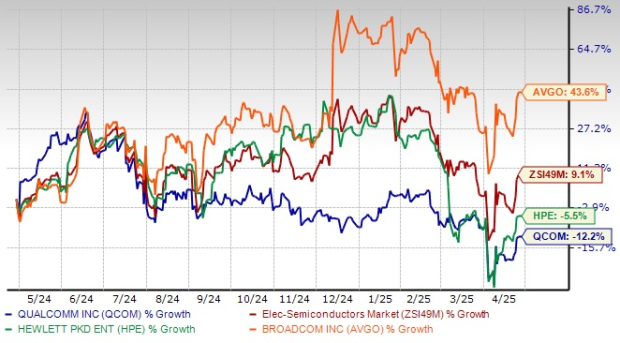

Price Performance

Over the past year, Qualcomm shares have decreased by 12.2%, while the industry grew by 9.1%. Notably, competitors like Hewlett Packard Enterprise Company (HPE) and Broadcom Inc. (AVGO) performed differently; Broadcom gained 43.6%, while Hewlett Packard saw a 5.5% decline.

Image Source: Zacks Investment Research

Key Valuation Metric

Regarding valuation, Qualcomm appears relatively inexpensive compared to its industry peers. The company currently trades at a price/earnings ratio of 12.09, below the industry average of 24.06 and its historical mean of 17.35.

Image Source: Zacks Investment Research

Investment Considerations

As a leading manufacturer of wireless chipsets based on baseband technology, Qualcomm is committed to maintaining its position in the 5G chipset market. The company is poised to facilitate a smooth transition to faster 5G networks, enhancing user connectivity and scalability for original equipment manufacturers (OEMs).

Qualcomm stands out as a unique chipset vendor with comprehensive 5G solutions that encompass both sub-6 and millimeter wave bands. It is also a significant provider of RF (radio frequency) components for premium smartphones. The company’s innovation roadmap focuses on connecting devices at the ‘connected intelligent edge.’

Furthermore, growth opportunities within the mobile domain, driven by advancements in the Snapdragon portfolio, and emerging areas like driver-assistance technology with Snapdragon Ride, present a positive outlook.

End Note

Given its robust fundamentals and revenue potential, Qualcomm emerges as a solid investment opportunity, supported by positive demand trends.

# Key Earnings Trends Indicating Positive Investor Sentiment

Recent market analyses show that certain stocks are becoming more appealing due to their relative affordability within the industry. Companies focusing on high-quality offerings, effective operational execution, and ongoing portfolio enhancements are consistently delivering increased value to their customers. As earnings estimates improve, investor perception of these stocks is turning increasingly favorable.

With a strong history of earnings surprises and a favorable Zacks Rank, these stocks are poised for robust quarterly earnings. For investors, now might be an opportune moment to capitalize on these rising stars.

Top 7 Stocks to Watch Over the Next Month

Experts have identified seven exceptional stocks from a current pool of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

This list has consistently outperformed the market over the years, yielding an average gain of +23.9% annually since 1988. Investors may want to keep a close eye on these carefully selected stocks.

For those seeking the most recent insights from Zacks Investment Research, you can access the report on the 7 Best Stocks for the Next 30 Days.

Below are some of the highlighted stocks:

- QUALCOMM Incorporated (QCOM)

- Microsoft Corporation (MSFT)

- Broadcom Inc. (AVGO)

- Hewlett Packard Enterprise Company (HPE)

This article was originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.